The New Zealand dollar moved by the flute of the double feature Wednesday: the Fed and the RBNZ. There is no time to rest as we now have the quarterly employment report and milk prices. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The Fed leaned to the dovish side, showing caution about the future. The RBNZ swiftly followed: while they left the interest rate unchanged, Wheeler and co. opened the door for further cuts later this year and complained about the value of NZD. However, a better market mood that followed, pushed the kiwi to higher ground.

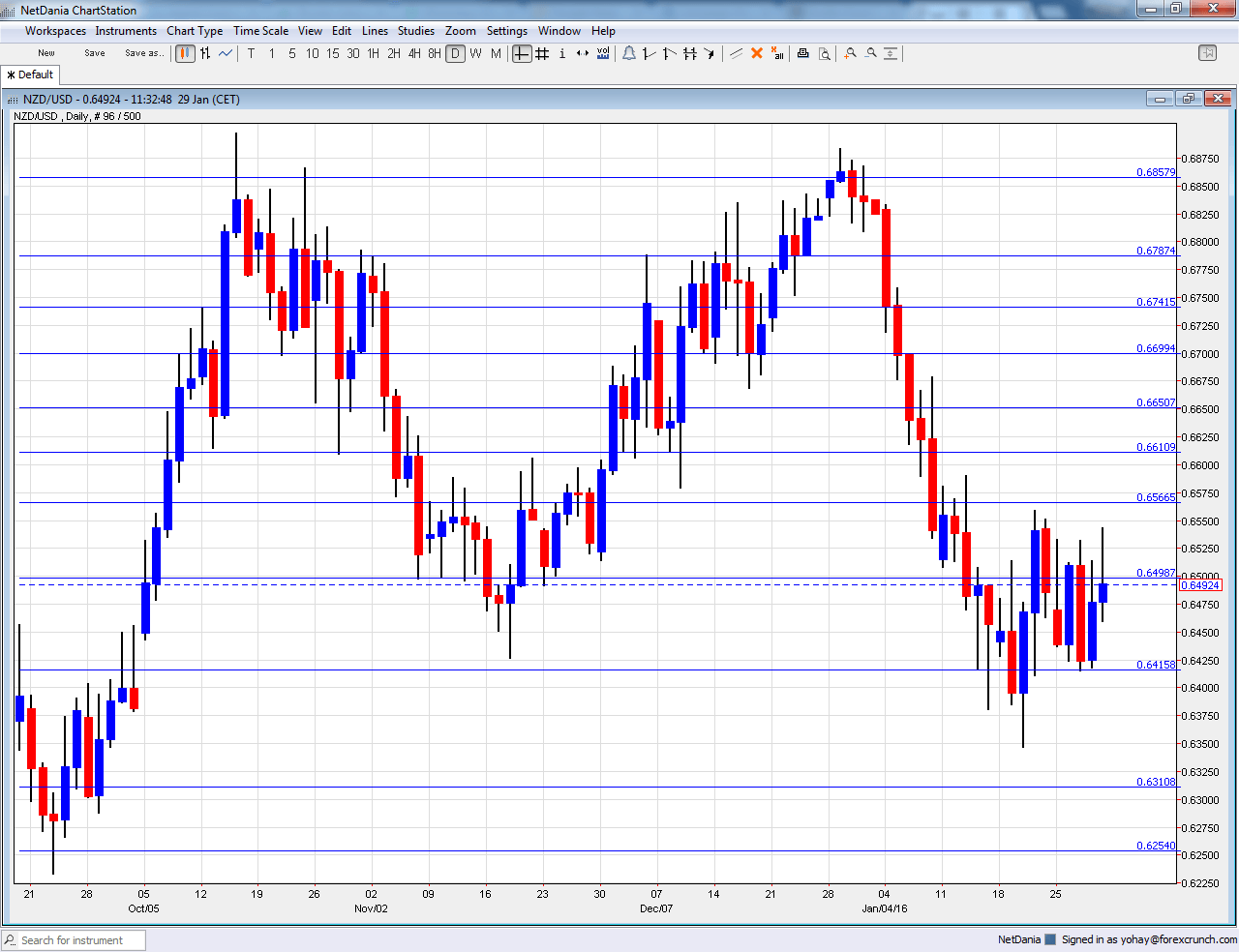

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Visitor Arrivals:Sunday, 21:45. Tourism also plays a significant role in New Zealand’s economy. In December, the country enjoyed a rise of 3.9% and now, another rise could be seen.

- ANZ Commodity Prices: Tuesday, 00:00. This indicator plays second fiddle to milk prices, but matters nonetheless. A drop of 1.8% was recorded in December and another small slide is on the cards now.

- GDT Price Index: Tuesday, during the European afternoon. New Zealand depends on exports of milk and related products, making this bi-weekly publication very important. A second consecutive drop was reported last time, 1.4%. Will we see a recovery now?

- Jobs report: Tuesday, 21:45. New Zealand publishes employment figures only once per quarter, making the release even more important than in other countries. The report for Q3 was very disappointing: a drop of 0.4% instead of a rise at the same scale and the unemployment advanced to 6%. The labor cost index moved up by only 0.4%.

NZD/USD Technical Analysis

Kiwi/dollar started remained on high ground but slipped under 0.65 (mentioned last week). A new low was seen at 0.6415, which works as strong support.

Technical lines, from top to bottom:

We begin from lower ground this time. The low of 0.6940 allowed for a temporary bounce. The round 0.69 level has switched positions to resistance.

0.6860 was a low point as the pair dropped in June 2015. It is followed by 0.6790 that capped the pair in recent months.

It is followed by the round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

Below, we find 0.6415, which cushioned the pair in January, as support. 0.6350 provided support in January 2016.

The last line for now is 0.63, which had a role in the past.

I am bearish on NZD/USD

A dovish RBNZ, with wishes to see a weaker kiwi and a damp market mood due in part to unconvincing US figures, could put a lot of pressure on the pair.

In our latest podcast we make sense of turbulent markets