Tether and Bittfinex are in a spot of bother with the New York Attorney General (NYAG) and if this latest evidence is confirmed it could get a whole lot worse – you decide!

Starting with the back story, the NYAG have asked Tether and Bittfinex owner iFinex to hand over documents as they are looking into possible fraud in which they believe iFinex used Tether to hide potential losses at the Bittfinex exchange. Once again I must stress nothing has been confirmed here. iFinex have already explained the deposited money had been seized and moved to a few jurisdictions including the UK by the authorities.

Now in a dramatic update Token Analyst has produced some evidence on twitter with their real-time analytics that could possibly prove that Tether has been manipulating the price of BTC.

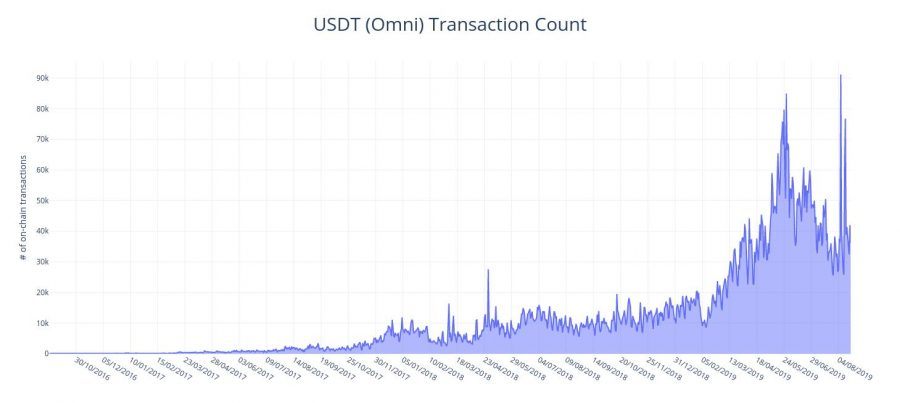

(Image fom Token Analyst)

This graph shows the amount of USDT volume coming into the market and it shows that there is clearly a correlation in price when Tether decides to mint new tokens. With a price fall when Tether has burnt a certain amount of tokens circulating in the market. Tether has recently moved from the Omni blockchain over to an Ethereum based blockchain, However, one thing to note is that despite deciding to migrate away from the Omni blockchain, there has been a significant spike in the number of on-chain Omni-based USDT transactions in 2019.

(Image from Token Analyst)

What does this all mean for iFinex, Tether and Bittfinex? Have they been manipulating the Bitcoin price?

We will leave that to the NYAG and the legal system but the data is interesting and they are already embroiled in a compelling case and now this data emerges