We have already seen how good euro-zone data does NOT help the euro, and the spectacular crash following the US NFP.

Why does this happen to the common currency? The team at Morgan Stanley explains:

Here is their view, courtesy of eFXnews:

Over the past couple of weeks, economic data in Europe have improved noticeably, led by better than expected employment gains, domestic demand, and inflation in Germany but despite these green shoots, the common currency has continued to decline towards cycle lows, notes Morgan Stanley.

What is prompting this disconnect between growth outperformance and currency returns?

MS believes that the EUR will continue to decline despite a moderate growth pickup as it undergoes a structural transition. Specifically, MS highlights two forces that have and are likely to continue to weigh on the common currency.

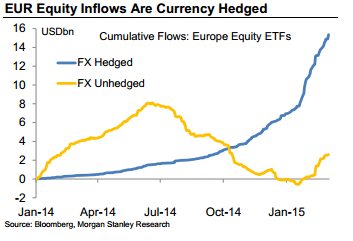

First are hedging flows and in this regard MS argues that the EUR is now trading similarly to the JPY post the start of Abenomics.

“Though foreigners are certainly buying European equities in large size amid improving growth and potential reflation, these inflows are done primarily on a currency-hedged basis, proving the EUR with limited support. We believe that investors are increasing FX hedge ratios on existing European equity holdings as well, given that a foreign investor essentially gets paid to remove FX risk from their European investments. This flow is likely to weigh on the EUR for some time to come, and will result in an environment where EUR rallies are shallow,” MS clarifies.

The second force keeping EUR on its downward trajectory is the increasing use of the common currency as a funder.

“With the ECB about to embark on a quantitative easing program in an environment of negative net European issuance, yields have compressed markedly. As such, the yield differential between the EUR and the rest of the G3 has continued to widen, with EUR rates now even falling below those in Japan. In this environment, investors, corporations, and even sovereigns are switching away from traditional funding vehicles, such as USD and JPY, and using the EUR instead,” MS adds.

EUR Forecasts:

In line with this view, MS sees EUR/USD falling towards 1.05 by the end of this year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.