- Sellers retain control, as the recovery lacks momentum.

- Coin awaits catalysts for fresh near-term trading impetus.

Monero (XMR), the 14th largest cryptocurrency with the current market capitalization of $1.26 billion and an average trading volume of $94 million, is the second-biggest loser among the top 20 widely traded cryptocurrencies. The coin has lost almost 4% over the last 24 hours and remains stuck in a narrow range, with the bearish momentum still intact. At the time of writing, XMR/USD trades near 73.30 region, having found support once again ahead of 72.50.

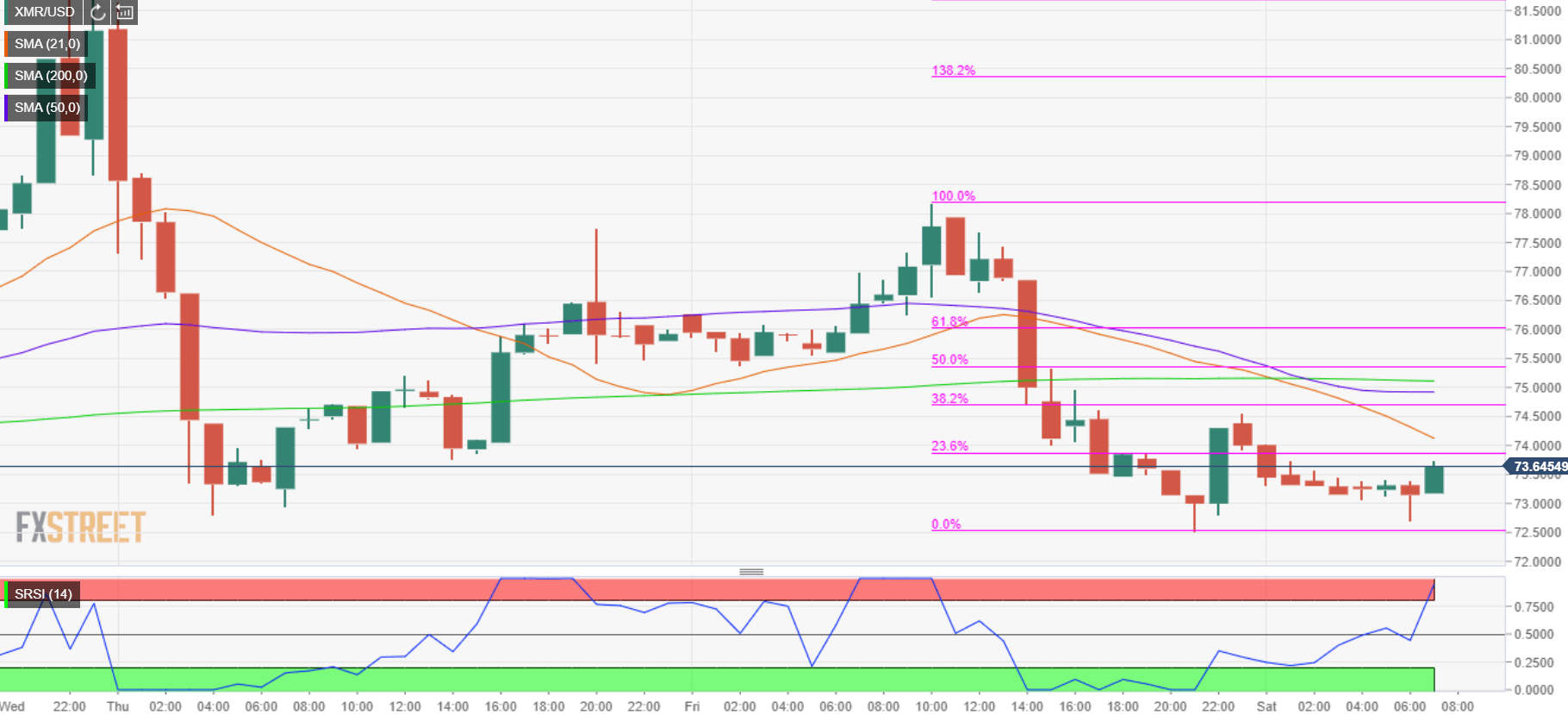

XMR/USD 1-hour chart

- The coin consolidates below 23% Fibonacci Retracement (Fib) of Friday’s fall near 73.90.

- Hourly Relative Strength Index (RSI) turns south from the overbought territory, set to test the 50 level.

- The bearish trend could resume on a sustained break below the key 72.50 support.

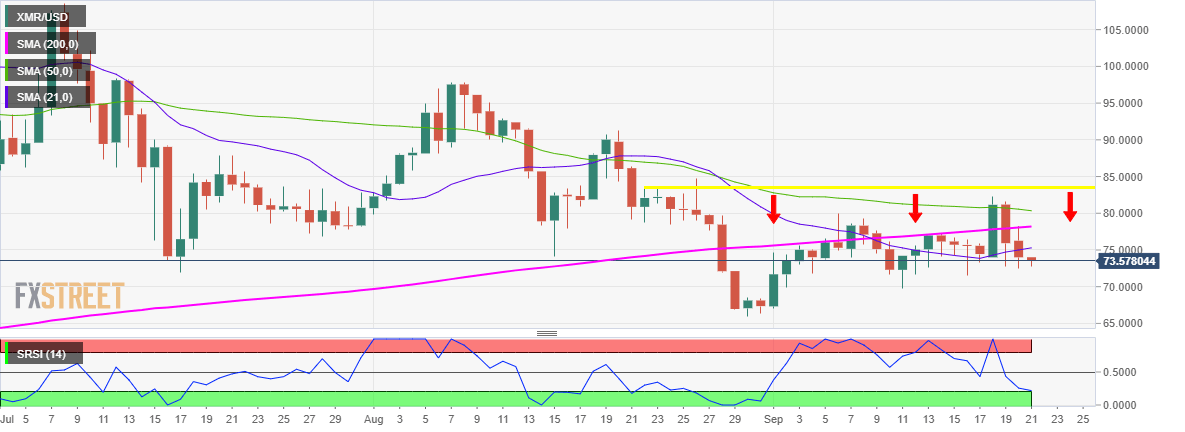

XMR/USD Daily chart

- Trapped in a narrow range since late-August, awaits fresh catalyst.

- The spot trades below all the key Daily Simple Moving Averages (DMA).

- Only a sustained break above the horizontal resistance of 83.50 can reverse the near-term bearish outlook.

- Daily Relative Strength Index (RSI) suggests that there is a scope for further downside.

XMR/USD Levels to watch