Idea of the Day

The US central bank is making greater efforts to split the difference between withdrawing asset purchases and keeping rates low. This matters for currencies, because asset purchases tend to influence longer-term interest rates (around 5 years and beyond), whereas the Fed Funds target rate is more influential for the short-term rates (up to 2 years), which have a greater influence on currency values.

The Fed minutes were discussing the fact that markets often link the two and in recent comments and guidance, the Fed has been keen to stress that a gradual withdrawing of the level of monthly bond purchase (named tapering) does not mean that rates are necessarily going to rise anytime soon. The same sentiment was also expressed towards the 6.5% unemployment rate threshold, with the discussion looking for ways for soften that, or assuring markets that rates would not automatically rise when it was reached. All this means that the prospect of tapering is not as dollar positive as perhaps previously thought. But the Fed’s attempt to split the two does, on balance, make tapering in December a little more likely.

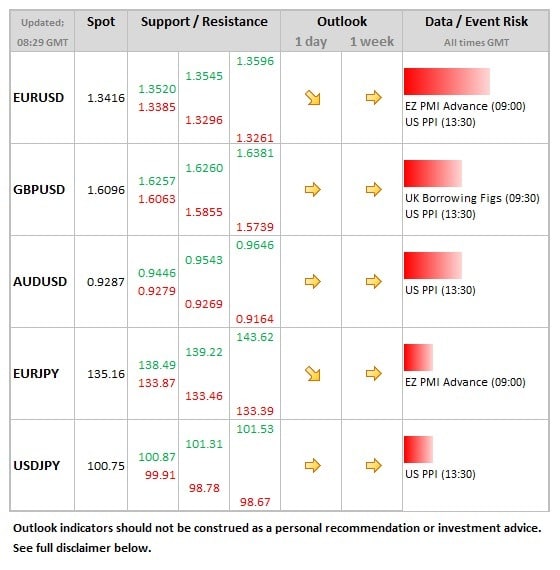

Data/Event Risks

EUR: Advance PMI data the early focus, being the first read of economic activity during November. Both manufacturing and services series are seen moving slightly higher for the Eurozone as a whole.

USD: The usual weekly claims data together with PPI data, both second tier releases for the dollar, so should have minimal impact.

Latest FX News

USD: Higher by 0.75% over the past 24 hours on the dollar index, but fair proportion of this has come from the euro move. Fed minutes were adding to dollar strength late into the NY session, with gains continuing in the Asia session.

JPY: The Yen weaker after the latest BoJ meeting. No major changes in policy, but there were some changes to language. There appears to be more doubt that the 2% inflation will be met by the April 2015 target date, with the BoJ saying it will continue to ease until the 2% inflation goal is achieved and stable.

EUR: Hit yesterday by a story suggesting negative deposit rate if main rate was cut further. Also this morning weaker PMI data from France has added to the weaker tone to the single currency.

Further reading:

French PMIs disappoint – EUR/USD dips below 1.34

Global equities unmoved by Bernanke’s “no taper” speech