- Tuur Demeester, the Founding partner at Adamant Capital, calculated that the Bitcoin market share of MtGox is more than the gold reserves of the Swiss Central Bank.

- MtGox is currently planning to execute the “Gox Rising” project to ensure that victims of the Mt. Gox hack are paid a fair share of what has become more than a billion in assets.

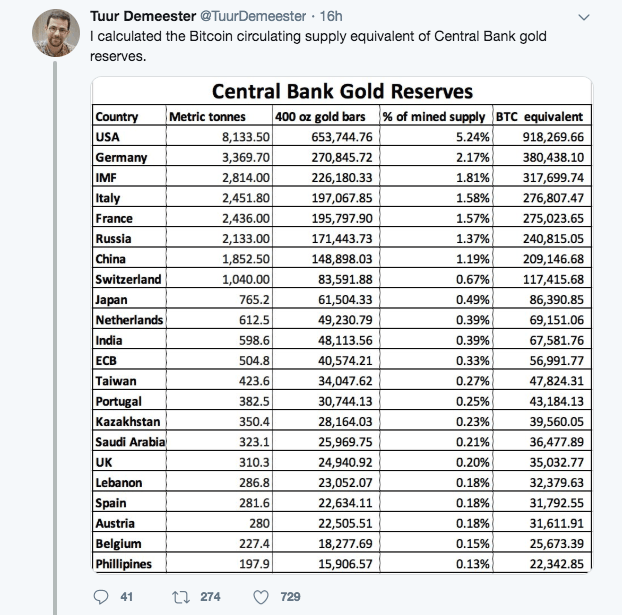

Tuur Demeester, the Founding partner at Adamant Capital, has calculated the Bitcoin circulating supply in equivalence of Central banks’ gold reserves and shared the following data:

Demeester explains:

“The current value of Dutch Central Bank gold is about $25 billion, so in order to buy 69k BTC (the mined Bitcoin equivalent of the Dutch gold reserve) it would only need to sell 1% of its gold, i.e. 492 gold bars.”

After that, Demeester made a pretty interesting comparison:

“Allows for fun comparisons, e.g.: The MtGox Trustee currently controls 137,891 BTC, which is bigger in terms of market share than the gold reserves of the Swiss central bank.”

As reported earlier by FXStreet, crypto billionaire Brock Pierce, plans to revive MtGox. His immediate priority is the “Gox Rising” project which seeks “to ensure that victims of the Mt. Gox hack are paid a fair share of what has become more than a billion in assets.”