The trading landscape is changing, so are you ready to change with it?

Originally written by Ryan Littlestone here

Volatility is changing. Volatility has changed. Like watching any trading chart, volatility has peaks and troughs. Volatility can be short or long-term. There can be short-term calm during long-term storms. When volatility changes over the longer-term, we traders have to change with it.

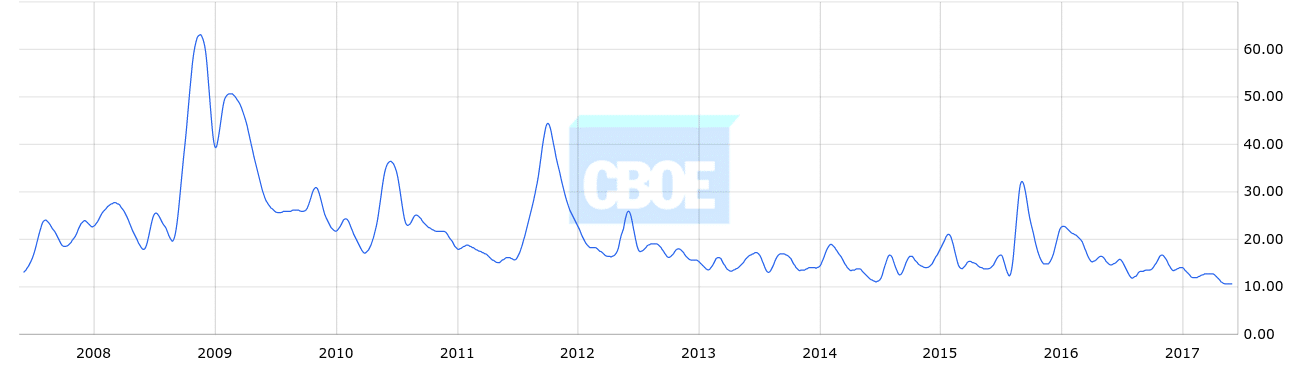

The current trading environment is now heading (or should be heading) for a prolonged period of low volatility. You’ve only got to look at the recent VIX chart to see that volatility is at multi-year lows.

We’ve just come off of a huge financial crisis, and some monumental fundamental changes that have turned the trading rules of thumb upside down for pretty much the last decade.

Who remembers the times when you’d be lucky to see a 20 pip range in a day in USDJPY? I sure there’s many that do but there will also be many traders who don’t. Some of those traders think that big ranges in currencies are the norm, and that’s why we need to know where markets are headed in volatility terms.

The effects on markets from events like a financial crisis are akin to dropping a stone in water. Initially, we get a big splash with large ripples that subside over time.

Right now we’re in a period where the last remaining and faint ripples are passing. Central banks are a good guide for how these last waves are tailing off. The Fed has pretty much docked in normality harbour, while the ECB has cited land as it heads in from open seas. The BOJ is still trying to navigate through the storms, and the BOE is in its blowup dinghy and going round in circles at the harbour mouth.

All this is being reflected in market volatility. No longer do we expect the dollar to rip higher by 500 pips because of interest rate changes. Even into Wednesday’s June FOMC, we haven’t seen the usual bid enter the dollar two or three days beforehand, and this is it yet another rate hike from the Fed that will likely see the dollar end up lower over the following days.

The opportunities for catching a long-term trend to capitalise on extraordinary monetary or fundamental policy changes are reducing, leading to volatility waning. There’s no trading a Fed taper, or first hike 6 months down the line. Soon we’ll be back to trading incremental policy moves on the normal ebb and flow of the economy and inflation.

The ECB and BOJ may still offer us some good trades. It might not be too late to jump on the ECB exiting QE, and the BOJ is still very much stuck down the rabbit hole. Brexit is another event still to be decided that will keep volatility raised. However, in the wider picture, these are singular events and not now intrinsically important in a global sense, which means markets will be much more subdued when trading them.

As usual, the lesson I’m trying to give is about trading, and in this case, adjusting. Lower volatility naturally leads to smaller trading ranges. If you’re a longer-term trader you’re going to have to be a lot more patient to wait for those choice levels. All of us will have to reassess and re-learn how to trade over the next year or so. Profit targets will have to be reduced to compensate but that can mean that stop levels can be given a bit more room. Yesterday’s 100 pips ranges in GBP and EUR will be tomorrow’s 50 pip ranges. Indicators you use that worked in faster markets may not work in slower ones.

Yes, we’ll still have events that will move prices but the size of movements will likely be smaller, and it’s in between those events where things will really die down, and that’s what we have to learn to adjust to.

Trading is constantly changing and the key to success and surviving is identifying and adjusting to those changes.