Rate Decision followed by RBNZ Press Conference and Monetary Policy statement are the major events for the NZD/USD traders this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

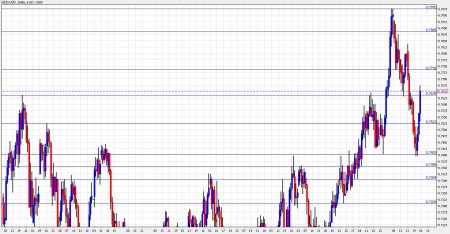

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

Last week the New Zealand dollar held above 75 US cents after the European Central Bank purchased bonds at 67 billion Euros, to overcome sovereign debt problems. The kiwi is at the top end of BNZ’s fair-value range of between 73.50 cents and 75 cents; however it will probably head towards the bottom of the range in the coming weeks due to the weak kiwi economy, Europe’s bond purchasing and US bond yields. Will this scenario come true?

- Manufacturing Sales: Tuesday, 21:45. Manufacturing value of Sales increased 3.1 % in the previous quarter driven by a 13.9 percent increase in the meat and dairy industry. However, the Volume of sales decreased by 1.8% at their lowest level for over 10 years. A modest rise is expected now.

- Rate Decision: Wednesday, 20:00. Two months of unchanged Official Cash Rate at 3.0% have kept the NZD at a modest growth. Alan Bollard spoke of the unevenness of global growth, with strong growth in emerging economies and much more modest growth in advanced economies at the accompanied rate statement. Markets do not expect the RBNZ’s rate hike campaign to begin anytime soon. It’s important to note the accompanying rate statement and the wording at the press conference that follows the rate decision and the monetary policy statement that will contain hints for the future. The same rate is expected to continue.

- Overseas Trade Index: Thursday, 21:45. New Zealand’s Overseas Trade Index rose by 2.1% in the June quarter 2010 less than 3.4% expected by analysts. Until June 2010 quarter, the merchandise terms of trade increased 12.7 %, the largest annual increase since June 1979 quarter. A smaller rise of 1.7% is predicted.

* All times are GMT.

NZD/USD Technical Analysis

NZD/USD had a rough start to the week, dropping to the 0.74 line (mentioned last week), but it later recovered, and managed to climb above 0.7634 to close at 0.7632.

Looking up, 0.7740 was a support line when the kiwi was trading higher and is now the first resistance line. Above, 0.7885 capped the pair when it was trading higher, just before it reached the year-to-date peak of 0.7975.

Even higher, peaks from 2008 are the next levels: 0.81 and the all-time high of 0.8214.

Looking down, 0.7634 now provides immediate support. It served as resistance in October and also one year ago. Below, 0.7523 is a minor support line.

Lower, the next support line is at 0.74, the lowest point in the past two months, and also a resistance line earlier. Below, minor support is found at 0.7355, which was a stubborn peak in the summer.

Below, 0.73 worked in both direction and is the next and close support line. Strong support is found at 0.72, which already had this role earlier. It’s closely followed by 0.7160, before the round number of 0.70.

I remain neutral on the kiwi.

The fundamentals in New Zealand aren’t good enough at the moment to support a significant move higher. Only a big leap in commodity prices will boost the pair. Otherwise, it is drifting on the news from Europe. Perhaps QE3 will help…

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro/Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar.

Want to see what other traders are doing in real accounts? Check out Currensee. It’s free..