- Terra Price overcomes the $17 major resistance levels to renew hopes of a swing towards the March ATH.

- The appearance of a bullish golden cross validates the LUNA’s bullish narrative.

- The $17.5 major resistance level proves to be tough hurdle for the rally continuation.

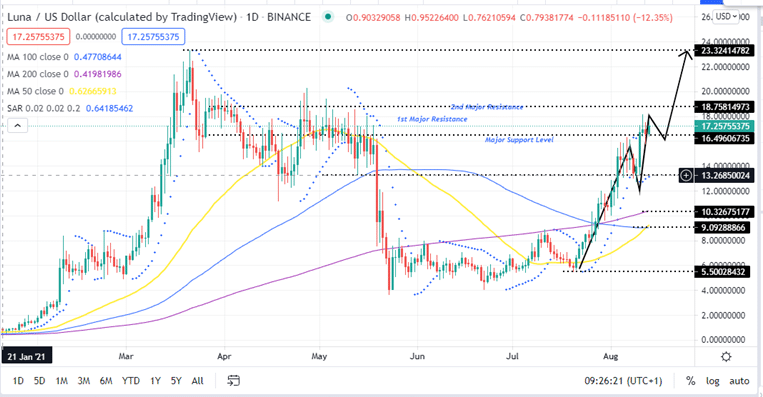

Terra price prediction is bullish after recording three straight bullish sessions between Monday and Wednesday this week. This bullish momentum saw LUNA rally a whooping 44% from a Monday intra-week low at $12.65 to a Wednesday intra-week high of $18.20. Seller congestion at the $17.5 resistance level resistance Terra that saw it retreat and close the day in red at $16.63 on Thursday.

Today, LUNA opened the day trading in green and is currently exchanging hands at $17.25. Bulls appear determined to breakout above this level to soar the Terra price upwards towards the March 21 all-time-high (ATH) around $23.21.

Can Terra Price Violate $17.5?

Note that for LUNA’s bullish narrative to hold, Terra must overcome the first major resistance level at $17.5. A daily closure above this level will increase the odds of an upward breakout that will take the asset towards the second major resistance zone between the $18.0 and $18.50 psychological levels.

Terra’s upward trajectory towards the ATH above $23 will need support from the wider market as resistance above the $18.5 level appears relatively weak.

Traders on crypto trading platforms should be aware that LUNA sits on strong support provided by the $16.5 major support level and the $13.27 support level. Further down, Terra is supported by the 200-day, 50-day and 100-day Simple Moving Averages (SMAs) respectively. These support zones are robust enough to absorb any selling pressure that threatens to push LUNA lower.

LUNA/USD Daily Chart

Improving the potential for the LUNA’s upward breakout is the bullish Golden Cross pattern on the daily chart that was triggered yesterday August 12 when the 50-day SMA crossed above the 100-day SMA. The previous Golden Cross occurred at the beginning of December 2020 before Terra price ignited to the upside towards the March 2021 ATH.

- If you are new to crypto trading this guide on how to buy cryptocurrency is a good place to start.

Looking Over The Fence

LUNA’s bullish narrative would be invalidated by a daily close below the $17.0 psychological level. If this happens the Terra price would immediately fall the first major support level at $16.50 or the second major support level at $13.27. If LUNA logs a daily close below the August 09 low at $12.65, the price prediction for the asset will notably bearish and forecasts a fall to the 200-day SMA at $10.32, 50- and 100-day SMAs around $9.09 or a test of the July 20 low around $5.50.

Looking to buy or trade Terra now? Invest at eToro!

Capital at risk