- XRP/USD stepped above $0.32 and tested $0.3260 before reversing the trend.

- Coinbase Wallet app requires that every wallet should have a minimum of 20 XRP.

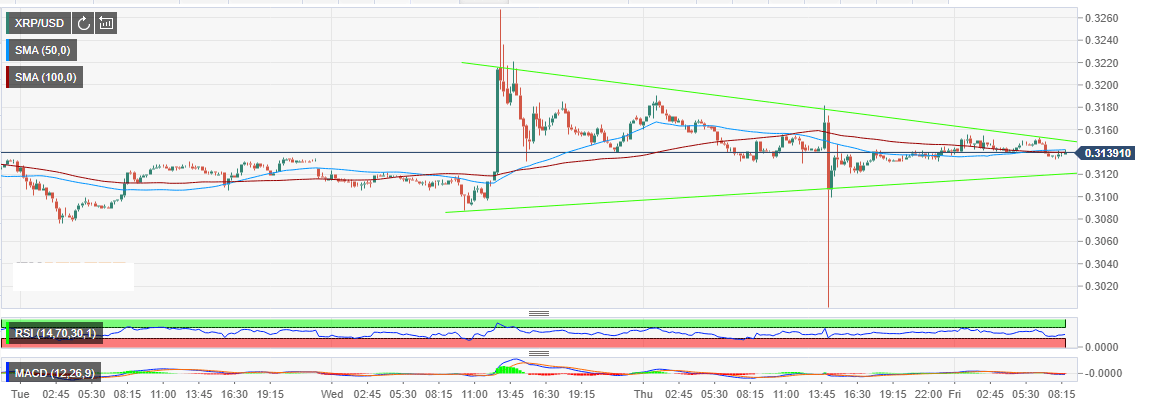

XRP/USD has not managed to sustain growth above $0.32 over the past couple of weeks. The price resumed the uptrend on Wednesday. XRP stepped above $0.32 and tested $0.3260 before reversing the trend. Ripple has resumed the sideways trading above $0.31 ahead of the weekend session. According to the cryptocurrency live rates provided by FXStreet, XRP/USD is trending a subtle 0.13% on Friday while exchanging hands at $0.3137.

In other Ripple news, Coinbase exchange has started supporting XRP on its wallet app. The Coinbase Wallet app currently supports Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Ethereum Classic (ETH) as well as 100,000 different ERC20 tokens and ERC721 collectibles that run on Ethereum blockchain. Users of XRP will from next week store their tokens on both iOS and Android platforms of the Coinbase Wallet app. Coinbase Wallet app requires that every wallet should have a minimum of 20 XRP.

Meanwhile, Ripple is trading at the narrow end of the contracting triangle pattern. This means that we can expect a breakout in the short-term. Especially if the current bullish momentum can clear the immediate resistance both the 50 SMA and the 100 SMA 15-minutes. XRP buyers must clear the resistance at $0.32 in order to open the door for more gains towards $0.32. However, XRP/USD is still in danger of dropping to $0.30 support and even test $0.28 support.

XRP/USD 15-minutes chart