- Cryptocurrencies are giving up gains of the previous week

- Bitcoin is doing relatively well as compared to altcoins.

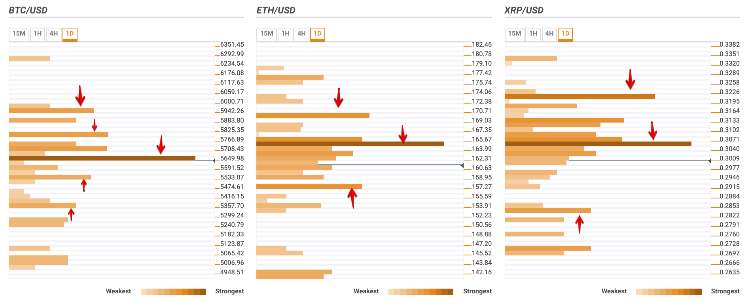

- Here are the levels to watch according to the Confluence Detector.

Cryptocurrencies are in retreat. The total capitalization of all digital assets in circulation collapsed from $184 billion during early Asian hours to $180 billion by the time of writing. Bitcoin, the largest and the most popular digital asset, retreated from May 4 high of $5,839 to trade marginally above $5,600 handle by press time, BTC/USD has lost over 1.5% in recent 24 hours; however, altcoins are in a deeper decline. Ethereum and RIpple both down over 2%, while other coins out of top-20 nursing losses from 3% to 7%.

Various positive news items related to institutional adoption have underpinned the currency crypto craze. The broader picture is of an ongoing rally since the initial jump in April and since the great crash of November and December.

Meanwhile, the fundamental background remains robust. Broader institutional adoption amid improved risk sentiments supports the long-term bull’s case scenario. Though, on the intraday level, the market is prone to the downside correction, which is healthy as long as the prices stay above critical levels.

So, what levels should we watch?

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD clinches to $5,600

Bitcoin settled above $5,600 after a strong sell-off during early Asian hours. The cryptocurrency may spend some time in the current range, consolidating consolidate before the next move. Initial resistance awaits it at $5,640, created by a combination of the Bollinger Band 15min-Middle, the previous monthly high, and the previous daily low as well as 23.6% Fibo retracement weekly and the middle line of 4-hour Bollinger Band.

The next strong barrier lies on approach to $5,800 where we see an upper boundary of 1-hour Bollinger Band, the previous weekly high and PP 1D-R1.

On a trip to the South, BTC/USD will case a substantial support at $5,530 with Fibonacci 38.2% one-week. A sustainable move lower is likely to increase the downside pressure and take us towards psychologocal $5,400 and $5,350 created by a confluence of Fibonacci 23.6% one-week and Bollinger Band 1day-Middle

ETH/USD has calmed down after the sell-off

Ethereum needs to stay above $160.00 to retain a positive stance. At the time of writing the second is hovering at $162.00, down 2% since this time on Sunday.

There are a lot of technical barriers located right above the current price, however, the most important resistance is spotted on approach to $164.00. It is created by a confluence of SMA50 (1-hour), SMA200 (15-min), SMA100 (1-hour), an upper barrier of 1-hour Bollinger Band and a midline of 4-hour Bollinger Band.

Once above, the recovery may be extended towards $170.00 (38.2% Fibo retracement monthly and an upper line of 4-hour Bollinger Band).

Below the current price, watch out for psychological $160.00 followed by $158.00 strengthened by DMA50

XRP/USD dives under $0.30

Ripple has a hard time staying above $0.30 handle. The third largest coin with the current market value of 12.5 billion has lost 2% of its value in recent 24 hours. The price recovered from the intraday low of $0.2987, but the momentum is not strong enough to take it safely above $0.30 handle.

A strong upside barrier $0.3050 may limit the recovery attempts for the time being. This resistance is created by a confluence of SMA10 and SMA50 (4-hour), SMA200 and SMA50 (1-hour), DMA10 and 38.2% Fibo retracement daily.

Once it is out of the way, the recovery may be extended towards $0.3100-$0.3130, protected by the middle line of 1-day Bollinger Band. The next upside barrier awaits the coin on approach to $0.3200 with 61.8% Fibo retracement monthly.

On the downside, a sustainable move below $0.2900 will spoil the short-term technical picture and bring $0.2827 (the previous month low) back in focus.