The New Zealand dollar struggled against the strength of the US dollar. The upcoming week is very busy, with the jobs report standing out. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The sole release from New Zealand was trade balance, which disappointed with a deficit of 1.436 billion. In the US, data was mixed with GDP beating in the headline but missing on the internals.

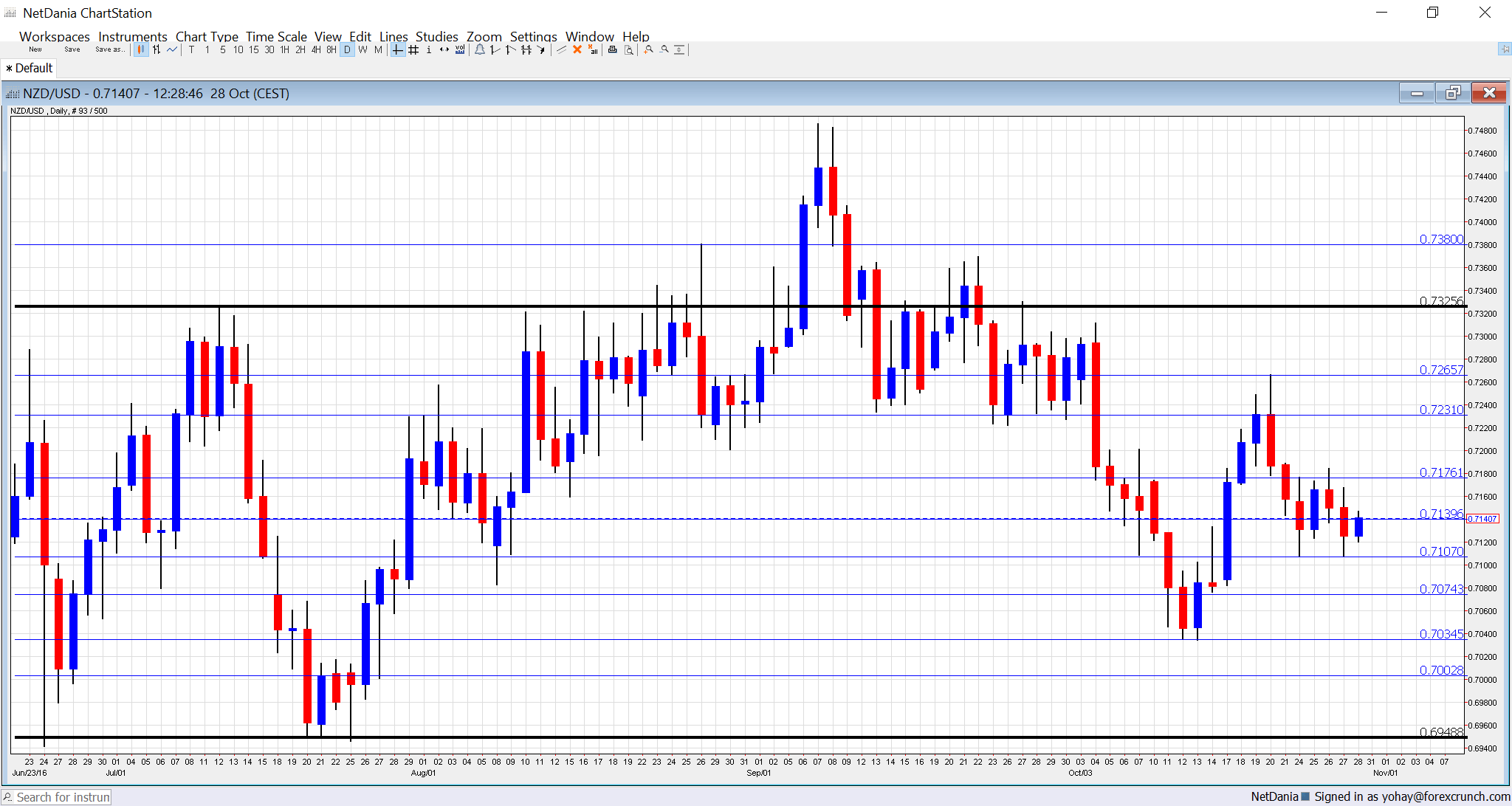

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Building Consents: Sunday, 21:45. The number of building approvals is a good gauge for the housing sector, despite some volatility. Consents dropped by 1% last time.

- ANZ Business Confidence: Monday, 00:00. This 1500-strong survey advanced nicely in September, reaching 27.9 points, the highest since April 2015.

- GDT Price Index: Tuesday, during the European afternoon. The price of milk has a significant impact on the kiwi dollar, as it is the country’s primary export. The bi-weekly Global Dairy Trade rose 1.4% last time.

- New Zealand jobs data: Tuesday, 21:45. This is a quarterly report, very different from most countries that publish it on a monthly basis. The level of employment jumped by a solid 2.4% in Q2 2016, sending the unemployment rate down to 5.1%. We cannot expect such a strong outcome this time. Labor costs advanced 0.4% last time.

- Inflation Expectations: Wednesday, 2:00. With official CPI inflation data published only once per quarter, this measure of inflation expectations fills some of the gap. In Q2, it stood on 1.7%.

- ANZ Commodity Prices: Thursday, 00:00. While this publication plays second fiddle to milk prices, it still has an impact. The indicator increased by 5.1% last month. A more modest rise is likely now.

NZD/USD Technical Analysis

Kiwi/dollar was on the back foot, capped by 0.7160 (mentioned last week) before sliding lower.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7330 was an initial high in 2016.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterwards as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I turn from bearish to neutral on NZD/USD

Tension towards the US elections could keep the pair within a relatively narrow range. Data from New Zealand could be mixed this week, also preventing a run to any direction.

Our latest podcast is titled Bold in oil and talking up the currency

Follow us on Sticher or iTunes

Safe trading!