- NZD/USD received significant positive momentum on Friday as a result of a better NZ CPI report.

- A restrained USD demand remained supportive of the upward rise in the midst of a bullish risk tone.

- Rebounding US bond yields and positive US retail sales data failed to excite USD bulls.

On Friday, July 16, the NZD/USD forecast maintained its sideways consolidative price action throughout the early North American session, remaining limited in a range slightly above the critical 0.7000 psychological level. However, the session ended with a downward move.

-If you are interested in forex day trading then have a read of our guide to getting started-

Following the previous day’s strong fall from 0.7045, or over one-week highs, the NZD/USD pair gained upward traction on the week’s last trading day.

A stronger New Zealand consumer inflation report for the second quarter, combined with a muted US dollar demand, gave the major a reasonably good lift.

NZ CPI rose at the fastest rate in over a decade, surging to 3.3 percent in the June quarter.

Against the context of the Reserve Bank of New Zealand’s hawkish surprise earlier this week, the data reinforced expectations on an interest rate increase at the August monetary policy meeting.

For the upcoming week, investors are still worried that the extremely contagious Delta version of the coronavirus may derail the global economic recovery.

This was viewed as another reason that contributed to the NZD/USD pair’s lack of substantial upside, warranting caution for aggressive bullish traders.

What’s next to watch in NZD/USD?

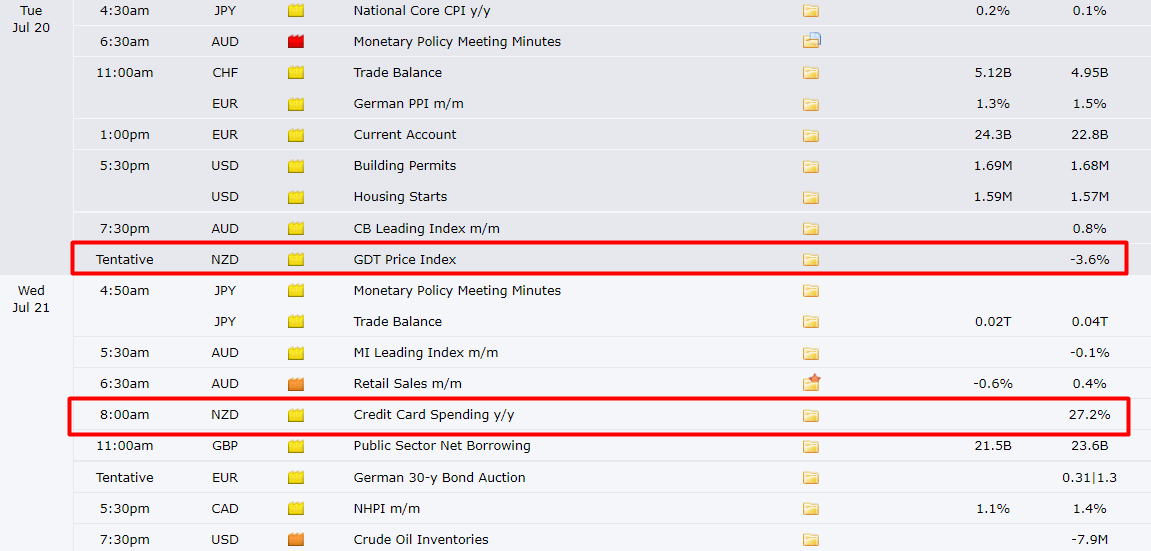

The next week’s economic calendar is quite thin with no major release. Both US and New Zealand data events are of low impact. We have GDP Price Index and Credit Card Spending data due next week for New Zealand.

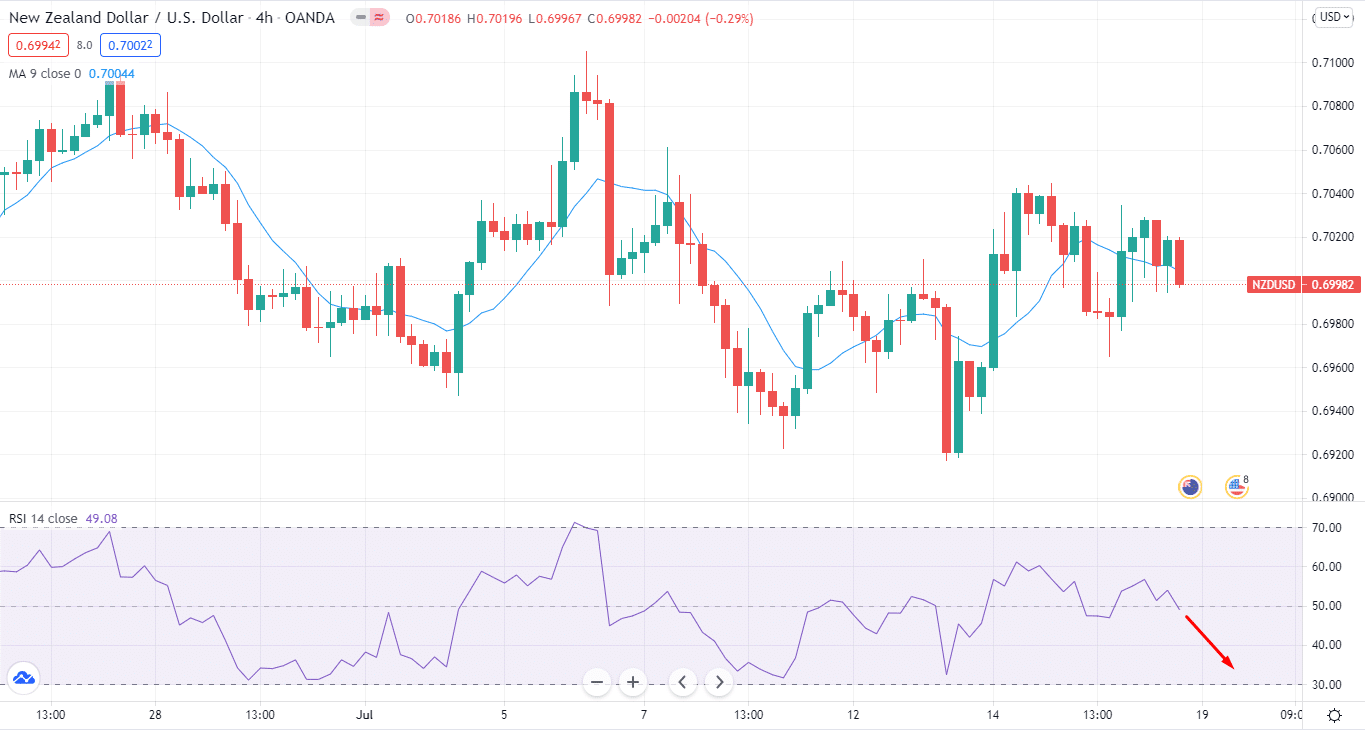

NZD/USD technical analysis: key levels in action

After yesterday’s surge, the NZD/USD pair bounced bearishly dropping below the 0.7000 level to 0.6998.

The MA is losing steam. A downtrend line on the relative strength index will be another signal in favor of the NZD/USD currency pair falling.

-Are you looking for automated trading? Check our detailed guide-

On the other hand, there can be a comeback from the bullish channel’s lower border. Cancellation of the option to reduce the pair quotations in the current trading week will result in a sharp rise and a break of the 0.7475 level.

This will imply a breaking of the resistance zone and a continuation of the increase in the NZD/USD pair, with a potential target above 0.8445.

The NZD/USD weekly forecasts predict a test of the resistance level near 0.7155. Furthermore, the NZD/USD pair can continue to tumble to a level below 0.6065.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.