The New Zealand dollar made more moves to the upside, but this reversed as the Federal Reserve became hawkish. What’s next? The milk auction is the next big thing. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

New Zealand’s trade balance deficit widened to 285 million NZD, worse than expected. The publication took its toll on the kiwi, but the currency eventually recovered, also thanks to an upbeat measure of commodity prices, up 2% as well as better terms of trade, a rise of 5.7%. The US dollar enjoyed optimism about a March rate hike but suffered from the Donald Disillusion. Eventually, the Federal Reserve had the upper hand, and the greenback won over.

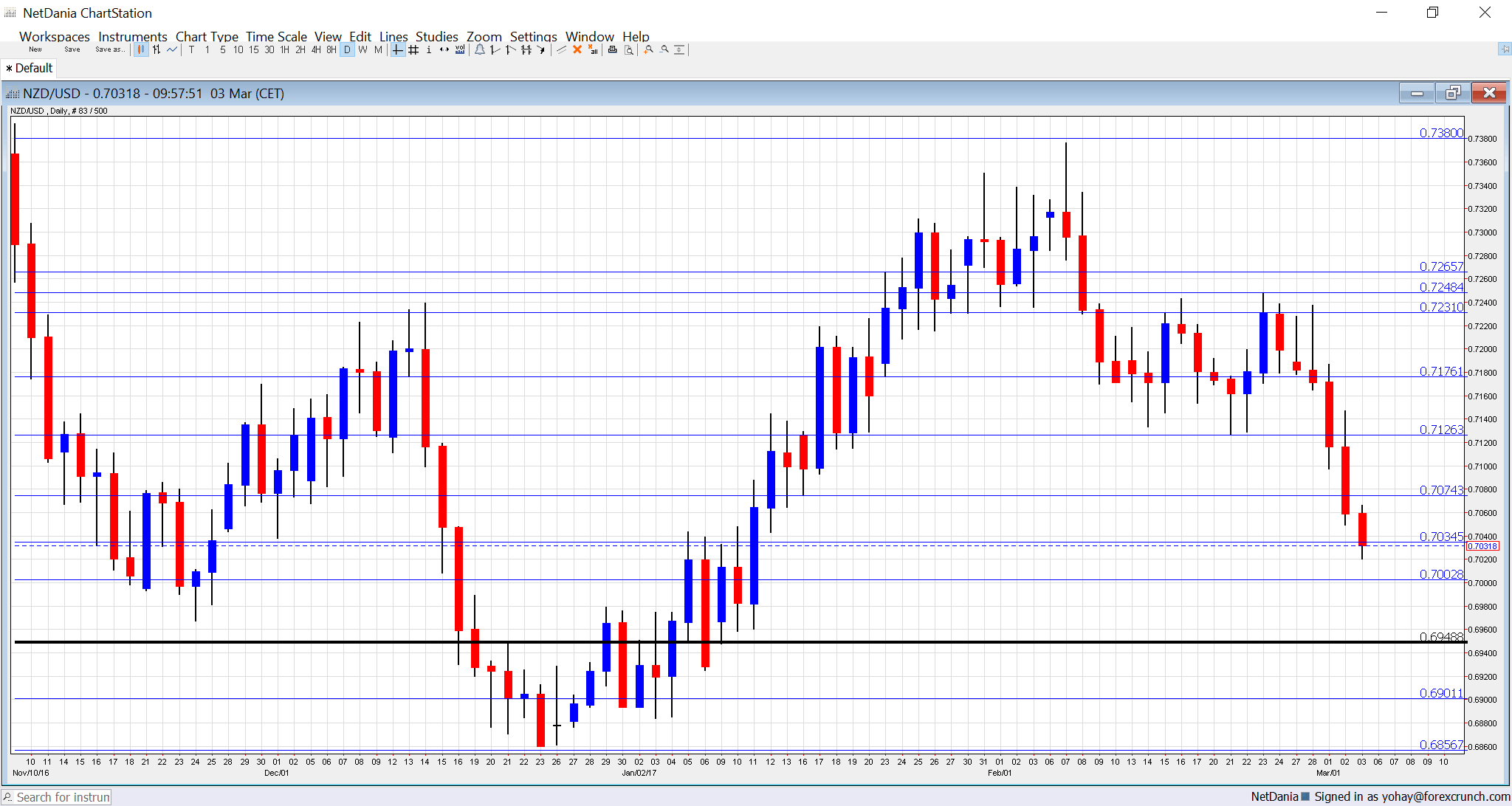

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Building Consents: Sunday, 21:45. Very early in the trading week, we get an early indicator about the housing sector in New Zealand. A drop of 7.2% was recorded last time, but volatility is not uncommon.

- GDT Price Index: Tuesday, during the European afternoon. The Global Dairy Trade reflects the nation’s No. 1 export: milk. A drop of 3.2% was recorded in the previous bi-weekly auction, yet this came after many rises.

- Manufacturing Sales: Tuesday, 21:45. The quarterly figure advanced by a very moderate pace of 0.4% in Q3. We finally get the Q4 data.

NZD/USD Technical Analysis

Kiwi/dollar dropped but bounced off the 0.7160 level (mentioned last week). It made a few moves to the upside but then collapsed, flirting with the 0.70 level.

Technical lines, from top to bottom:

0.7380 was the high recorded back in February and is our top line for now. Below, we find 0.7250, which capped the pair back twice in mid-February and serves as a double top.

0.7160, which capped the pair back in November is a pivotal line within the range. 0.7125 worked as a double bottom before it collapsed in early March.

0.7075 served as resistance back in November and then worked as a stepping stone on the way up. It is followed by 0.7035 that worked as resistance in early January.

The very round number of 0.70 is a battle zone. Further below, 0.6960 worked as support in November and then in January once again.

The round number of 0.69 is weak support and it is followed by 0.6865.

I am neutral on NZD/USD

While the New Zealand economy provides reasons to be cheerful about the kiwi and Donald Trump provides reasons to be worried about the dollar, the hawkishness of the Federal Reserve balances things out.

Our latest podcast is titled March hike, Macron, and Mario Draghi

Follow us on Sticher or iTunes

Safe trading!