The RBNZ cut interest rates by 0.25%, from 2.25% to 2%,, as expected. So much expected, that the currency actually shot higher. A classic “buy the rumor, sell the fact”? Or perhaps things went to an extreme this time.

This seems to be the case of Too Much Information (TMI). The team led by Graeme Wheeler gave us all the signs. This included a special report by the Wellington-based institution that provided a big signal.

In our preview, we talked about the hike being priced in. We also added that markets are already hungry for a 50bp rate cut or at least a signal that more rate cuts are coming.

Well, we did not get a 50bp cut and Wheeler also added that it was not an option during the meeting. However, they did leave the door open to more cuts, as early as this year. In addition, the central bank did draw a clear correlation between the value of the kiwi and their actions. So, if NZD/USD rises, they will cut more. That is supposed to curb any rallies.

Nevertheless, it seems markets are defying central banks over and over again. See the article: Central Banks Have Lost The Ability To Drive Currencies Lower

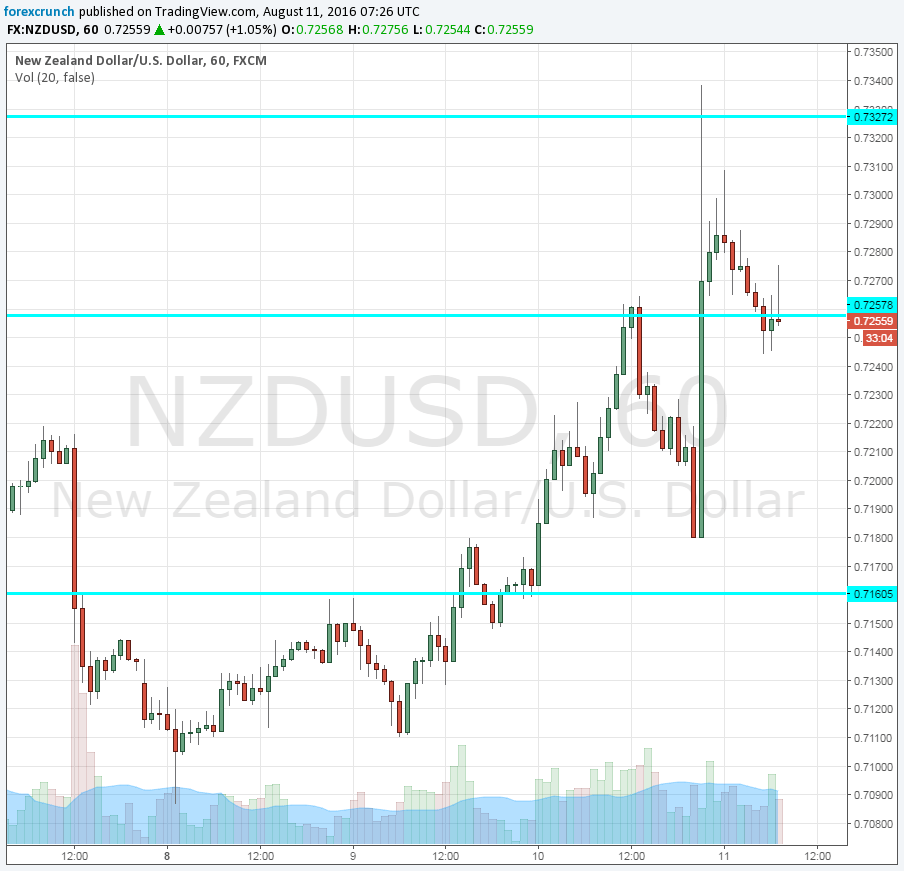

Here is the NZD/USD chart. The pair was trading around 0.72 just before the decision. It then shot up and even breached the 0.7330 level before getting back to the higher range of 0.7250 to 0.7330. Despite another slide, we are still above the pre-RBNZ levels.