- Litecoin price rallies 8% over the last 24 hours to trade above the $200 mark.

- LTC needs to close the day above $200 to maintain the bullish momentum.

- Multiple technical signals accentuate Litecoin’s bullish momentum.

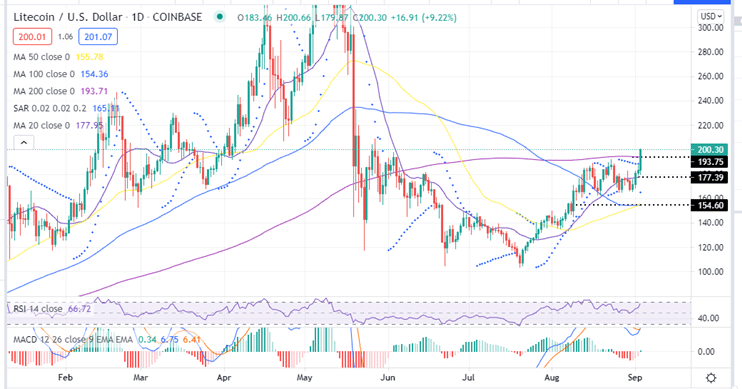

The LTC price dropped significantly after reaching a high of around $191 August 23 to areas below $65 on August 27. What followed was a sluggish price action that saw LTC consolidate between August 24 and July 31. During this time, Litecoin traded in a tight range between $164 support wall and the $180 psychological level.

The consolidation allowed the bulls to regroup, refocus and what followed was a 17% rally from around $170 on September 01 to trade above $200 today. At the time of writing, Litecoin is hovering at $200.31 on most crypto exchanges.

Litecoin Trades Above the 200-day SMA

Today’s bullish trading session saw the Litecoin price overcome the 200-day Simple Moving Average (SMA). This moving average, the $180 support zone and the 20-day SMA at $177 are currently providing robust support for Litecoin on the downside.

This an indicator that Litecoin price prediction in the short-term is bullish as bulls focus on the May 23 range high at $233. Note that Litecoin bulls needs to defend these support zones to make sure that the upward trajectory continues.

Note that a daily closure above the $200 psychological level will see LTC price rise higher with the next key level to watch being $220. Any movement higher will see the asset re-test $233 range high.

LTC/USD Daily Chart

Note that the upsloping moving averages and the Parabolic SAR which just reversed from negative to positive adds credence to this bullish narrative. Note that as long as the Parabolic SAR remains below the price, the bullish momentum is set to continue.

Also note that the 50-day SMA crossed above the 100-day SMA yesterday on the same daily chart. Though not a golden cross, it illustrates the positive sentiment surrounding the LTC price. At the same time, the MACD sent a call to buy Litecoin when the 12-day EMA crossed above the 26-day EMA earlier today adding credence to the bullish outlook.

In addition the upward movement of the Relative Strength Index at 66 towards the overbought zone indicate that the bulls are in control of Litecoin.

On the flipside, if Litecoin closes the day below the 20-day SMA at $177.39, it will trigger massive sell orders that might push the price below the $60 psychological level towards the 100- and 50-day SMA around $155.

How to Buy Litecoin

The top exchanges for trading in LTC currently are: eToro, FTX, Binance and Coinbase. You can find others listed on our crypto trading platforms page.

Looking to buy or trade Litecoin now? Invest at eToro!

Capital at risk