The New Zealand dollar gained some ground, recovering previous losses. Trade balance stands out in the upcoming week. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

After a few positive auctions, the GDT Price Index disappointed with a drop of 3.2%. Milk prices have seen better days. On the other hand, PPI Input slightly beat expectations with 1% instead of 0.9% predicted. In the US, an ongoing disillusion with Donald Trump is hurting the greenback.

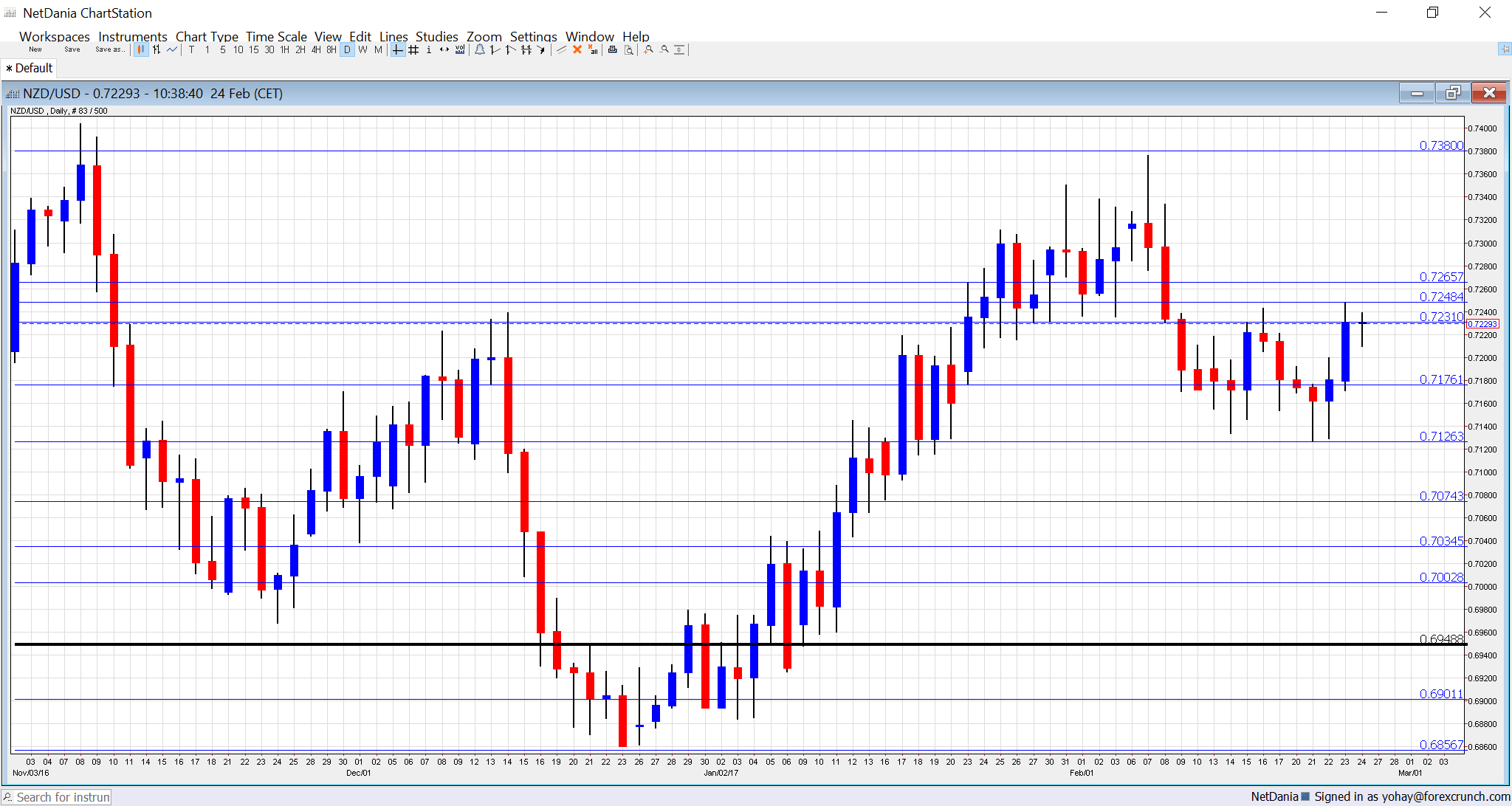

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Visitor Arrivals: Sunday, 21:45. Tourism plays an important role in New Zealand’s economy. The number of visits disappointed with a drop of 1.3% in December. A rise is likely now.

- Trade Balance: Monday, 21:45. New Zealand’s trade balance was quite balanced in December with a small deficit of 41 million. A wider deficit is on the cards now.

- ANZ Business Confidence: Tuesday, 00:00. This widely respected 1500-strong survey has ticked up to 21.7 in January. It will likely hold its ground now.

- Overseas Trade Index: Tuesday, 21:45. The indicator, known also as “Terms of Trade”, has disappointed with a drop of 1.8% in Q3, but is now predicted to rise by 4.1%.

- ANZ Commodity Prices: Friday, 00:00. While the GDT Price Index carries a lot of weight, this figure also matters. It slid by 0.1% last month.

NZD/USD Technical Analysis

Kiwi/dollar hovered around levels that were seen last week.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7310 was the high point in January 2017.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterward as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am neutral on NZD/USD

Our latest podcast is titled Fed refocus as monetary matters once again

Follow us on Sticher or iTunes

Safe trading!