Best Forex Brokers Saudi Arabia 2021

If you are based in Saudi Arabia and wish to begin forex trading, one of the essential steps in your journey is choosing a reliable broker. These days, there are so many brokers to choose from – so narrowing down the selection can be a challenging task in and of itself.

However, this guide will present the Best Forex Brokers in Saudi Arabia – providing you with all the information you need to know and highlighting how you can get set up and ready to trade in less than ten minutes.

Best Forex Brokers Saudi Arabia 2021 List

If you’re looking for the best forex broker 2021 in Saudi Arabia, then look no further. The list below highlights the top brokers for Saudi Arabian traders – and in the section that follows, we review a selection of these brokers to inform your decision.

- eToro – Overall Best Forex Broker in Saudi Arabia

- Libertex – Best Forex Broker in Saudi Arabia with ZERO spreads

- Capital.com – Best Forex Broker in Saudi Arabia for Low Fees

- VantageFX – Best Forex Broker in Saudi Arabia for ECN Account

- Avatrade – Best Forex Broker in Saudi Arabia with MT4 and MT5 support

- Pepperstone – Best Forex Broker in Saudi Arabia for Experienced Forex Traders

- Skilling – Best Forex Broker in Saudi Arabia with User-Friendly Platform

- Interactive Brokers – Best Forex Broker in Saudi Arabia for Professional Traders

- Forex.com – Best Forex Broker in Saudi Arabia for Account Variety

- IG – Best Forex Broker in Saudi Arabia for Currency Selection

Top Saudi Arabian Forex Brokers Reviewed

Choosing between the best forex brokers can be tricky, especially since there is so much to consider. Elements such as the broker’s fee structure and regulatory approval are both important things to research, as these factors play a significant role in your trading success.

To help streamline this process, the section below reviews the top forex brokers in Saudi Arabia, covering all of the essential information you need to know to make an effective broker choice.

1. eToro – Overall Best Forex Broker in Saudi Arabia

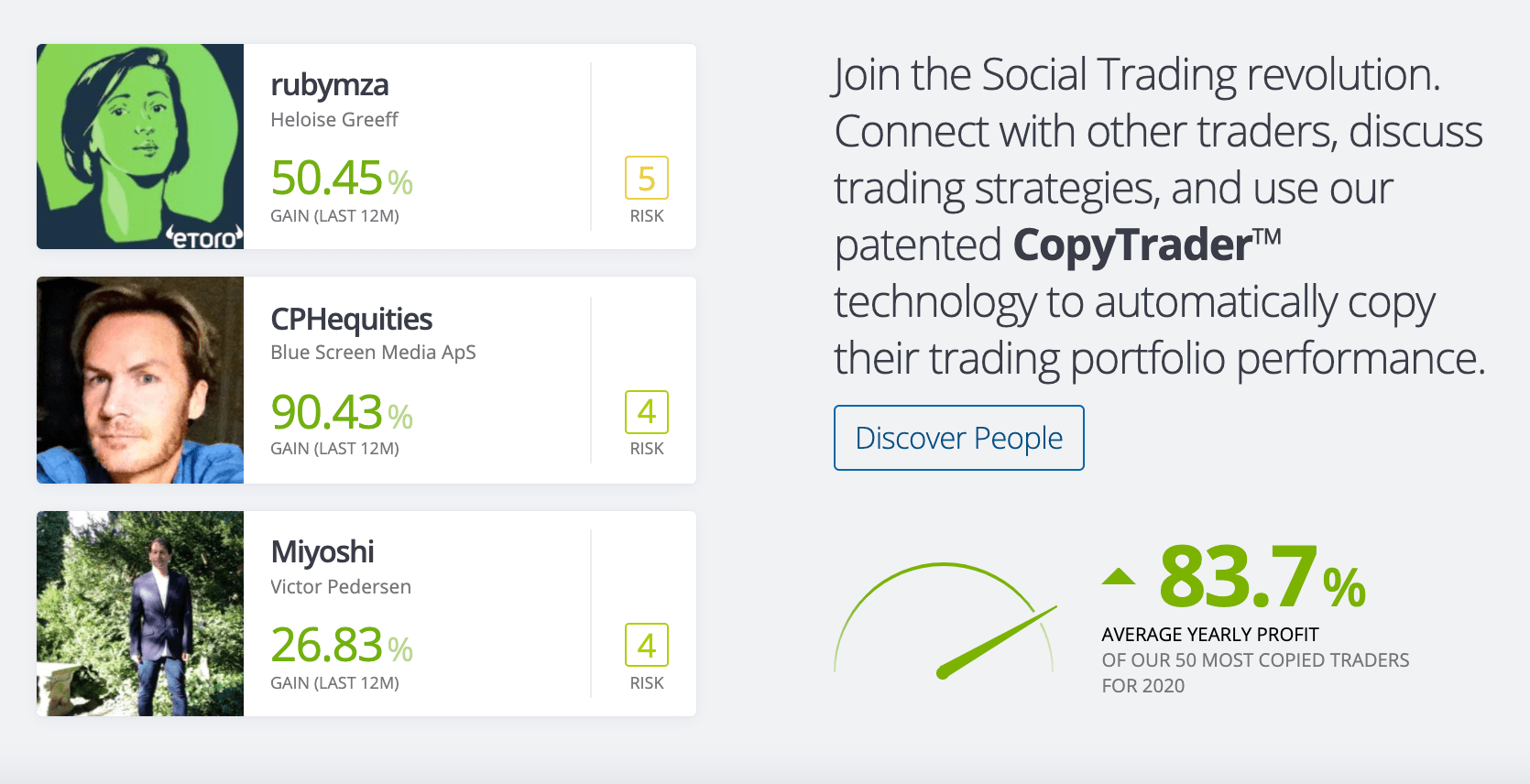

Taking first place in our top forex brokers list is eToro. eToro is one of the best brokers worldwide for forex trading due to its high level of regulation and appealing fee structure. In terms of licensing and oversight, eToro is regulated by numerous top organisations, including the FCA and the FSCS. This level of regulation adds credibility to eToro’s platform and ensures traders can operate safely.

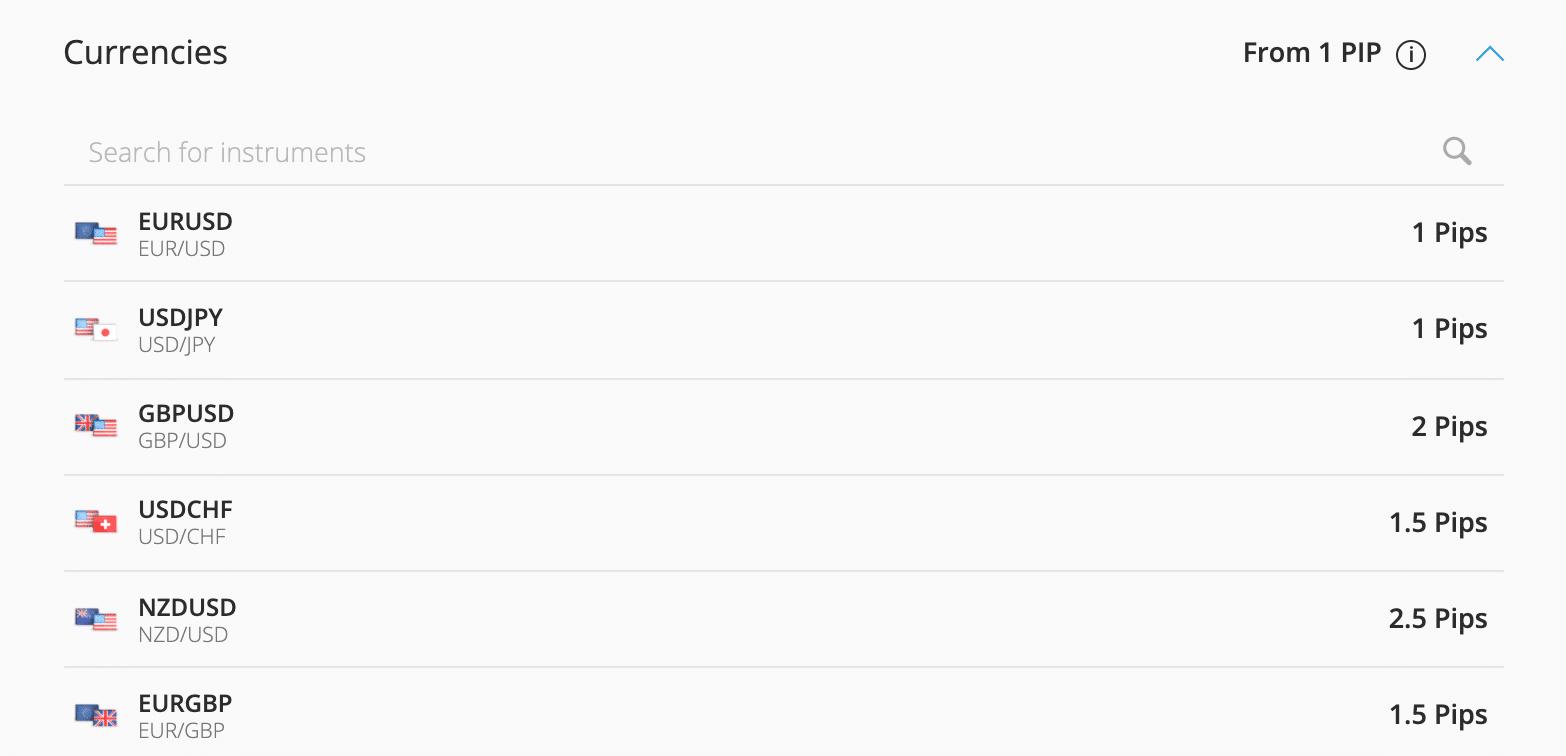

One of eToro’s main selling points is its fee structure. Users do not have to pay any commissions whatsoever when placing a trade – trades are free to make. This is because eToro’s ‘fee’ is built into the spread, which is the difference between the quoted buy and sell prices. eToro has very tight spreads, which are clearly stated on their website – for example, the EUR/USD and USD/JPY spreads are only one pip.

Aside from fees, eToro also offers traders numerous handy features. One of the best features they offer is their ‘CopyTrader’ feature, which allows users to quickly and automatically copy the trades of other top traders on the platform. This feature is ideal for beginner traders and those traders who do not have enough time during the day to conduct research and monitor the charts. Finally, eToro does not charge any deposit fees, withdrawal fees, or monthly account fees.

- Super user-friendly online forex broker

- Trade forex with tight spreads

- You can also trade stocks, indices, ETFs, cryptocurrencies, and more

- Deposit funds with a debit/credit card, e-wallet, or bank transfer

- Social and copy trading

- FCA and FSCS protections

Cons

- Not suitable for advanced traders that like to perform technical analysis

67% of retail investors lose money trading CFDs at this site

2. Libertex – Best Forex Broker in Saudi Arabia with ZERO spreads

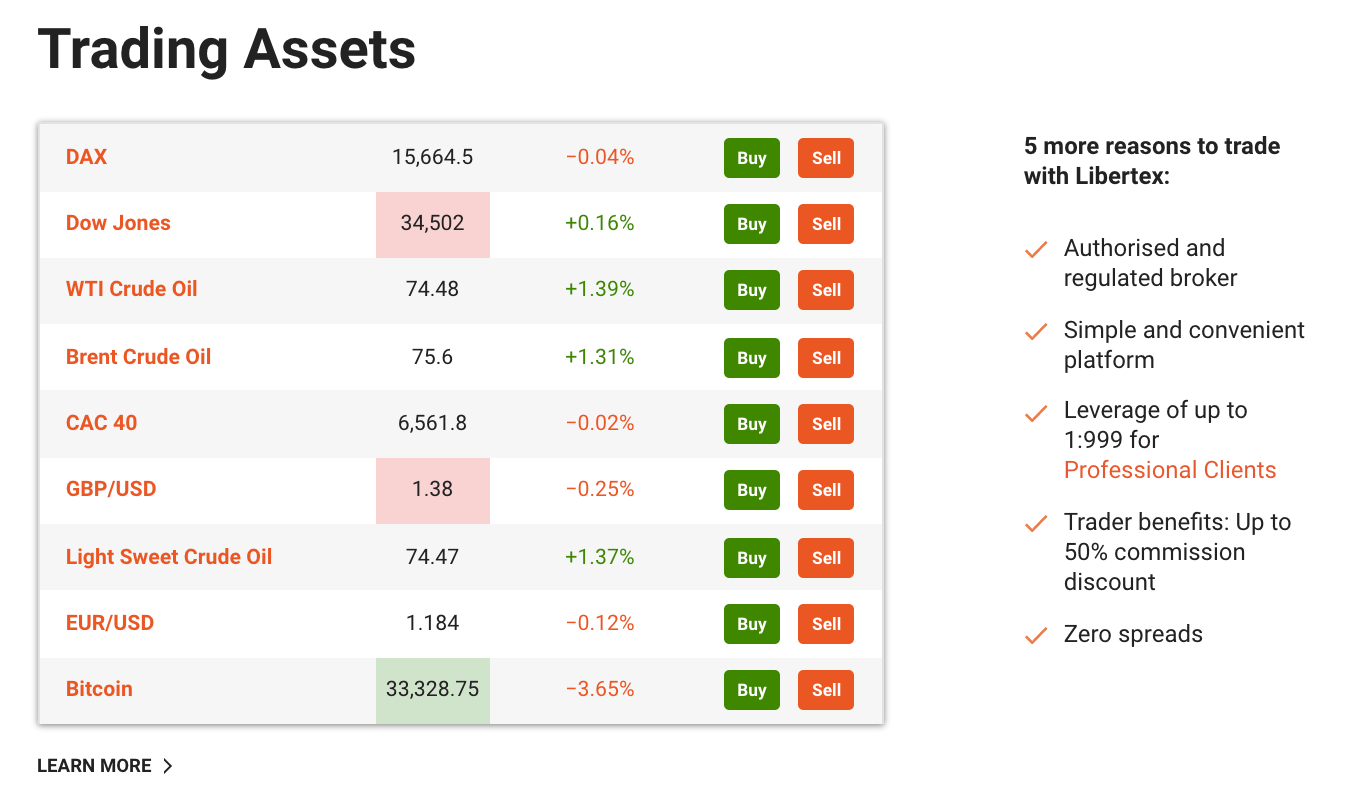

Another of the top forex brokers in Saudi Arabia is Libertex. Libertex is popular with traders in numerous countries and is regulated by CySEC, one of the top-tier regulatory bodies. With over 20 years of experience in the industry, Libertex has developed a fantastic trading platform and user experience that is ideal for beginner and advanced forex traders alike.

One of the best things about Libertex is that they are a 0 spread forex broker. This makes them stand out from other brokers in the industry, as instead, they only charge a small commission when placing a trade. This commission can vary depending on the specific currency pair; however, commissions can be as low as 0.008% for major currency pairs. Apart from these commissions, Libertex does not charge any deposit or withdrawal fees to users.

As noted, Libertex has a fantastic trading platform, which is web-based – meaning you can access it from all of your devices. In addition, Libertex offers fast execution times for forex trades, ideal for traders looking to operate on lower timeframes. Notably, Libertex also provides full support for MT4, ensuring traders who wish to automate their trading or use custom indicators are catered to.

- Zero spread forex trading

- Good educational resources

- Long established broker

- Compatible with MT4

- Competitive spreads

Cons

- Only offers CFDs

83% of retail investors lose money trading CFDs at this site.

3. Capital.com – Best Forex Broker in Saudi Arabia for Low Fees

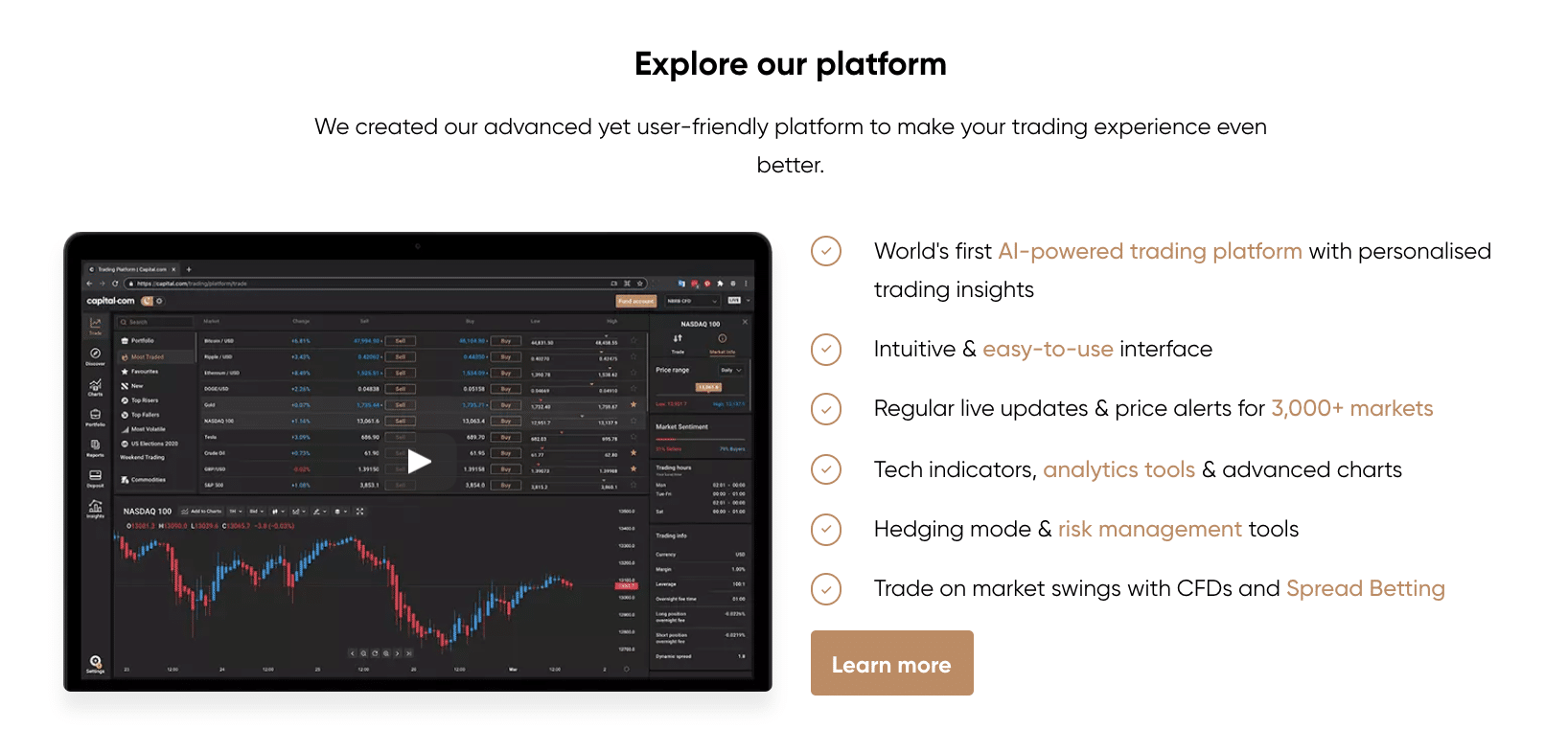

If you are interested in forex day trading and looking for a low-cost broker, then Capital.com might be a good option. Capital.com are a trusted forex broker in many countries and are currently regulated by the FCA and CySEC. Furthermore, Capital.com has offices in London, Cyprus and Belarus – highlighting how reputable and established they are in the global trading scene.

Capital.com offer extremely low fees, as they do not charge a commission when placing trades. Like eToro, costs are built into the spread – and these spreads are very minimal with Capital.com. For example, the average spread for EUR/USD during peak trading hours is only 0.6 pips. Furthermore, Capital.com offer great leverage options for traders, with 30:1 leverage being offered. Notably, the amount of leverage you can get will depend on where you are based – so double-check this beforehand.

Capital.com do not charge any monthly account fees, withdrawal fees, deposit fees, or inactivity fees. Also, their account opening process is straightforward, and users can deposit a minimum of only $20. In terms of deposit options, Capital.com currently accept credit/debit card, bank transfer, e-wallets, and ApplePay. Finally, Capital.com also offer an extensive library of educational material for their users – with guides, tutorials, and glossaries available to help improve the trading experience.

- Educational app for new traders

- AI assistant identifies your weak points

- Trade ideas generated daily

- Excellent charting and analysis interface

- $20 minimum deposit

Cons

- Cannot build custom trading strategies

72.6% of retail investors lose money trading CFDs at this site.

4. Vantage FX – Best Forex Broker in Saudi Arabia for ECN Account

If you are looking for one of the best ECN brokers, Vantage FX might be an excellent option. Vantage FX is regulated by ASIC and CIMA – two regulatory bodies with great reputations. Furthermore, the broker has been around for 12 years, ensuring they are established in the FX trading scene.

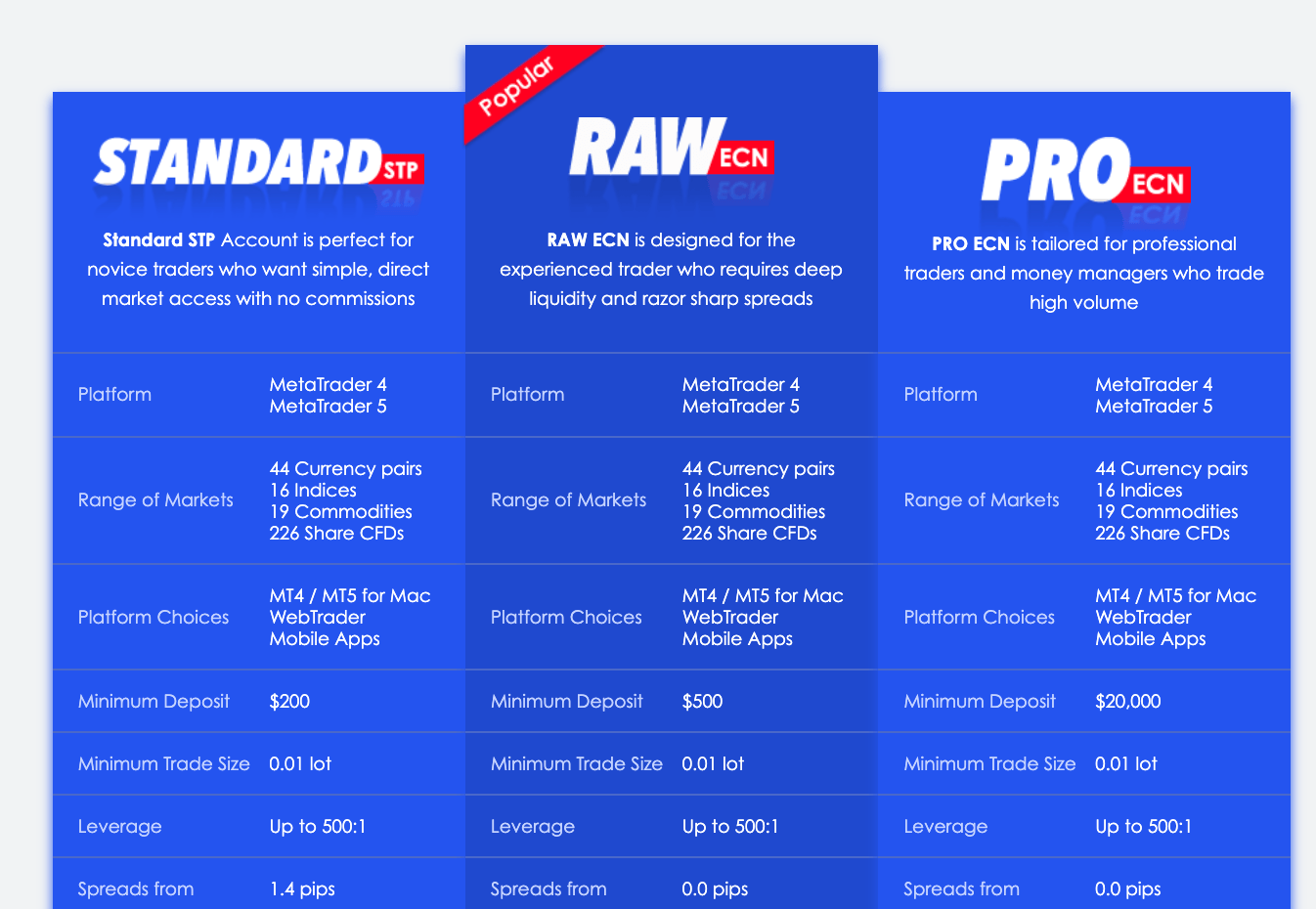

Notably, Vantage FX offers three different account types – Standard STP, Raw ECN, and Pro ECN. Each type has a different fee structure, with both ECN accounts offering zero spreads when FX trading. However, ECN accounts will have a higher minimum deposit threshold and a commission per trade; the STP account has a lower deposit threshold and no commission per trade. So, it’s crucial to figure out which account suits your experience level and needs before committing.

Aside from trading fees, Vantage FX does not charge any other fees – no deposit, withdrawal, account, or inactivity fees. Furthermore, Vantage FX offers full support for MT4 and MT5 and even has a user-friendly mobile trading platform too. Finally, Vantage FX offers various educational resources for traders, along with an ‘Analyst Views feature which provides trade ideas with breakdowns on why these ideas may work out.

- ECN broker accounts

- Trade from 0 pips and a commission of $3 per trade

- Regulated in various jurisdictions

- Offers markets on forex, shares, energies, indices, and more

- Supports MT5

- Leverage of up to 1:500

Cons

- Mobile app isn’t the easiest to use

Your capital is at risk when trading financial instruments at this provider

5. Avatrade – Best Forex Broker in Saudi Arabia with MT4 and MT5 support

Rounding off our best forex brokers list is Avatrade. Avatrade was founded in 2006 and is regulated in numerous countries by top regulatory bodies such as ASIC, FSA, FSB, and the Central Bank of Ireland. Furthermore, Avatrade has won multiple awards over the years for its customer service and trading platform.

Like other brokers, Avatrade does not charge a commission but instead incorporates its fee into the spread. Although spreads aren’t as low as some other brokers, they are still relatively tight in the grand scheme of things. For example, EUR/USD’s typical spread is 0.9 pips, whilst USD/JPY’s spread is 1.1 pips. Apart from the spread, users will not have to pay any other fees, including withdrawal, deposit, and monthly account fees.

Avatrade’s minimum deposit is only $100, which can be completed via debit/credit card, bank transfer, and various e-wallets. Notably, Avatrade offers full support for MT4 and MT5 – ideal for traders who like to use custom indicators or forex robots. Finally, users can even download ‘AvaSocial’, Avatrade’s social trading app that allows trades to be automatically copied from other successful traders on the platform.

- Regulated in 6 different jurisdictions

- Supports CFD markets on forex, stocks, cryptocurrencies, and more

- 0% commission and low spreads

- Compatible with MT4 and MT5

- Minimum deposit of just $100

- Leverage offered on all markets

Cons

- Stock CFD department is limited in comparison to other MT5 trading platforms

71% of retail investor accounts lose money when trading CFDs with this provider

Best Forex Brokers in Saudi Arabia Comparison

The section above has reviewed some of the top forex brokers in Saudi Arabia, breaking down their fee structures and highlighting key features. To help streamline your decision making even further, we’ve created a handy table below which compares factors such as pricing, spreads, fees, and leverage between the top Saudi Arabia forex brokers. By using this table, you’ll be able to easily see which broker suits you best and make an optimal decision.

| Pricing (Spreads/Commissions) | Average GBP/USD Spread | Deposit Fee | Withdrawal Fee | Max Leverage | |

| eToro | 0% commission + variable spreads | 2 pips | 0.5% for non-USD deposits | $5 | 30:1 |

| Libertex | ZERO spreads + variable commission (based on currency pair) | ZERO | None | None | 30:1 |

| Capital.com | 0% commission + variable spreads | 1 pip | None | None | 30:1 |

| Vantage FX | ECN: ZERO spreads + Commission

STP: 0% commission + variable spreads |

ECN: ZERO

STP: 1.6 pips |

None | None | Up to 500:1 |

| Avatrade | 0% commissions + variable spreads | 1.6 pips | None | None | 30:1 |

How to Choose the Right Forex Broker for You

When researching the best forex broker 2021 for Saudi Arabian traders, there are numerous elements to consider. Choosing a broker is one of the essential parts of being a successful trader, so it’s important to do your due diligence and consider all of the factors of a broker’s trading environment.

To help streamline this process, the section below presents some of the most important things to look out for when choosing a forex broker.

Safety

Understandably, one of the top things to look out for when forex trading is safety. Choosing a broker that is well-established and regulated by some top entities is crucial to your trading success, as it will ensure your personal information and capital are both protected.

One of the best tips for forex traders who are new to the market is to look for brokers who are licensed and regulated by top-tier entities. These include the FCA, ASIC, CySEC, FSA, and more. Although these regulatory bodies typically only provide oversight in their home country, it’s still a plus point when brokers are regulated, even if it isn’t in your country of residence – this adds safety and reliability to the trading environment.

Fees

Another thing to look out for is a broker’s fee structure. Typically, brokers will have trading fees and non-trading fees. The former tends to refer to commissions and spreads, which is how the broker receives compensation for being the middleman. Some brokers will offer 0% commissions (such as eToro) and incorporate their fee into the spread. It’s also a good idea to look for low spread brokers as they will save you a lot of money in the long run.

Keep an eye out for non-trading fees too. These fees include deposit fees, withdrawal fees, inactivity fees, and monthly account fees. Also, some brokers will charge a currency conversion fee if you are depositing a currency that isn’t supported – so keep an eye out for this too.

Range of Assets

The FX market is vast, with hundreds of currency pairs to choose from. Depending on the broker, majors, minors, and even exotics may be available for traders to buy and sell. This ensures that there’s always a steady stream of opportunities for potential profits, allow traders to operate optimally.

Minors and exotics may not be offered by all brokers, as these are less-traded pairs that usually come with higher spreads. In addition, due to these pairs having less liquidity, they tend to be much more volatile than other pairs – so if you are a beginner trader, it’s probably best to stick with the majors.

Trading Tools

Technical analysis is an integral part of trading, so ensuring your chosen broker has a good selection of trading tools can give you an edge when operating in the market. Features such as price alerts and charting tools can ensure you can identify and capitalise on trading opportunities. Furthermore, if these tools are available on the platform, it means you can conduct analysis and place trades all in one place.

In addition, MT4 and MT5 support is also a good thing to look out for. This allows traders to use custom indicators and automate their trading if they wish.

Platforms

Tying into the trading tools point, a broker’s platform is also an essential factor to examine. As you will be trading through your computer or mobile device, using a broker that offers a user-friendly and speedy platform can be the difference in your trading. Many brokers will offer their own proprietary platform, complete with unique features and tools.

As noted, MT4 and MT5 support is also a good benefit for forex traders, as these platforms are widely used to facilitate FX trades. Finally, using a broker that has a handy mobile app can mean that you can trade on the go. This ensures that you do not miss market opportunities, even when out and about.

Account Types

Many brokers will offer a selection of account types designed to appeal to traders of different experience levels. There are both STP brokers and ECN brokers, both of which provide fast execution speeds. Due to the nature of the FX market, instantaneous execution is crucial for specific strategies such as scalping or day trading.

Notably, different account types will usually come with different fee structures and deposit thresholds. For example, ECN accounts usually offer zero (or minimal) spreads but will charge a commission and require a large initial deposit. On the other hand, STP accounts tend to charge 0% commissions but employ a spread. So, it’s best to research the different types and choose one that suits your situation.

Payments

Finally, the payment methods that a broker accepts is another factor to consider. These days, most brokers will accept credit/debit cards, bank transfers, and various e-wallets. However, depending on where you are located, certain e-wallets such as PayPal may not be accepted.

Also, keep an eye out for deposit fees or currency conversion fees. Most brokers will have a selection of base currencies that they accept – and if you deposit in a different currency, it will have to be converted, which comes with a fee. You can usually get around this fee by using a multi-currency bank account that allows you to convert your native currency into one of the broker’s accepted currencies.

How to Get Started with a Saudi Arabian Forex Broker

If you’re looking to make money with forex right away with a trusted forex broker, then this section will show you how. By following the five key steps below, you’ll be able to set up an account with our recommended broker, eToro – and begin trading in under ten minutes.

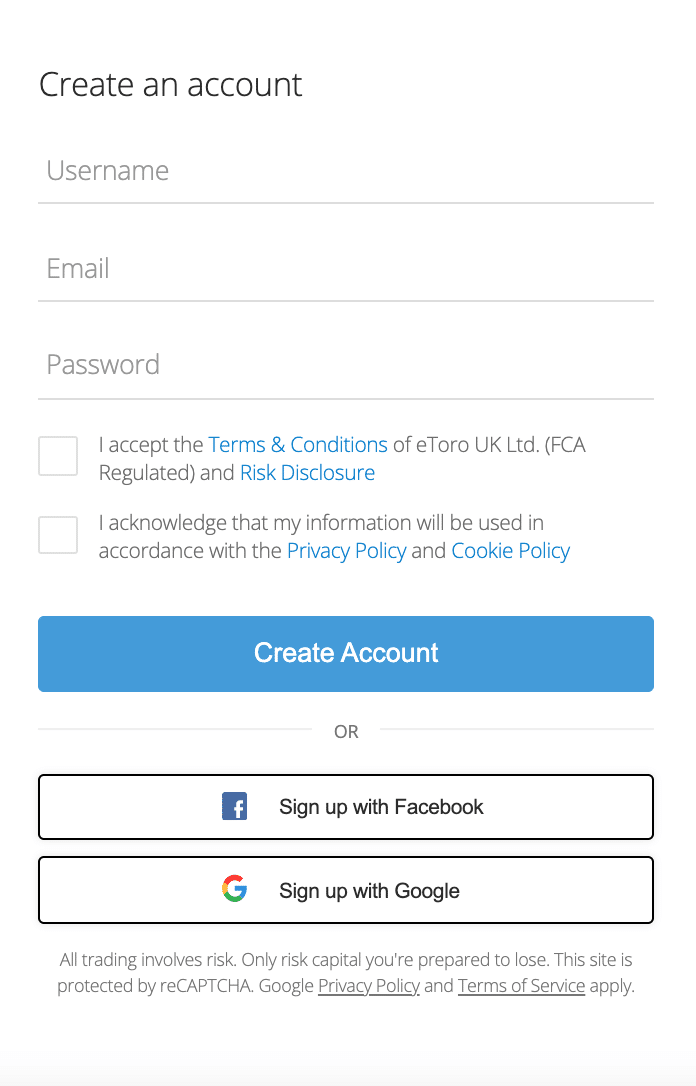

Step 1: Open an eToro Account

Head over to eToro’s website and click ‘Join Now’ in the top right corner. Then, enter a valid email address and choose a password for your account. If you’d prefer, you can even sign up using eToro’s smartphone app – one of the best trading apps available today.

Step 2: Verify your Account

When new users sign up, eToro will require some KYC checks to be completed and verification to be finalised. Luckily, this is very simple to do and usually takes minutes. Simply enter the necessary personal information and upload proof of ID (a copy of your passport or driver’s license) and proof of address (a copy of a bank statement or utility bill). eToro will then verify these documents, which usually only takes a few moments.

Step 3: Fund your Account

New users at eToro will need to deposit a minimum of $200 to begin trading. However, subsequent withdrawals will only need to be a minimum of $50. In terms of deposit methods, you have the following options available to choose from:

- Credit card

- Debit card

- Bank transfer

- Klarna

- Skrill

- Neteller

Step 4: Search for Currency to Trade

Click into the search bar at the top of the screen on eToro’s trading platform and type in the name of the currency you wish to trade. For the purposes of this guide, we’ll be looking to trade EUR/USD. When it appears in the drop-down menu, click ‘Trade’.

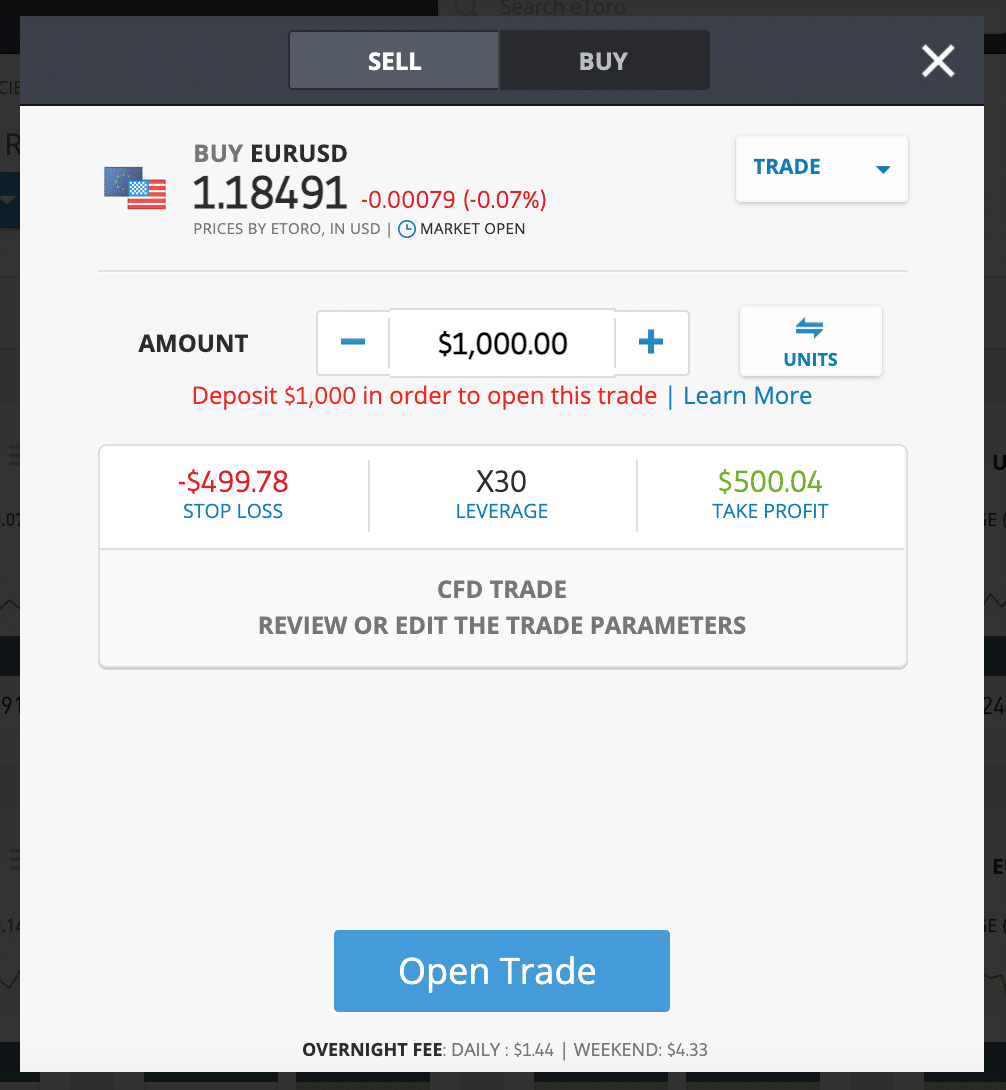

Step 5: Trade Forex

An order box will now appear, similar to the one below. First, choose whether to open a buy or a sell position by using the toggle at the top. Then, enter your position size and decide whether to use a stop loss or leverage. Once you are happy with everything, click ‘Open Trade’.

And that’s it! You’ve officially begun trading the forex market with one of the best forex brokers in Saudi Arabia – all without paying any commissions!

Best Forex Brokers Saudi Arabia – Conclusion

As this guide has shown, there are many top brokers in Saudi Arabia to choose from. Elements such as the broker’s fee structure and features offered are crucial to analyse to ensure you can trade optimally. By using this guide, you’ll be able to streamline your broker decision and begin trading optimally.

However, if you’re ready to get started right away, we’d recommend opening an account with eToro. We’ve found that eToro offers the best trading environment for Saudi Arabian forex traders, as they are regulated by numerous top entities and provide a vast selection of currencies to trade. What’s more, eToro charge 0% commissions on forex trades and offer tight spreads on many top pairs.

67% of retail investor accounts lose money when trading CFDs with this provider.