The Greek crisis has certainly escalated with Greece’s bundling of IMF payments and the defiant speech by PM Alexis Tsipras.

Will we see an even more worrying outcome? The team at Barclays examines the risk of capital controls:

Here is their view, courtesy of eFXnews:

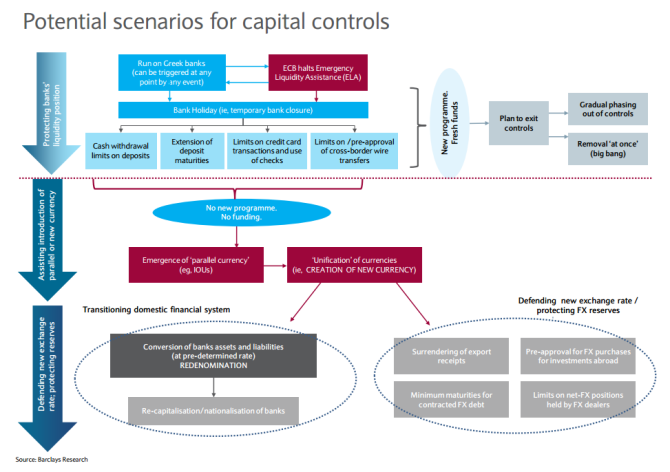

Barclays Capital warns in a note clients this week, that the risk of capital control in Greece is on the rise even if a program with its creditors is eventually be agreed and an exit is avoided. In this technical note, Barclays discusses the type of potential controls that could be relevant under alternative scenarios.

1- “The focus would initially be on protecting domestic banks through administrative controls (in the event of a bank run). We think Cyprus provides a relevant case study. In March 2013, the Cypriot authorities imposed domestic and external payment restrictions to protect the system from a potential deposit run,” Barclays clarifies.

2- “In contrast to Cypriot banks at the time, Greek banks today are deemed solvent and there is no intention to bail-in large depositors. We think controls could be temporary as they were in Cyprus, serving as a bridge until a programme is agreed. In contrast, without a new programme, a potential exit scenario would more closely resemble Argentina’s 2001/02 crisis, which also started with deposit controls but – in the absence of an internationally supported plan – quite rapidly deteriorated into tighter controls and a forced currency conversion, followed by numerous restrictions to defend the new exchange rate system,” Barclays argues.

3- “Under severe capital controls, redenomination and nationalisation risk rises. The Greek banks would be most at risk, while the two largest non-financial issuers could potentially continue to service their external debt even after a redenomination of domestic liquidity and revenues. Such a scenario also poses major risks to GGBs and other EGB markets. While privately held marketable Greek bonds are under English law, we still think they will potentially come under severe stress, if in a redenomination scenario Greece defaults to official creditors,” Barclays adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.