The New Zealand dollar rallied sharply on a strong employment report and weakness in the greenback. Two events dot the kiwi calendar this week, that begins late after a holiday. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

New Zealand saw a rise of 0.9% in employment during Q4, better than expected. The drop to 5.3% grabbed the headlines, even if it was skewed by a drop in the participation rate. The big drop of 7.4% in the GDT Price Index did not have a strong impact as expected. From the other side of the Pacific, the crash of the USD, due to poor readings on the US economy gave the kiwi further fuel to move higher.

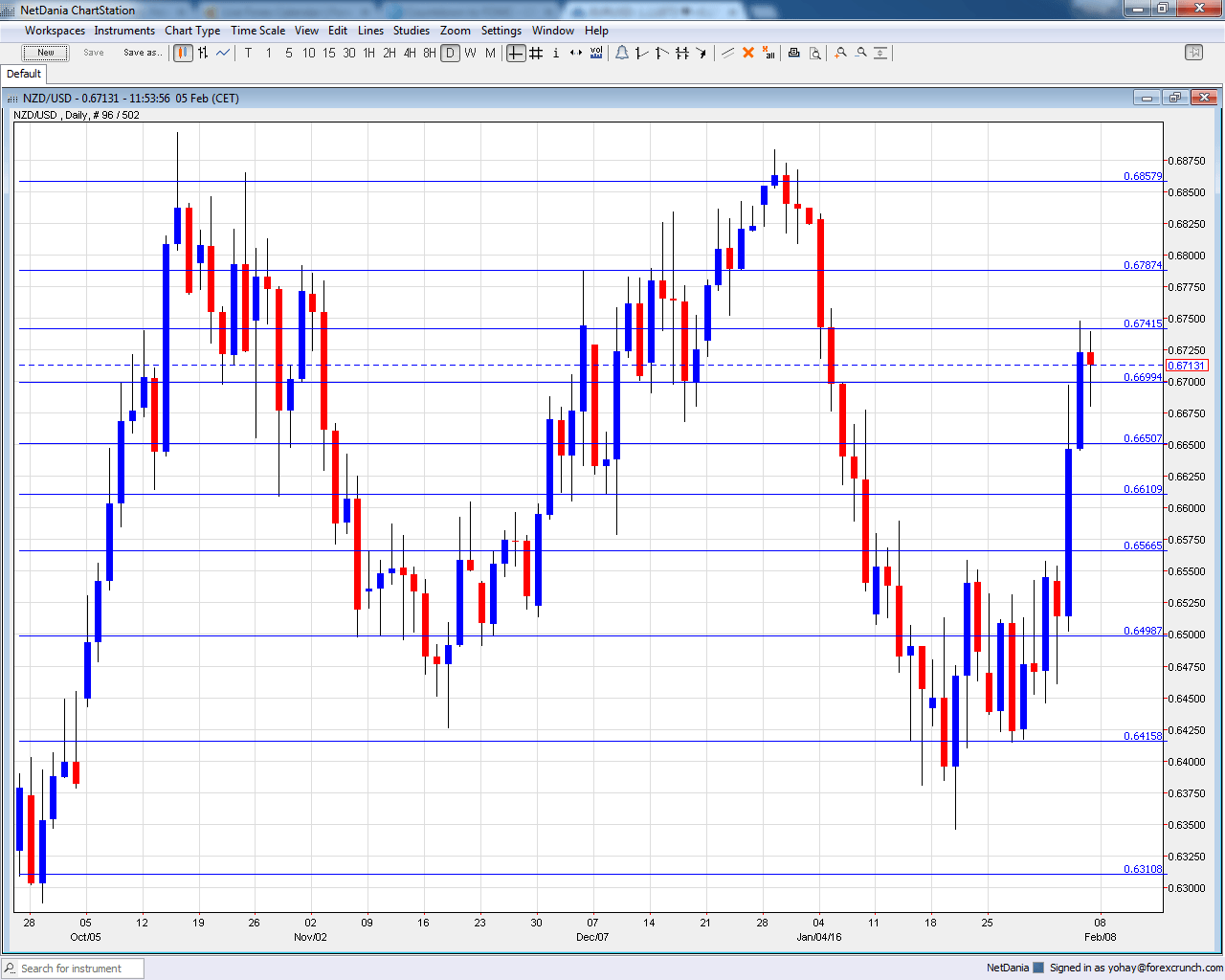

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Business NZ Manufacturing Index: Wednesday, 21:30. This PMI like indicator for the manufacturing sector has been showing strong growth of late. A similar score to last month’s 56.7 points is on the cards for January.

- FPI: Thursday, 21:45. Even though the publication plays second fiddle to milk prices, it is still of importance. In December, prices fell by 0.8%.

NZD/USD Technical Analysis

Kiwi/dollar managed to settle above 0.65 (mentioned last week) before making a big break and taking a break at 0.67.

Technical lines, from top to bottom:

We begin from lower ground this time. The round level of 0.70 is already in sight. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6860 was a low point as the pair dropped in June 2015.

It is followed by 0.6790 that capped the pair in recent months. The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

Below, we find 0.6415, which cushioned the pair in January, as support. 0.6350 provided support in January 2016.

I am bullish on NZD/USD

The positive jobs report may have been a game changer for the kiwi, that could continue the upwards trend, at least until the RBNZ begins jawboning about the strength of the currency.

Our latest podcast is titled Americans get a raise, negativity in Japan, Gas Naturally Low