NZD/USD continued its free fall, but at least escaped the very steep channel. Has it found a bottom after diving so deep? NBNZ Business Confidence is the highlight of this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

Last week, New Zealand’s government released its Annual Budget forecasts expecting a budget surplus of NZ$197 million in 2014-15 and a growth rate of 2.6% year to March 2013 and a higher growth rate of 3.4% year to March 2014. NZ Treasury has implied RBNZ would raise rates during the first quarter of 2013.

Updates: The kiwi started the week on the right foot, climbing above the 0.76 line. NZD/USD was trading at 0.7634. Building Consents will be released on Tuesday. The indicator will be hard-pressed to duplicate the remarkable jump of 19.8% in April. The kiwi weakened, as investors remain wary about talk of a Greek exit from the Euro-zone, and concerns over the health of the banking sector in Spain. NZD/USD continues to test the 0.76 line, as the pair was trading at 0.7597. After a spectacular April, Building Consents plummeted, posting a dismal -7.2%. The kiwi was down slightly, with NZD/USD trading at 0.7575. Business Confidence fell sharply, posting a reading of 27.1 points. It was the indicator’s worst showing in 2012. The kiwi fell as low as 75.06 in the Asian session, but retraced, with NZD/USD trading at 0.7558.

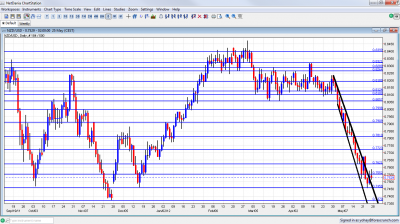

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Building Consents: Tuesday, 22:45.New Zealand building consents edged up 19.8% in March amid growing demand for new housing in Auckland and Christchurch. This increased followed a 6.2% decline in February indicating a possible recovery in the housing industry.

- NBNZ Business Confidence: Thursday, 1:00.New Zealand business confidence continued rising to35.8 in March amid a surge in retail and services sectors. 36% expect improved economic conditions this year. However the strong currency is a big worry for exporters despite the latest improvements.

- Overseas Trade Index: Thursday, 22:45. NZ terms of trade dropped less than predicted in the 4th quarter of 2011 down 1.4% from the third quarter. Analysts expected a 1.9% decline. The change for the 3rd quarter was revised up from minus 0.7 percent to minus 0.6 percent. A bigger drop of 2.6% is expected in the first quarter.

- ANZ Commodity Prices: Friday, 1:00.New Zealand commodity prices dropped 4.5% to an 18 month low in April, amid a decline in the price of sheep meat loosing 12% and dairy dropping 7%.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar managed to escape the steep channel mentioned last week and break above the 0.7620 line. But this didn’t hold for too long, and after testing lows at 0.7457, the pair managed to stage a recovery and close at 0.7529.

Technical lines, from top to bottom:

We start from lower ground once again. 0.8060 was resistance in October and support beforehand.. It was also tested in January and in March, is much weaker now after only temporarily stopping the fall. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance.

Another round number, 0.79, is key resistance, after being a very distinct line separating ranges. 0.7810 was a double bottom in May 2012 and also served as resistance at the end of 2011, and now returns to this role after the crash.

0.7773 was the bottom border of a range at the beginning of 2012, and also in December. 0.77 provided support in December and serves as resistance..

0.7620 provided support in May 2012 and is resistance once again. 0.7550 is now key resistance, even after the breakdown. It was a very distinct line separating ranges and had a similar role back in January.

Below, 0.7460 is significant support after working as support at the end of 2011 and also in May 2012. This is key support. 0.7370, which was the trough in December is low support. This is a significant line if 0.7460 breaks.

0.7308 is minor support after working as such at the beginning of 2011. 0.72 worked in both directions during the past few years.

0.71 is the last line, after being a distinct trough in March 2011.

Steep Channel Broken

As the graph shows, the pair managed to break out of a steep downtrend channel since that accompanied it since the beginning of May. Does this signal a stabilization?

I remain bearish on NZD/USD

The kiwi proved to be quite vulnerable, as the worsening European mess joins another drop in Chinese manufacturing PMI. 0.7370 is the next target.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.