- The current gains come after a period of devastating declines since November.

- Litecoin is trading at $31.43 after hitting a dead end at $32.00.

Many are refraining from referring to the current bullish trend as a bull rally. However, virtual assets like Bitcoin Cash and IOTA are recording gains of 32% and 11% respectively on Thursday. Litecoin has not been left behind in the recent gains, besides it is showing a 7% growth in value on the day.

The gains come after a period of devastating declines since November. The recent sell off has been one amongst the worst in the market this year. The total market capitalization dropped below $100 billion as both coins and altcoins descended to fresh 2018 lows.

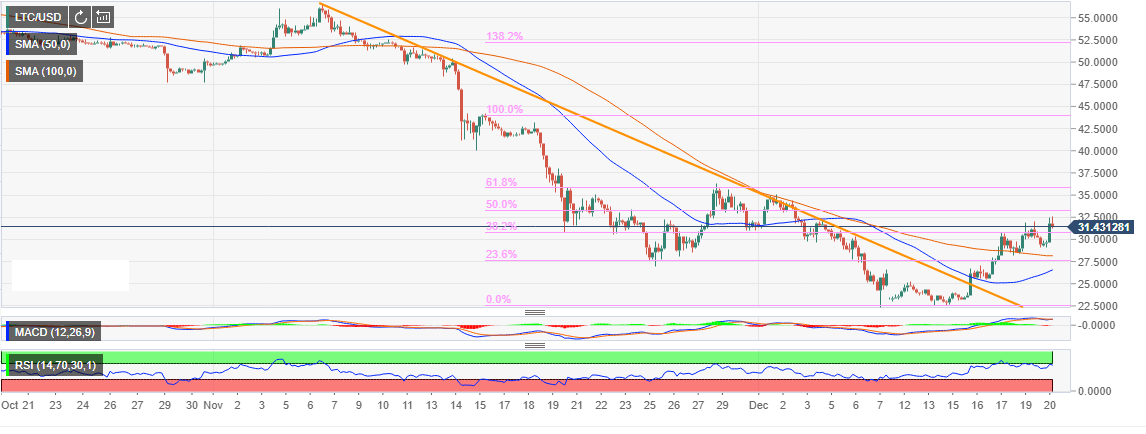

For Litecoin, the asset formed a bottom at $22.5 (swing low) before the upside correction that started earlier this week. The jump above the trendline resistance that had been capping gains for a while ignited further recoil above the simple moving averages. There was struggle around $30.00, however, the bulls pushed for gains above the 38.2% Fib level taken between the highs of $52.26 and the lows of $22.5.

Litecoin is trading at $31.43 after hitting a dead end at $32.00. The technical levels are still positive, which means that Litecoin will sustain growth above $30.00. The gap between the 50 SMA and the longer term 100 SMA is decreasing as the bulls increase the entries. The RSI is heading back above 70 while the MACD is in an upward slope. Although Litecoin bulls might lack the momentum to reach $40.00, they have the power to prevent declines below $30.00 in the short-term.

LTC/USD 4-hour chart