The New Zealand dollar went back to the previous range on weaker data but recovered quite quickly on milk prices and USD weakness. The focus now shifts to the rate decision. Will the RBNZ attempt to weaken the kiwi? Will the positive trend continue? Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Business confidence dropped quite significantly to 7.1 points and building consents fell. The kiwi suffered but got some help from rising milk prices, the first time after 4 consecutive drops. In the US, figures have been mixed, with a worrying service sector report hitting the greenback hard, sending NZD/USD higher.

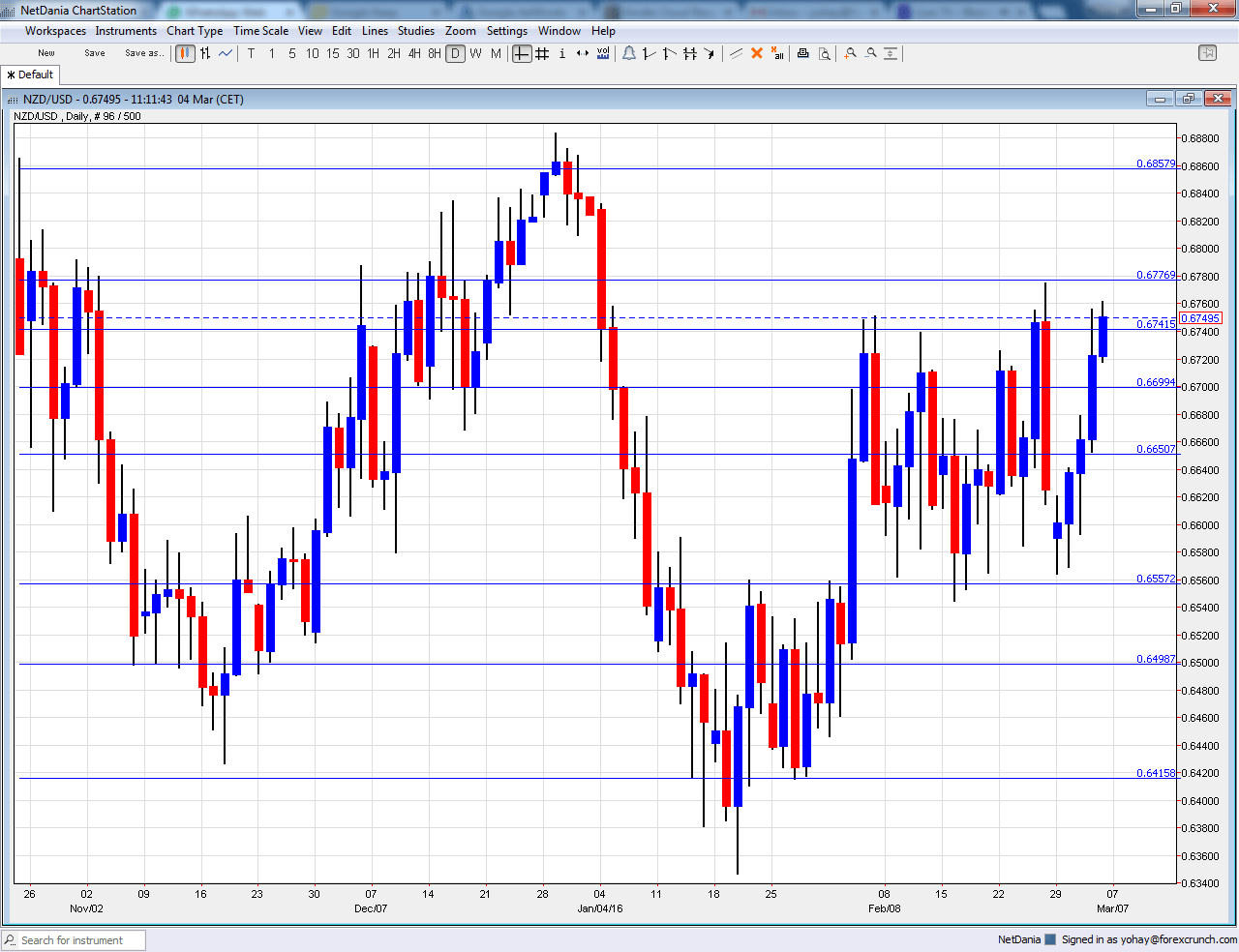

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Manufacturing Sales: Monday, 21:45. Sales advanced by 4.2% in Q3, a second consecutive rise. This figure, albeit quite lagging, provides a wide picture on the economy.

- Rate decision: Wednesday, 20:00. The Reserve Bank of New Zealand left interest rates unchanged at 2.50% last time, and also now, no change is expected. The big question is the sentiment in the statement: will they put the pressure on the kiwi? The situation in New Zealand is OK, but worries about emerging markets weigh.

- Business NZ Manufacturing Index: Thursday, 21:30. This PMI-like survey has shown stronger growth in recent months, reaching 57.9 in January. It could slide now.

- FPI: Thursday, 21:45. The Food Price Index rose by 2% in January, and could rise a bit more now. The GDT Price Index overshadows this publication.

NZD/USD Technical Analysis

Kiwi/dollar broke slid down under 0.67 and returned to the 0.6550 to 0.67 seen previously mentioned last week.

Technical lines, from top to bottom:

The round level of 0.70 is already in sight. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6860 was a low point as the pair dropped in June 2015.

It is followed by 0.6780 that capped the pair in recent months. The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

Below, we find 0.6415, which cushioned the pair in January, as support. 0.6350 provided support in January 2016.

I am bearish on NZD/USD

The RBNZ is likely to take advantage of its rate decision to talk down the kiwi. This doesn’t mean any imminent rate cut, but perhaps hints of such a move later this year. Together with some USD strength, the direction could be to the downside.

Our latest podcast is titled Time for Regrets? Referendum and Rates version