Ripple, the cryptocurrency that received support from some Asian banks, is enjoying a meteoric rise. XRP/USD made a big breakout above $1.50 and continues higher. It traded around $1 early in the week and was nearly half its current value just one week ago, in the big crypto-crash.

Ripple is standing out from the rest of the digital coin pack. Other cryptocurrencies have recovered, but haven’t reached new records.

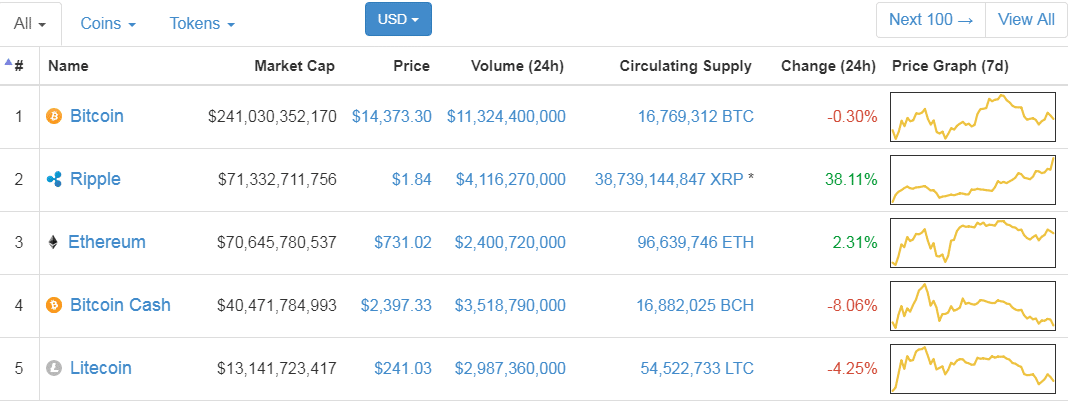

Update: Ripple price breaking above $2, market cap a third of bitcoin

Bitcoin, the No. 1 crypto and often confused with the blockchain technology, is at $14,000, a far cry from touching the flirts of BTC/USD with $20,000 earlier in the month.

Bitcoin cash, which Ripple passed on the way, trades at $2300 after we have seen BCH/USD crossing the $4000 level not that long ago.

Ethereum, the more sophisticated crypto coin that offers smart contracts, is trading just above $700, also quite a bit below the peak at around $880. Ethereum is seen as the next generation of cryptocurrencies after bitcoin thanks to its superior technology. The market cap of Ethereum was second to bitcoin.

Not anymore.

The market cap of ripple was breathing in Ethereum’s neck, and now the places have flipped: Ripple is No. 2 with nearly $72 billion and Ethereum is No. 3 at $70.6 billion.

Here is how it looks on CoinMarketCap:

Will it last? The price of Ripple and also other digital currencies are moving so fast, so it is hard to tell. There are good reasons to be optimistic about the future of both technologies, for different reasons. Are they overvalued? Perhaps. But that doesn’t necessarily mean an immediate correction.

More: Ripple Price: 3 reasons why XRP/USD rallies while the rest reel