The New Zealand dollar accelerated its losses and closed the week with a 3% drop well below 0.80 in one of the worst weeks ever. Business confidence is the main event this week. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

While New Zealand’s trade balance exceeded expectations with a smaller than expected deficit, there were stronger forces that hit the pair: the US dollar was storming across the board and commodity currencies were hit hard. When the kiwi was already down, RBNZ governor made a special statement saying the exchange rate, despite its recent fall, is still unjustifiable and unsustainable. He put fuel on the fire and this resulted in a terrible slide. Can the fundamentals of the New Zealand economy beat these words?

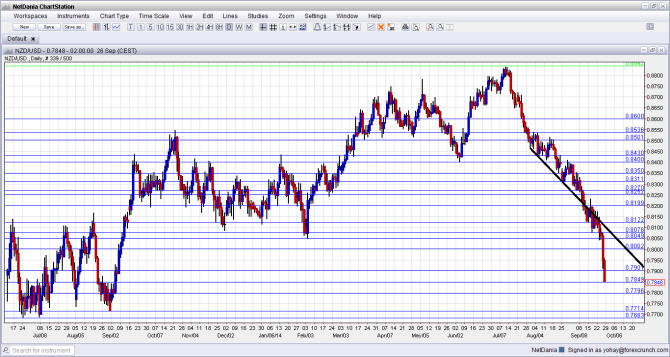

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Building Consents: Monday, 21:45. After a few months of volatility, this indicator of the housing sector ticked up by 0.1% in July. A similar figure is expected now.

- ANZ Business Confidence: Tuesday, 00:00. This highly regarded survey of 1500 businesses is on the decline since it reached a multi-decade low above 70 points back in February. After scoring 24.4 points in August, another slide is likely, but optimism (a score above 0), is likely to prevail.

- GDT Price Index: Wednesday. The Global Dairy Trade, or put simply, the price of milk,. is critical to New Zealand’s economy. After a series of falls in the past few months, the last auction resulted in no change in prices. The unexpected numbers and the unexpected timing make it a big market mover for the kiwi.

- ANZ Commodity Prices: Thursday, 00:00. Commodity prices have been sliding in the past 6 months, and no respite is likely now. The fall of 3.3% seen in August is expected to be followed by a more moderate slide.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar began the week with a gradual slide towards the 0.8050 line, mentioned last week. After holding on to this line for some time, the pair free-fell below 0.80 and closed at the very low level of 0.7850.

Live chart of NZD/USD:

[do action=”tradingviews” pair=”NZDUSD” interval=”60″/]Technical lines, from top to bottom:

We start from lower ground for yet another week. 0.8312 was the low point in August 2014 and it also follows the downtrend support line. The next line is 0.8270, which was the low point in September.

Further below, the round levels of 0.82 is certainly worth watching. It is followed by the initial September low of 0.8120.

0.8075 is the new cycle low and works as weak support. Even lower, 0.8050 provided support for the pair back in February and is the last line before the very round figure of 0.80.

Even lower, the round number of 0.79 provides support further down the line. It is followed by 0.7850.

Going deeper, the round number of 0.78 is weak support after working as resistance in the past. 0.7715 is stronger support after serving as a cushion for the pair in September 2013. 0.7685 is very strong support and it held the pair back in the summer of 2013.

Below this point, we are back to levels last seen in 2012: 0.7615 is initial support and the critical line is 0.7460.

I am neutral on NZD/USD

The strength of the US dollar is certainly overwhelming, yet the kiwi might have some room to stabilize, probably not recover. At these levels, even the RBNZ might be smiling quietly and celebrating its success with downing the currency. More: Are the AUD and NZD currencies on path for more devaluation?

In our latest episode, we talk about Contango vs. Backwardation, Scottish reverberations and key US data:

Subscribe to our podcast on iTunes.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.