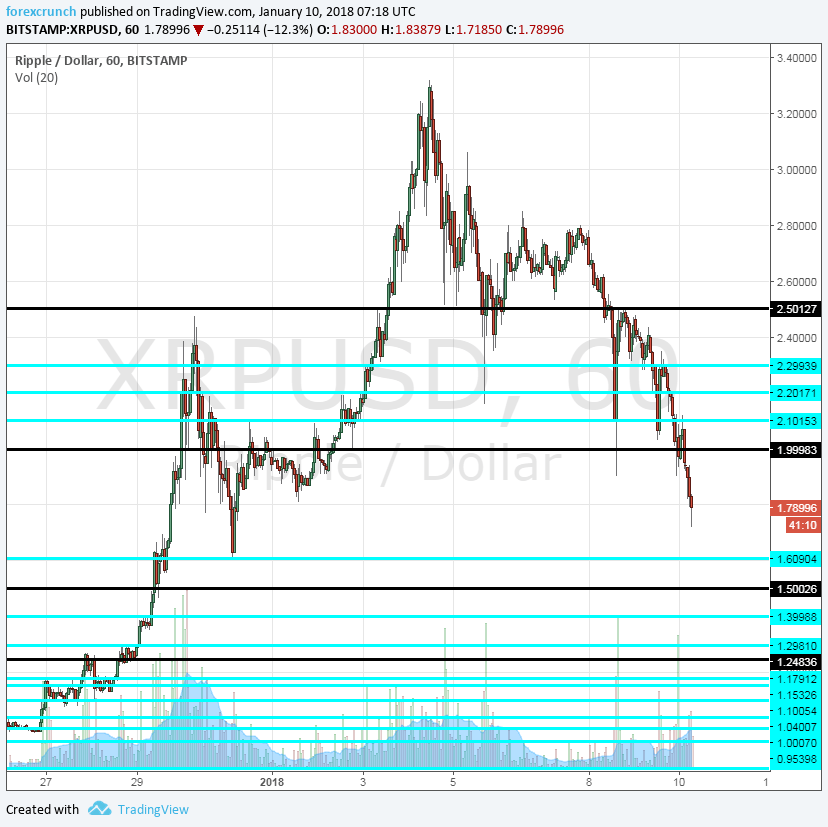

XRP/USD is now trading at only $1.75, extending the fall from the highs. The move higher was triggered by rumors of Coinbase inclusion and the move lower was sparked by a denial of such an inclusion. Nevertheless, there is another reason for the fall: taking profit on the huge rally.

At the current pricing, Ripple is nearly half the value it enjoyed just last week when it got close to $3.40. On the way down, the cryptocurrency broke below the $2 level which was a critical level on the way up.

From here, support awaits at $1.61, a swing low in late 2017. Ripple had already almost touched $2.50 and $1.61 is the point it fell too. Further support levels are at $1.150 and $1.40.

More: Why is Ripple plunging? 4 reasons and levels to watch

Ripple vs. Ethereum

Ripple dethroned Ethereum on its rapid ascent, but it lost the second place back to ETH on the way down. It was a double-whammy move: XRP/USD fell while ETH/USD gained a lot of ground, reaching $1,353 at the time of writing.

This gap between the coins is now widening: Ethereum’s market cap is around $134 billion and Ripple’s is only $70 billion. So, Ripple is worth only a bit over half of Ethereum.

Will the deterioration continue? It is hard to say. Ripple has its uses in transactions between Asian and other banks. These real-world uses are valuable. Perhaps the surge was too quick, and now the fall may be too harsh.