The kiwi took a big hit in the past week, and lost around 300 pips. Inflation Expectations is the major event this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD

Last week retail sales edged up better than expected rising by 2.2% while core sales grew by 2.4% giving a boost to the kiwi meantime, costs of goods bought by manufacturers increased by 0.6% in line with predictions. Will this positive trend continue?

Updates: The kiwi continues to struggle and has taken a dive under 0.75. One of the things that weigh on the New Zealand dollar is contraction in Chinese manufacturing (according to HSBC), as well as the problems in Europe. The failed German bond auction raised fears all over the world and sent the kiwi lower. NZD/USD eventually stabilizes above 0.74, but it’s not the end of the story. No mercy for the kiwi dollar, as credit rating downgrades and another terrible auction weigh on Europe. An ugly close for NZD/USD is in sight in this Thanksgiving weekend.

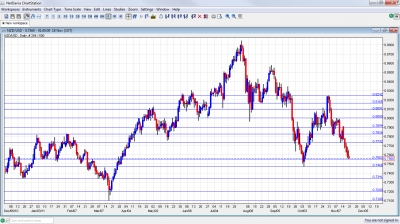

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Credit Card Spending: Monday. 2:00. Credit card spending continued to grow inNew Zealand rising by 5.2% on a yearly base following 4.7% increase in the previous month. However domestic billings dropped by 0.5% from a month earlier.

- Visitor Arrivals: Monday, 21:45. New Zealand visitor figures increased dramatically in September as people arrived for the Rugby World Cup. Short-term visitor arrivals reached 219,900 in September, up from174,200 a year earlier, and 18.1% higher than in the previous month. The Government expects the tournament to draw about 95,000 people and infuse $700 million into the economy.

- Inflation Expectations: Tuesday, 2:00. Inflation expectation dropped below the 3.0% mark to 2.9% in the second quarter from 3.0% in the first quarter. The moderation in CPI is to the liking of the RBNZ expecting inflation to be subdued in 2012. Nevertheless the RBNZ members will avoid raising rates due to the concern over global economy downside risks.

- Trade Balance: Wednesday, 21:45. New Zealand increased trade deficit in September reaching NZ$751 million after NZ$697 billion deficit in August, due to higher purchases of energy products. Analysts expected the deficit to narrow to NZ$421 million Deficit is expected to narrow to NZ$454 million.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar dropped sharply early in the week. After losing the 0.7732 line (mentioned last week), the pair attempted to get back above it, without success. Eventually, the 0.7550 line provided the necessary cushion.

Technical lines from top to bottom:

0.8240 was a swing high in October and also served as support back in June. It is a strong line. 0.8160 was the bottom border of the range and also support in July. It works better as support, so it remains weak at the moment.

0.8090 worked as support in June and in July and another minor resistance line. The round number of 0.80 is already stronger: it capped the pair in November for several days and is also a psychological line. 0.79 is also a round number that worked as resistance in September and turned into support in October.

0.7825 is of historic importance, as it capped the pair three times, in January and in September, and provided support in April. 0.7732 proved to be a significant line – very distinct in separating ranges.

0.7550 now has a stronger role after stopping the fall o fthe kiwi. It had a similar role back in January.

0.7470 was the trough in October and very strong support now, if 0.7550 is broken. Further below, we reach lines last seen at the beginning of the year: 0.7340 worked as support at the end of 2010 and at the beginning of 2011. It had a similar role in March.

The round number of 0.72 worked as support back in 2009, and the last line for now is 0.71, which was a swing low in March 2011.

I remain bearish on NZD/USD

The chances of a rate hike are falling, as the global economy is expecting a downturn. The current debt crisis in Europe is weighing heavily on the kiwi, with the bond rout threatening to reach even Germany. As a risk currency, the kiwi suffers from global worries.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.