The Euro was sold aggressively against the Japanese yen, as it traded as low as 135.53 recently where it found support for a correction. The EURJPY pair is currently retracing higher and eyeing for a catalyst for further moves. There was only one release lined up in the Euro zone today i.e. the German Wholesale Price Index (WPI), which was released by the Destatis. The outcome was mostly in line with the expectations, as the German WPI registered an increase of 0.1%, compared to the fall of 0.2% last time. This might lift the Euro in the short term, but it is likely to come under pressure again once it completes the retracement.

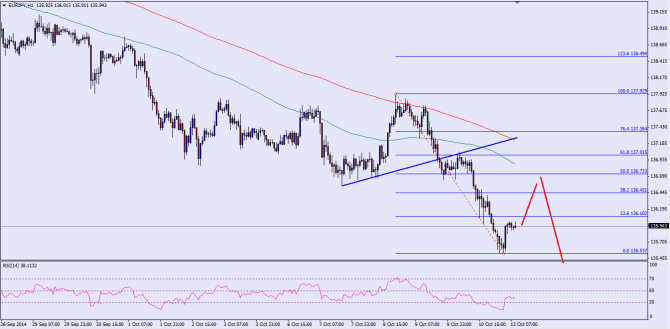

There was an important bullish trend line on the 1 hour chart of the EURJPY pair, which was breached during this past week. The pair created a new low of 135.53, and now correcting higher. There is a possibility that the pair might climb towards the 50% fib retracement level of the last drop from the 137.92 high to 135.53 low at 136.73. The mentioned level is just below the 100 hourly moving average. So, it might act as a swing area for the pair in the near term. The hourly RSI is well below the 50 mark, and forming a minor divergence. This might encourage a correction, but which can be an opportunity to sell the pair moving ahead.

Alternatively, there is also a possibility that the EURJPY not even tests the 50% fib level and starts moving down from the current levels. In this situation, the previous low might act as a support.

Overall, one might consider selling around the 136.50 level as long as the pair stays below the 100 hourly moving average.

————————————-

Posted By Simon Ji of IKOFX