- Litecoin price could drop towards the $140 psychological level.

- IOMAP shows LTC faces massive resistance on the up-side.

- Litecoin must close the session above the $150 level to re-start the bullish leg.

Litecoin price ended the day trading in the red on Friday to close the day below $148. It, however, started the day on Saturday trading in the green as the underlying pressure from the bulls attempted to push the price towards the $160 psychological level. However, pressure from the bears scuttled the attempts to push LTC price any further as sellers ending the week on Sunday at around $148.76. At the time of writing, the asset is trading in the green around $149 as bulls aim .

Litecoin Price Trades Below the $150 Mark

Before the latest bearish leg, LTC/USD had rallied 47% between July 21 and August 08 when it jumped from $106 to highs of about $157 going above the $150 psychological level. During this rally, the tenth largest cryptocurrency my market capitalization according to Coinmarketcap flipped the 50-SMA (simple moving average), the 100 SMA and the 200 SMA from resistance to support.

The parabolic SAR turned negative during the fourth four-hour trading session on Sunday at the same time the Moving Average Convergence Divergence Indicator (MACD) sent a call to sell crypto signal the recently witnessed bearish momentum could be sustained as seen on the four-hour chart.

LTC/USD Four-Hour Chart

At the time of writing LTC was trading hands just below the $150 0 psychological level at around $148.99 on most crypto exchanges. Note that a daily closure below this level will push the Litecoin price further down towards the 50 SMA currently at $145 and 100-day SMA at around $140.

Litecoin Faces Massive Resistance Upwards

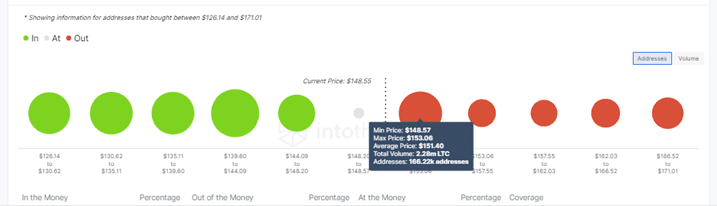

On-chain metrics from In/Out of the Money Around Price (IOMAP) model by IntoTheBlock’s indicates any upward recovery by LTC will be met by significance resistance. The immediate resistance is found around the $153 resistance zone. It lies within the $148 and $153 investor cluster where roughly 166,000 addresses previously bought approximately 2.28 million LTC.

This resistance appears robust enough to absorb any buying pressure aimed at re-starting the recovery leg.

Litecoin IOMAP Model

Compared to the immediate support at $145, it is relatively weak. It is within the $144 and $148 price range where 110,000 addresses previously bought 1.48 million LTC. However, a fall below this level would meet robust support as indicated by the IOMAP.

Looking Over The Fence

Note that a Litecoin price session closure above the $150 psychological level could re-start the bullish leg to push the price even higher. If this happens, LTC could overcome the $160 barrier and re-test the areas above the $170 and $180 psychological levels as seen in June.

Looking to buy or trade Litecoin now? Invest at eToro!

Capital at risk