- Ripple looks forward to becoming smart contracts and decentralized finance (DeFi) friendly following a partnership with Flare Networks.

- Unclear regulations in the United States could see Ripple make the United Kingdom a new home.

- XRP is getting ready for an action-packed 2021 with a price prediction pointing to $3.

- Ripple’s CEO Brad Garlinghouse believes the blockchain startup will soon go public through an IPO.

Describing 2020 remains a daunting task for many people across the globe. From the worldwide COVID-19 pandemic, black lives matter riots/protests in the United States, the dramatic US presidential elections, Brexit in the United Kingdom and the cryptocurrency market crash in March to the majestic recovery that led to a tremendous bull run in the last quarter of 2020.

The world was turned upside down as people quickly learned to survive without close human contact, not because it was a choice but perhaps the only way to survive. Lockdowns became a norm globally, with governments doing all they can to curb the novel virus spreads.

The rise in cryptocurrency demand shaped the 2020 bull run

Cash transactions dwindled across the world as people avoided handling physical money, channelling the attention to online platforms and cryptocurrencies. Companies sent their workforces home, transitioning to an online-based work experience, at least for those who managed to keep their jobs.

Unemployment, high inflation and unstable economies drove people to seek alternative sources of income. Cryptoassets quickly gained millage over conventional investment forms, particularly the decentralized finance (DeFi) tokens. Demand for cryptocurrencies was felt from both the retail and institutional sectors, as crypto exchanges recorded a massive upsurge of Bitcoin and other crypto assets’ purchases.

This demand saw the market quickly revamped from the lows in March to the incredible price action towards the end of the year. Ripple (XRP) has posted a 721% upswing to the yearly high of $0.82, as quoted on Binance.

It almost sounds weird to say that 2020 has been a successful year, especially with the pandemic still with us. However, the year has seen multi-year price barriers shattered, with XRP almost hitting the $1 mark again.

Ripple’s counterparts, Bitcoin (BTC) and Ethereum (ETH) were not left behind. If anything, their recovery has been advantageous – BTC shot up to new all-time highs but failed to touch $20,000 while Ether rocket launched itself toward $1,000 hitting a glass ceiling of $636 on its way.

Ripple Price Analysis 2020: A year of hope, gain and redemption

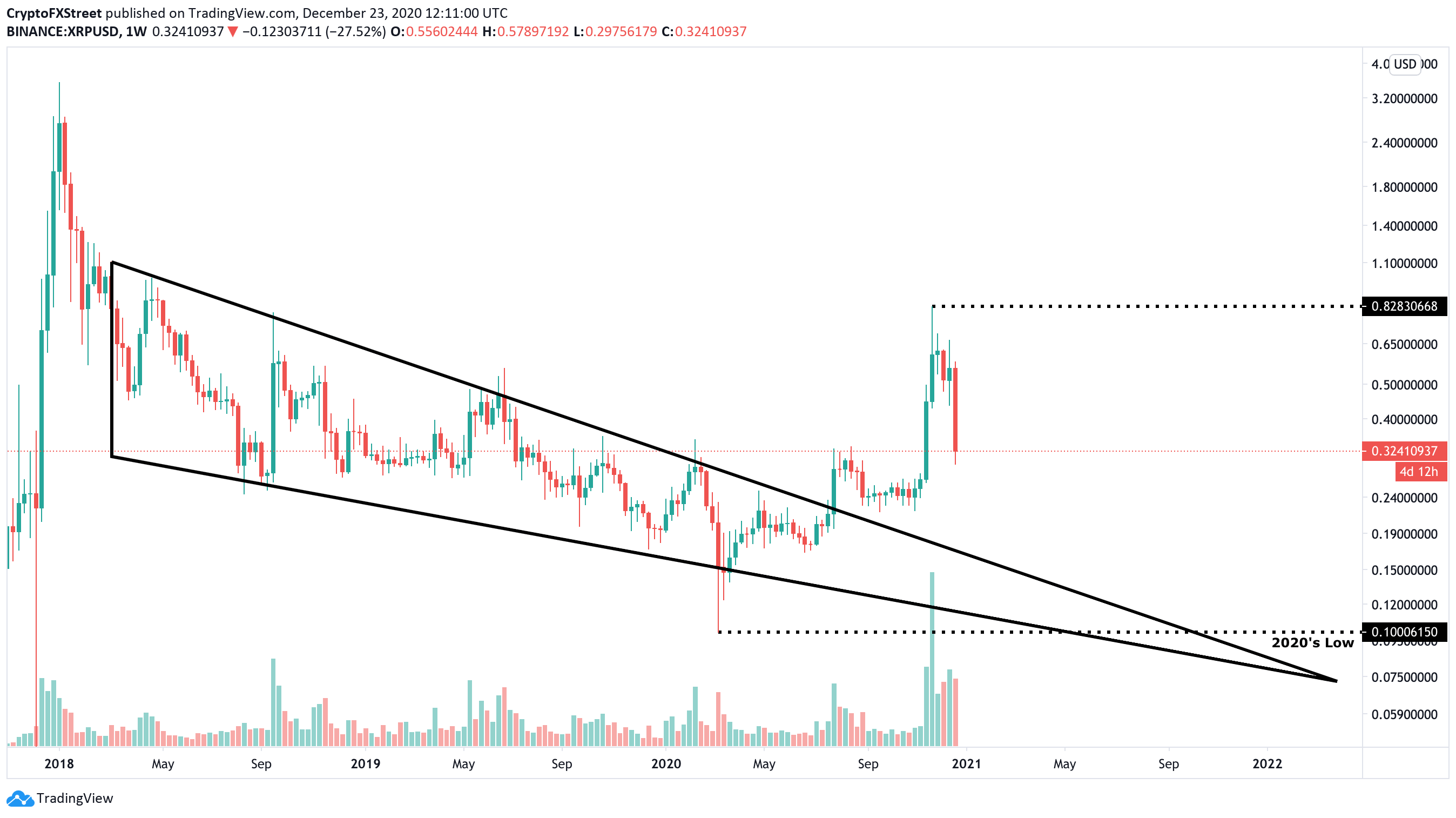

The cross-border token opened the year trading around $0.2. The first quarter of the year saw XRP make impressive strides, where several barriers were broken to $0.35. However, the pandemic struck, leading to a massive crash in the entire cryptocurrency industry.

A yearly low at $0.11 soon became Ripple’s local bottom; after the nerve-shattering retreat as the world adapted to the challenges posed by the coronavirus, XRP, alongside other digital assets, embarked on a remarkable recovery mission, topping $0.34 in August.

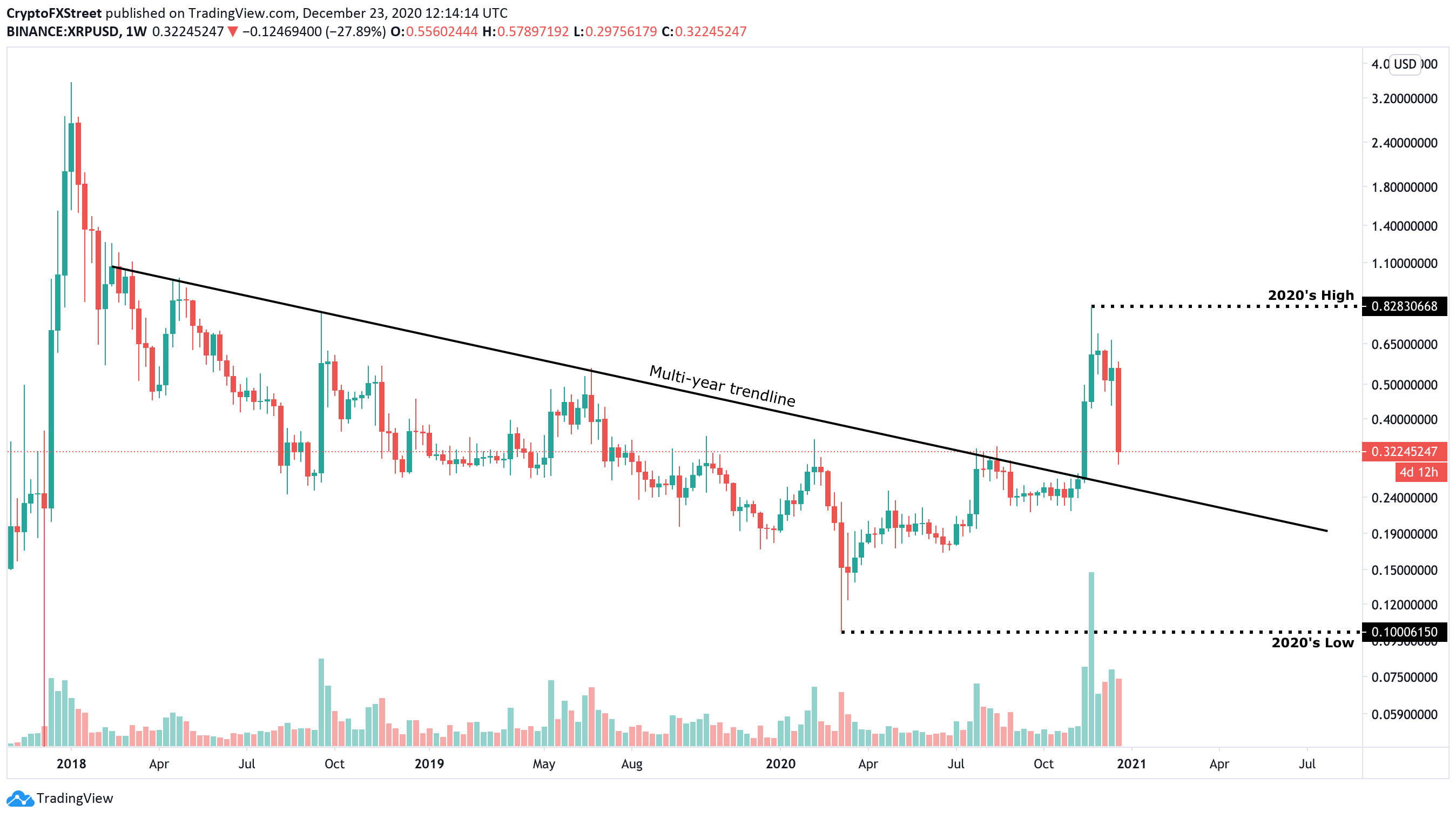

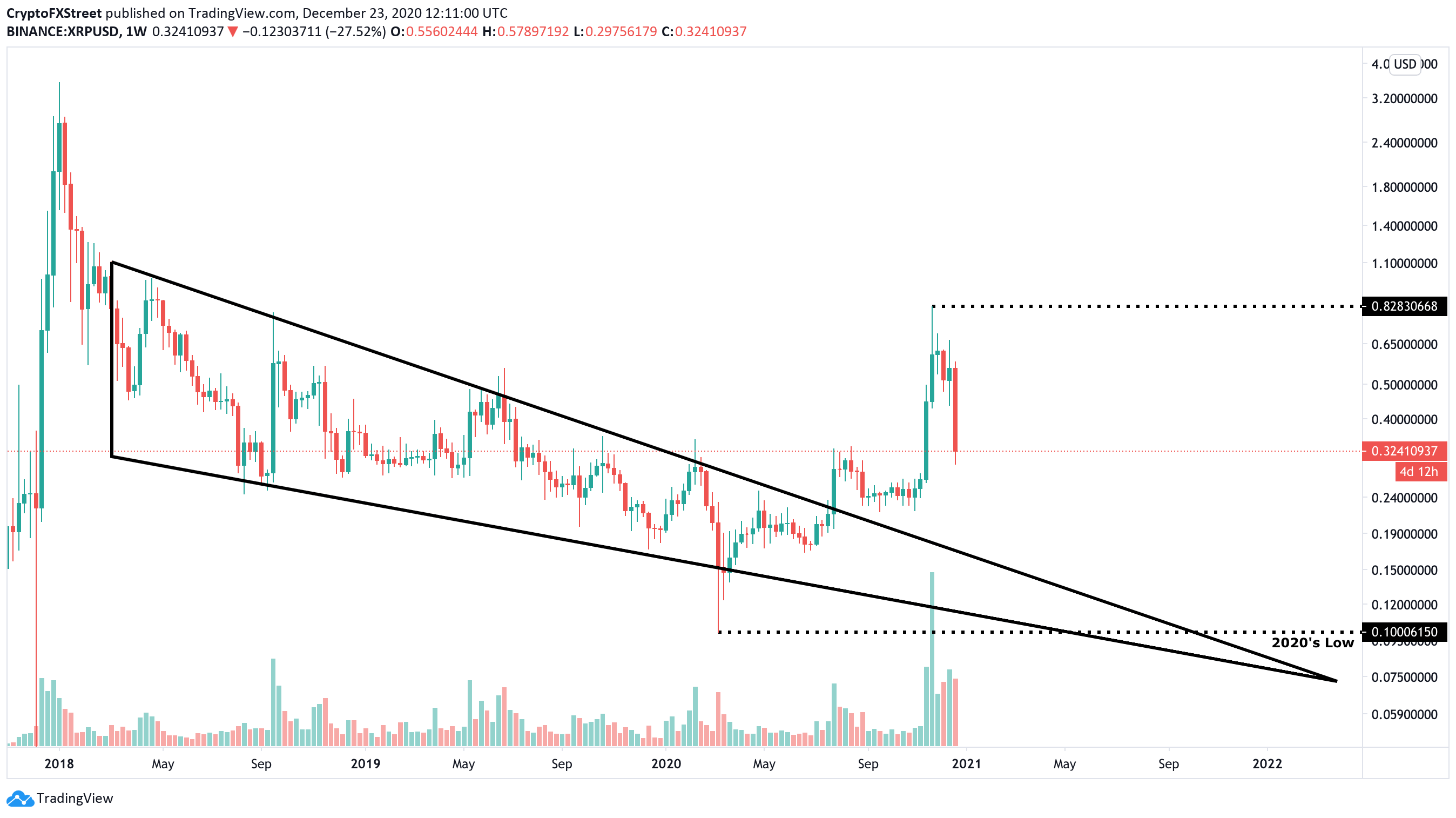

A snarl-up in recovery occurred in August, affecting most cryptocurrencies apart from the tokens in the DeFi sector, like Yearn.Finance (YFI) which rallied to a yearly high of $44,000. XRP/USD corrected toward $0.2, but the downside was protected by the 50 Simple Moving Average, as observed on the weekly chart.

Following the support, Ripple settled for a lengthy consolidation between the 100 SMA and the 50 SMA until a break above a multi-year descending trendline occurred. The breakout marked the beginning of the splendid rally to new annual highs at $0.82.

XRP/USD weekly chart

Ripple’s 2020 journey in a nutshell: Developments, achievements and challenges

Ripple did not perform the best in 2019 regarding price action. However, as covered in the token’s 2020 forecast, the blockchain company bagged several achievements. For instance, RippleNet partners hit the 300 mark. Several banks signed official partnerships and the new flagship product ODL (On-Demand Liquidity).

On the other hand, 2020 seems to have been slow in development but has emerged as the best year in price recovery. Also, some events and achievements from the San Francisco-based blockchain startup are hard to miss.

Rising above the global pandemic

COVID-19 continues to cause havoc around the world, but Ripple is standing firm as a company. The startup was among the first ones to allow its employees to work from home while assuring them of utmost support during challenging times. Several months later, Ripple has successfully conducted its businesses in all its global locations.

Ripple bags more partnerships

As mentioned before, Ripple continued operations swiftly amid the novel coronavirus as well as the shaky global economy. Partnerships have been Ripple’s way of increasing awareness and transforming the financial sector. The CEO of Ripple, Brad Garlinghouse, reckons that it is essential to focus on more than the price action of XRP.

Ripple recently announced via a blog post that the University Blockchain Research Initiative (UBRI) had secured four key partnerships. The strategic partnerships include the University of Zurich, the Instituto Tecnológico Autónomo de México (ITAM), ETH Zurich and the Ryerson University. Currently, the research center boasts of 37 partnerships across 15 nations.

Intriguingly, some of the critical partnerships made directly by Ripple include Azimo, for faster and cheaper payments between Europe and the Philippines, DeeMoney, a Thailand-based fintech company, Siam Commercial Bank (SCB) and Lemonway for instant and cost-effective euro-to-euro payments. RippleNet’s most significant milestone in 2020 was the signing of the first bank customer, Banco Rendimento.

Ripple’s 2020 development milestones: Tapping the power of RippleNet Cloud

RippleNet introduced a new service referred to as RippleNet Cloud to ensure faster, cheaper and reliable connections. RippleNet Cloud’s purpose is to give clients access to the RippleNet network without the expensive installation equipment. In this case, customers can increase efficiency and even push their competitive advantage a notch higher.

Ripple to tap into smart contracts with the Flare Networks partnership

The partnership between Ripple and Flare Networks is likely 2020’s most pompous achievement. Notably, Ripple will have an opportunity to tap into the decentralized finance (DeFi) ecosystem following smart contract features on the XRP Ledger.

Flare Networks recently conducted an airdrop that saw XRP users rewarded with Spark tokens at a ratio of 1:1. Some of the eligibility requirements for new tokens included holding XRP before the airdrop and transferring the tokens to supporting exchanges as reported. According to a statement by the team at Flare Networks:

“Flare Finance seeks to provide XRP/Spark users with the fastest and cheapest DeFi experience thanks to the superior architecture of Flare Network and the XRP Ledger. Our user experience will be based on providing the simplest means possible to unlocking and utilizing the value carried in your FLR and XRP.”

Ripple and regulation: Considers setting home outside the US

Ripple’s battle to have clear regulations, especially in the United States, is still on in 2020 and will continue in 2021. The blockchain startup feels that unclear rules stand in the way of its growth. Recently, Garlinghouse said that most of the RippleNet customers are from outside the United States.

In October, Garlinghouse threatened to get the company out of the US. Ripple is eyeing countries like the United Kingdom, Japan and the United Arab Emirates. At least in the UK, the Financial Conduct Authority does not refer to XRP as a security token. Explaining his preference for the British regulatory environment, Garlinghouse said:

“What you see in the UK is a clear taxonomy, and the UK’s FCA took a leadership role in characterizing how we should think about these different assets and their use cases.The outcome was the clarity that XRP is not a security and is used as a currency. With that clarity, it would be advantageous for Ripple to operate in the UK.”

Ripple Price Forecast 2021: XRP on the grand journey to $3

The cross-border token has had a year of bullish reckoning, from a low at $1.1 to a high at $8.2. The ballistic breakout occurred after Ripple broke out of a multi-year descending wedge pattern. Similarly, stepping above the 50 SMA and the 100 SMA on the weekly chart catapulted the crypto asset to new yearly highs.

Meanwhile, a retreat has been underway in the past couple of weeks. XRP/USD lost two key levels, $0.6 and $0.5. For now, securing support at $0.5 is the bulls’ topmost priority.

The rally that began a few months back seems to have taken a hiatus. However, The TD Sequential indicator is likely to present a buy signal on the 12-hour chart in the coming few days, adding credence to the optimistic outlook. The bullish formation will manifest in a red nine candlestick anticipating one to four candlesticks to the upside.

According to Santiment, a behavior analytics platform for cryptocurrencies, whales’ holdings of XRP tokens have started to increase after a recent dip. The spike has been observed in addresses holding between 100,000 to 1 million XRP, 1 million to 10 million XRP and those with over 10 million tokens.

As the number of high volume holders increases, so does the buying pressure behind Ripple. Therefore, the ongoing retreat will soon find an anchor and allow bulls to rebuild the uptrend eying $3 by the end of 2021.

%20%5B13.03.11,%2023%20Dec,%202020%5D-637443372502429944.png)

What will drive Ripple price to $3 in 2021?

Ripple understands that adoption is critical to growth for the price of XRP as well as the company. Some partnerships that continue to play a significant role in XRP growth include Banco Santander (SAN), HSBC Holdings (HSBA), Mizuho Financial Group (8411), Sumitomo Mitsui Financial Group (8316) and the global money transfer giant MoneyGram.

Consequently, Ripple is preparing to bring to the market another service called PayString. The service was made public in November after Ripple Labs made a trade market application to cater to electronic financial services such as remittances, fiat and virtual currency transfers.

The hope for an IPO is still alive

Ripple is eying going public through an initial public offering (IPO) to become a publicly-traded company. Garlinghouse said in November that COVID-19 brought challenges that prevented any blockchain company from going public. However, he believes that the situation will not stay the same for long.

Conclusion

Ripple has had a great 2020 as far as price action is concerned. A rebound is likely before the year ends, while 2021 offers massive opportunities for growth. Ripple, as a company, is poised to achieve several milestones, perhaps even an IPO. Clear regulations, especially in the United States, would be a colossal boost to XRP and the blockchain startup in general.

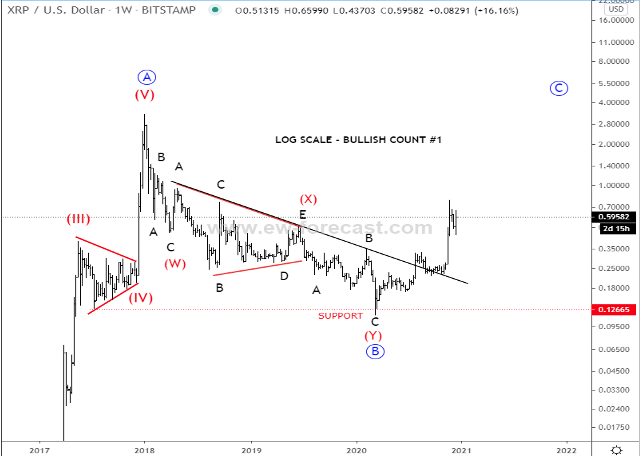

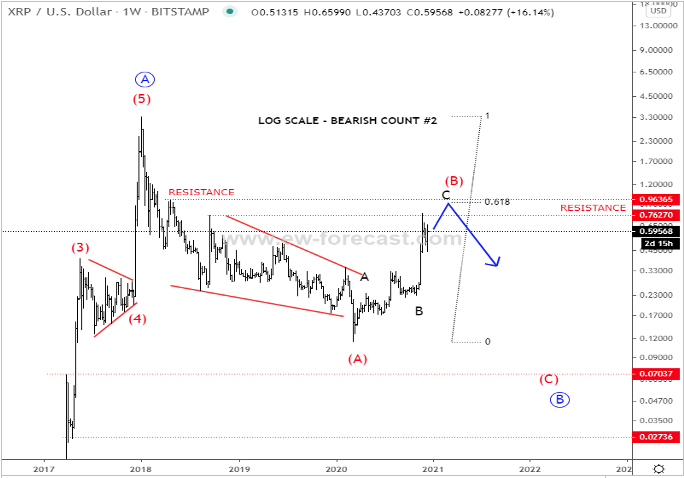

Gregor Horvat has two different scenarios with different counts for Ripple next year on his Elliott Wave analysis:

XRP/USD Elliott Wave Analysis

On XRPUSD we are observing 2 counts. In the first, primary one we see it turning bullish for wave C after a completed complex W-X-Y corrective decline in wave B. However, in the secondary one we can see it finishing a corrective rise in wave (B) that can stop around 1.0 area before another sell-off back below 0.10 region for wave (C) of a deeper higher degree wave B.

Forecast Poll 2021

| Forecast | Q1 – Mar 31st | Q2 – Jun 30th | Q4 – Dec 31st |

|---|---|---|---|

| Bullish | 37.5% | 41.7% | 41.7% |

| Bearish | 8.3% | 12.5% | 12.5% |

| Sideways | 54.2% | 45.8% | 45.8% |

| Average Forecast Price | 0.6608 | 0.8131 | 1.0321 |

| EXPERTS | Q1 – Mar 31st | Q2 – Jun 30th | Q4 – Dec 31st |

|---|---|---|---|

| Alberto Muñoz | 0.6900 Bullish | 0.7800 Sideways | 0.8500 Sideways |

| Alex Zha | 0.4000 Sideways | 0.3000 Bearish | 0.2500 Bearish |

| Andrew Lockwood | 0.3300 Bearish | 0.2250 Bearish | 0.2200 Bearish |

| Brad Alexander | 0.6000 Sideways | 0.7000 Sideways | 0.4000 Sideways |

| Dmitry Lukashov |

0.7200 Bullish |

0.8800 Bullish | 0.7000 Sideways |

| Dukascopy Bank Team | 0.5000 Sideways | 0.8000 Bullish | 1.0000 Bullish |

| Eliman Dambell | 1.8000 Sideways | 1.3000 Bullish | 0.8500 Bullish |

| FP Markets Team | 0.9850 Bullish | 0.7700 Sideways | 1.7500 Bearish |

| Frank Walbaum | 0.7100 Bullish | 0.9800 Bullish | 1.5000 Bullish |

| Giles Coghlan | 1.0000 Bullish | 1.6000 Bullish | 2.6000 Bullish |

| Grega Horvat | 0.8000 Bullish | 0.7000 Sideways | 0.5000 Sideways |

| Jeff Langin | 0.6000 Sideways | 0.7500 Sideways | 0.5500 Sideways |

| JFD Team | 0.5000 Sideways | 0.3500 Bearish | 1.3300 Bullish |

| Kaia Parv, CFA | 0.6200 Sideways | 0.5600 Sideways | 0.5000 Sideways |

| Konstantin Anissimov | 1.0000 Bullish | 2.7000 Bullish | 4.0000 Bullish |

| M.Ali Zah | 0.6500 Sideways | 0.8500 Bullish | 1.3500 Bullish |

| Matthew Levy, CFA | 0.5000 Sideways | 0.4000 Sideways | 0.2000 Bearish |

| Navin Prithyani | 0.3350 Bearish | 0.8000 Bullish | 1.0000 Bullish |

| Paul Dixon | 0.6000 Sideways | 0.6000 Sideways | 0.6000 Sideways |

| RoboForex Team | 0.5000 Sideways | 0.9000 Bullish | 1.2000 Bullish |

| Sachin Kotecha | 0.4000 Sideways | 0.5500 Sideways | 0.6500 Sideways |

| TheoTrade Analysis Team | 0.3400 Sideways | 0.4000 Sideways | 0.7000 Sideways |

| Tomàs Sallés | 0.7000 Bullish | 0.9600 Bullish | 1.3700 Bullish |

| Walid Salah El Din | 0.5800 Sideways | 0.6600 Sideways | 0.7000 Sideways |

Similar to BTC and ETH, early year strenght in USD will pressure the USD price of XRP. This will cause XRP to give back most all of its 2020 gains, but will regain its recent high by the end of the year.

by TheoTrade Analysis Team

There is no reason for XRP to be this valuable.

by Alex Zha