Idea of the Day

For markets at least, the strength of the euro was the main surprise going into the end of last year. Some of this strength was based on temporary factors related to year end and balance sheet dressing on the part of European banks. Money market rates moved substantially higher as a result, supporting the stronger tone to the euro. It could well be that we see a heavy tone to the euro this week as these effects unwind. Note that excess liquidity (the amount of liquid funds banks are holding above their requirements) jumped to the highest level since March on Tuesday and even if most of this move is unwound, some of it should feed through to lower money market rates and a softer single currency.

Data/Event Risks

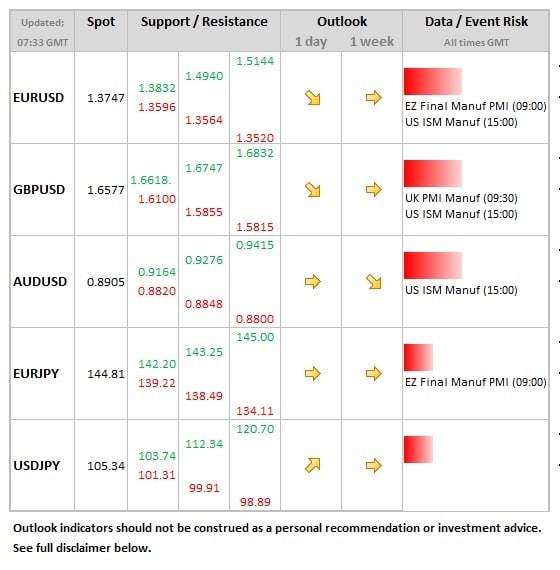

GBP: The manufacturing PMI data has been very robust for nearly the past year now, with the December reading at levels last seen in early 2011. Market expects a steady outcome, but firmer number would put further fuel underneath the sterling rally.

USD: The weekly claims data have been largely ignored in recent weeks owing to underlying volatility and distortions, with small rise from 338k to 342k expected in today’s release. The manufacturing ISM release is seen falling modestly to 56.8.

Latest FX News

AUD: Starting the European session bang on the 0.89 level. We see the Aussie as one of the weaker performers in the coming year on the majors. Data is thin both this week and next.

GBP: Sterling has been performing well in recent sessions, with cable touching the 1.66 level during Asian trade. This looks to be more a factor of the softer tone being seen in both the dollar and also the single currency.

CNY: The HSBC Manuf PMI data showed the anticipated fall from 50.8 to 50.5, but causing some softness in Asian equities. USDCNY still on a weakening trend, just above the 6.05 level.

Further reading: