The New Zealand dollar was on the back foot as the US dollar regained its strength. The RBNZ’s decision is now left, front and center. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

A global sell-off of stocks over various worries boosted the US dollar and the kiwi, as a commodity currency, was headed in the other direction. New Zealand’s deeper than expected current account deficit did not help.GDP provided an opportunity for things to balance out. On one hand, quarterly growth was weaker with only 0.9%, yet annual growth remained a robust 3.6%. In the US, the disappointing retail sales report alongisde other misses, buried the chances of a rate hike, yet did not bury the dollar.

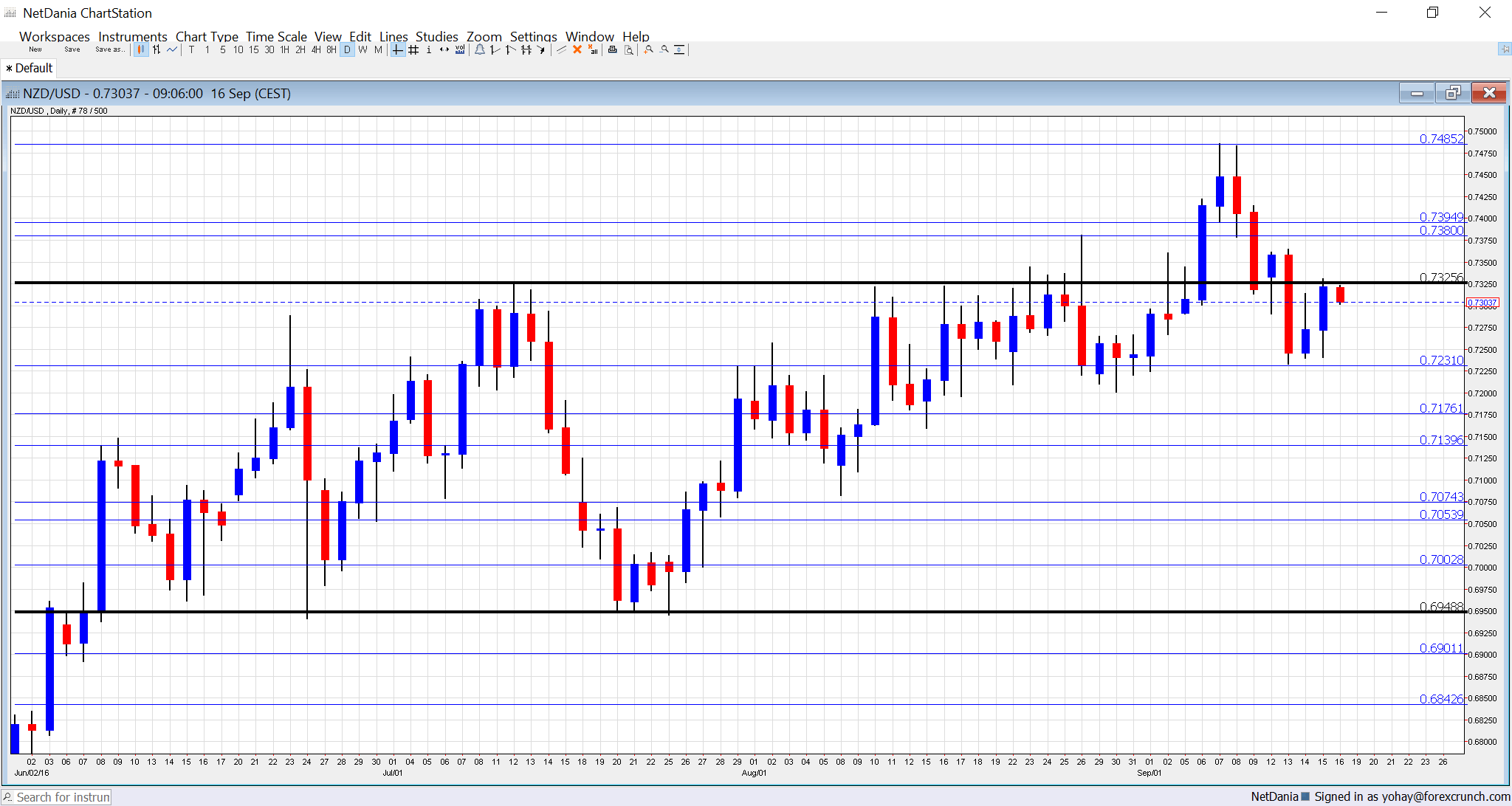

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Westpac Consumer Sentiment: Sunday, 22:00. Early in the week, this large bank releases its quarterly 1500 strong survey. Consumer confidence dropped in Q1 to 106 points, and another crumble cannot be ruled out.

- GDT Price Index: Tuesday, during the European afternoon. The Global Dairy Trade is a bi-weekly measure of New Zealand’s export: milk. In the past three auctions, prices of this white gold have leaped. Will we have a fourth consecutive jump or a correction? The publication always results in volatility.

- Visitor Arrivals: Tuesday, 22:45. Tourism also plays a role in the economy. Arrivals were up 2.9% in July and August, a month of holidays in the northern hemisphere, could see further gains.

- Credit Card Spending: Wednesday, 3:00. With official retail sales data published only once per quarter, this measure of plastic card usage provides up to date snapshot insights. An annual rise of 5.6% was recorded in July.

- Rate decision: Wednesday, 21:00. The Reserve Bank of New Zealand maintains an interest rate of 2%, higher than most developed countries but extremely low in local standards. With a stable economy, the RBNZ is likely to leave rates unchanged this time. However, comments by Governor Graeme Wheeler are likely to be more bearish on the exchange rate. NZD is trading at an elevated ground in comparison to the USD and also to the AUD, nearing parity with the latter. Currency intervention is never ruled out in Wellington.

NZD/USD Technical Analysis

Kiwi/dollar dropped to lower ground, bet held onto the 0.7240 level (mentioned last week).

Technical lines, from top to bottom:

We start from a higher point this time. 0.7740 is the high watermark that capped the pair back in April 2015. It is followed by the round level of 0.76. 0.7460 is the high level seen in September 2016.

The round number of 0.74 served as resistance and support back in 2015. 0.7330 is the high of 2016 so far.

0.7290 was the pre-Brexit peak and serves as high resistance. The next line is 0.7240 which capped the pair in July 2016.

0.7160 worked as support when the kiwi was trading on the much higher ground in 2014. 0.7050 was the peak in April 2015.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am bearish on NZD/USD

The RBNZ decision, coming hours after the Fed, could keep the kiwi depressed even if Yellen remains dovish. In addition, milk prices could turn sour after 3 huge leaps.

Our latest podcast is titled Brexit: Bad, Bearable or Brilliant?