- Stellar price trades in the red for the third day this week.

- Technical analysis shows XLM could drop to July low below $0.20.

- Stellar must reclaim the support at $0.361 to reverse the bearish leg.

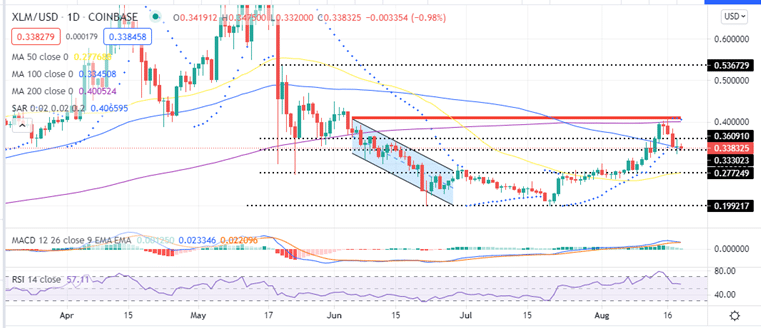

Stellar price prediction is bearish as it trades in the red for the third time this week. This bearish leg has seen XLM drop 21% from a high of $0.411 on Monday to Wednesday’s low at $0.324. During this drop, the decentralised exchange token flipped the crucial support provided by $0.361 mark from support to resistance and the crucial parabolic SAR from positive to negative.

Stellar Price Could Drop to $0.20

XLM/USD rallied 106% from a low of 0.199 on July 21 to a high of $0.411 on Wednesday August 18. This rally saw Stellar flip the 50- and 100-day Simple Moving Averages (SMAs) from resistance to support. Previously, the Stellar price had declined in a descending parallel channel losing 52% from a high of $0.411 on June 05 to the July low at $0.199.

Note that XLM was rejected by the tip of the upper boundary of the descending channel at $0.411 which is reinforced by the 200-day SMA. Rejection at this zone has seen Stellar turn bearish this week. It is at this same level was rejected at on June 05 before plunging to areas below $0.20 on July 20.

If the same scenario plays out, Stellar could drop 41% from the current price around $0.338 towards the $0.20 psychological level.

- If you wish to trade Stellar using crypto robots, check our guide for details.

Traders should note that the extension of XLM’s bearish leg will be confirmed if it closes the day below the 100-day SMA at $0.366. If this happens, Stellar could drop to retest the $0.30 psychological level. A further drop will see XLM drop to the 50-day SMA at $0.277 or retest the July 20 low below $0.20.

XLM/USD Daily Chart

This bearish outlook is accentuated by the downward movement of the RSI towards the oversold zone indicating that the bears are in control of XLM. In addition, the Parabolic SAR reversed from positive to negative and remains so. Moreover, the MACD is moving downwards.

It is also important to note that the MACD sent a sell crypto signal on August 17 when the 12-day EMA (blue line) crossed below the 26-day EMA (orange) on the 12-hour chart affirming the bearish bias.

Looking Over The Fence

Stellar’s bearish thesis could be invalidated if it close the day above the $0.361 level. However, the any trend reversal to bullish will be affirmed when Stellar price overcomes the 200-day SMA to rise above the $0.411 Monday high.

If this happens, XLM will break above the descending channel price range to explore the May 20 high around $0.536.

This bullish possibility is supported by the bullish MACD as it still moved above the zero line on the daily chart.

Moreover, positive Stellar fundamentals increase XLM optimism. Rumors on Stellar partnering with Advent International to acquire MoneyGram; the recent spike in the prices of other altcoins such as Solana, Terra and Audius; and increased volume of Stellar Lumens traded every day which has climbed to $1 billion over the past week.

Looking to buy or trade Stellar now? Invest at eToro!

Capital at risk