The recent recovery of the euro does not convince the team at BNP Paribas:

They explain why there is a lot of room to the downside in EUR/USD and how they are building long USD exposure:

Here is their view, courtesy of eFXnews:

In the non-farm payroll data to be released Friday 6 February, BNP Paribas’ economists forecast the US economy to add 220k new jobs, the unemployment rate to fall to a new cyclical low of 5.5% in January, and for average earnings growth to have rebounded from an erratically weak reading in December.

“This should support US front-end rates and the USD. Fed Chair Janet Yellen’s Humphrey-Hawkins testimony later this month should also be important in clarifying the Fed’s response to lower oil prices and potentially signalling any change to the forward guidance on policy,” BNPP argues.

In line with this view, BNPP advises using the current USD pullback to rebuild long exposure especially as BNPP reestablished a fresh short EUR/USD position earlier this week.

“Bearish EURUSD is a core view for us in 2015, but last week we were cautious entering a short position with the pair appearing vulnerable to a squeeze higher,” BNPP argues.

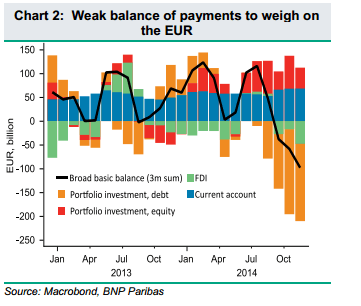

“Going forward we view there to be several key factors leading to a weaker EURUSD. A gradual decline of real yield support, a further building of short EURUSD positions by investors and a deteriorating balance of payments situation all signal weakness for EURUSD going forward,” BNPP argues.

BNPP entered this short EUR/USD from 1.1450, with a stop at 1.1620, and a target at 1.0800.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.