Idea of the Day

Focusing on sterling today as third quarter GDP data gets its first airing. Back at the start of the year, the belief was that the pound was going to get beaten down by a new central bank governor intent on pursuing further quantitative easing. Partly by market mis-judgement, more owing to the upward surprises to activity data, we’ve seen a dramatic turn-around in the fortunes of the currency, which has been partly unwound during October relative to the euro. The expectation is that we should see a third consecutive quarter of positive growth, averaging at 0.6% QoQ growth over this period. Despite this, the Bank issued forward guidance suggesting that rates would remain low until the labour market improved, with several caveats. The recent price action against the euro fits with our feeling earlier in the month that sterling was looking a little tired on some metrics (data surprises, interest rate differentials), but this could have further to run if we see GDP disappoint today.

Data/Event Risks

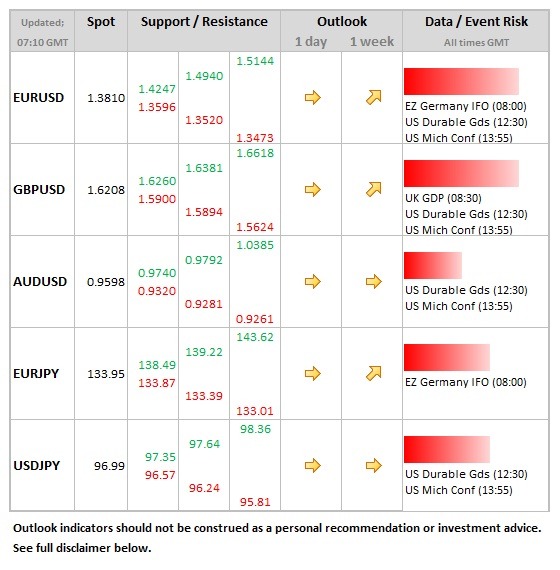

EUR: The German Ifo data is one of the most important releases in the monthly data calendar. The headline measure has been improving for the past 5 months, taking it back to levels last seen in the early part of last year.

GBP: The market expects 0.8% gain on the quarter, leading to annual growth of 1.5%, from 1.3% in Q2. Sterling has been under modest pressure for most of the current month, down against all but the Canadian dollar.

Latest FX News

AUD: The US dollar was generally weaker during the Asia session, apart from against the Aussie, which has continued to look a little tired this week.

JPY: Inflation data firmer than expected, with headline prices rising 1.1% (from 0.9% previously). The yen was initially little moved by the data, but USDJPY has moved lower on a generally weaker dollar during the Asia session. The 200 day moving average (below which yen has not closed since November last year) comes in at 97.35.

CNY: Money market rates have continue to firm in China into the end of the week, by the biggest amount since June of this year. Although steadier today, the yuan has strengthened this week after a very steady 6 weeks.

Further reading:

UK GDP: +0.8% as expected – GBP/USD ticks up

German Ifo Business Climate disappoints at 107.4 – EUR rally stops