The New Zealand dollar had a very interesting week with milk and GDP maintaining the balance while the Fed hurt the greenback quite hard. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

After one rise after 4 falls in milk prices, they resumed their falls. This hurt the kiwi, but not for long. The extremely dovish Fed decision sent the dollar down and then the kiwi got another small boost from the beat on New Zealand GDP: the rise of 0.9% q/q in Q4 was certainly encouraging.

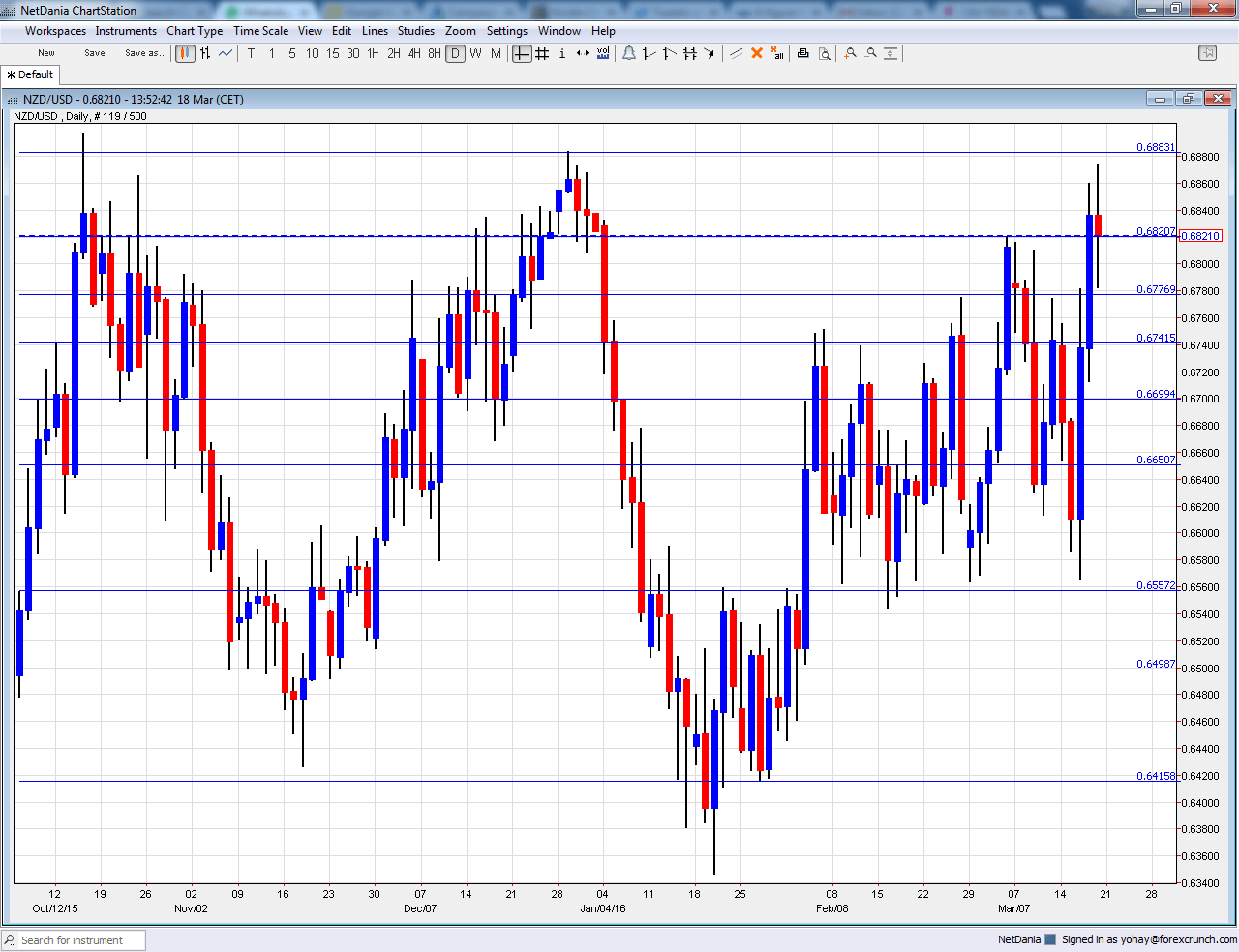

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Westpac Consumer Sentiment: Sunday, 21:00. Just as the trading week begins, we’ll get a look at the consumer. A score of 110.7 points in Q4 was an improvement in comparison to Q3. Another small rise could be seen now.

- Visitor Arrivals: Sunday, 21:45. Tourism also plays a role in the New Zealand economy and February is mid-summer. After a rise of 2.9%, another move to the upside is expected.

- Credit Card Spending: Monday, 1:00. With retail sales published only on a quarterly basis, this measure of spending helps understand the state of consumption. A nice rise of 8.9% was recorded in January and the rise could be more modest this time.

- Trade Balance: Wednesday, 21:45. New Zealand surprised with a surplus in January. While it was only 8 million, it cut the streak of deficits. Will the figure be positive again?

NZD/USD Technical Analysis

Kiwi/dollar made a move to the upside, breaking above the ranges mentioned last week.At some point it topped 0.6820 but did not reach 0.6860.

Technical lines, from top to bottom:

The round level of 0.70 is already in sight. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6860 was a low point as the pair dropped in June 2015. 0.6820 is worth noting after it capped the pair in March 2016.

It is followed by 0.6780 that capped the pair in recent months. The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

Below, we find 0.6415, which cushioned the pair in January, as support. 0.6350 provided support in January 2016.

I am bearish on NZD/USD

While the economy continues growing nicely, the worrying fall in milk prices and the tendency of the RBNZ is still to the downside. One the US dollar finds a footing, we could see some stabilization here.

In our latest podcast we digest the dovish Fed