- Ripple price cancels all the gains accrued in July; back to trading end of June lows.

- Seller’s dominance is on the rise, but a support above $0.430 will prevent extended declines towards $0.400.

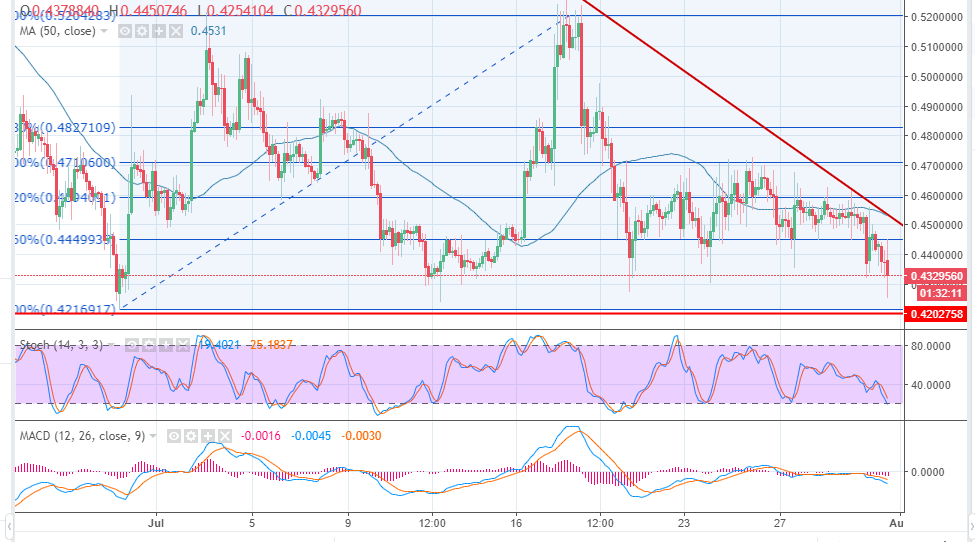

Ripple, like the majority of coins and altcoins, is likely to end July in overarching declines. XRP/USD has canceled most of the gains accrued since the beginning of the month. As we usher in the Month of August, Ripple is free falling below $0.440 after rejecting the support highlighted by the 23.6% Fib level with the last swing high from lows of $0.4244 and highs of $0.5204 at $0.4469.

Ripple is also trading within the confines of a falling wedge pattern, which could also mean that it is approaching a breakout to the upside. XRP/USD is testing the lows trade at the end of June of $0.4202 on June 29. Consequently, the stochastic indicator on the 4-hour chart is advancing further in the oversold territory and the MACD momentum indicator is moving deeper in the negative region (-0.0048). This means that the sellers’ dominance is rising while a support above $0.430 would be a huge boost for the buyers.

In the event of a trend reversal, $0.440 will stand in the way of the pullback. The 23.6% Fib retracement level is the immediate key resistance level, but trading above $0.45 supply one will pave the way for higher corrections towards the coveted $0.50.

XRP/USD 4-hour chart