- Bitcoin (BTC) remains bullish at $45,170 and would propel the crypto market bullish momentum if the pending golden cross is confirmed.

- If Algorand (ALGO) breaks above the immediate resistance at the $2.30 mark, it could resume the uptrend tagging the $3.0 level.

- Tezos (XTZ) remains bullish at $7.20 within the confines of the rising channel.

- Polkadot (DOT) could rally 34% to tag the May 19 range high above $44.

- Cardano (ADA) remains bullish following the successful launch of the Alonzo hard fork on September 12.

Bitcoin (BTC) led other and moved higher over the weekend. Bitcoin was rising due to market optimism after many countries expressed interest in following El Salvador’s lead and making BTC legal tender or legalising payment in BTC. Polkadot (DOT), Algorand (ALGO), and Tezos (XTZ) also moved behind largest cryptocurrency. Cardano (ADA) makes our top-5 cryptocurrencies to buy this week list as it has just had a major upgrade to its blockchain network. Therefore, it is expected that the successful launch of the Alonzo hard fork will positively impact ADA’s price despite the current correction.

At the moment, Bitcoin price is struggling to hold above the $44,000 level as it consolidates between the $44,000 and $48,000 psychological levels. This is an important level for investors who are witing to see which direction BTC takes.

In addition to this, crypto players are also looking out for the fundamentals that are likely to turn the cryptocurrency market momentum positive. As far as Bitcoin is concerned, the flagship cryptocurrency reached an important milestone after miners produced the 700,000th block on Saturday September 11. Bitcoin was trading bear the $8,000 mark when the miners produced the 600,000th block on October 18, 2019.

Reaching such a milestone increases the chances of eventual success of Bitcoin, and by extension, cryptocurrencies, thus justifying the upward movement of the prices.

In addition, increased institutional adoption and widespread acceptance is expected to turn the crypto market sentiment bullish. The legalising of Bitcoin as a legal tender in El Salvador last week allows crypto supporters to show-case a real-life situation of where Bitcoin provides solutions to some of the world’s financial problems.

During the same week, Ukraine passed a bill legalising and regulating Bitcoin and other cryptocurrencies such as Litecoin in the country. This is an important step as it provides official clarity on the digital assets which was in a grey area previously in the European country. On Wednesday September 08, the Ukrainian Parliament passed Bill No. 3637 On Virtual Assets that gives the Ukrainian government the ability to legally regulate digital assets. The Bill states that:

“This Law regulates legal relations arising in connection with the turnover of virtual assets in Ukraine, defines the rights and obligations of participants in the virtual assets market, the principles of state policy in the field of virtual assets.”

Even though the law does not make cryptocurrencies legal tender as with Bitcoin in El Salvador, it makes the buying, selling and holding of cryptocurrencies legal.

Against this backdrop, the cryptocurrencies continue to take root and the crypto marker sentiment is expected to remain bullish the remaining part of 2021.

Look at the top-5 cryptocurrencies to buy that may make lead this bullish trend this week.

- If you wish to trade these cryptos, read our guide on best crypto brokers to get started.

1. Bitcoin (BTC)

Bitcoin is at the top of our Top-5 cryptocurrencies to buy list for the week ahead. Bitcoin price prediction for the coming week is bullish as it consolidates below the $48,000 psychological level.

BTC dropped below the 200-day Simple Moving Average (SMA) on September 10 but bears have not managed to pull the Bitcoin price further away from this point. At the time of writing, Bitcoin is hovering around $45,120 as bulls strive to push the BTC back above the 200-day SMA.

Along with this, Bitcoin investors are watching for the formation of a golden cross in BTC/USD daily chart. This may happen in the near future when the 50-day SMA crosses above the 200-day SMA. If this happens, it will be an indication that the Bitcoin is likely to tilt in favor of the bulls

BTC/USD Daily Chart

A bullish set-up will ensue if BTC closes the day above the immediate resistance at $46,042 where the 200- and 50-day SMA coincide. A clear breakout above this level would see BTC/USD price tag the $50,000 level or the $52,900 resistance.

Seller congestion around the $52,900 resistance zone is likely to curtail any further upward movement of BTC. But if the bullish momentum is strong enough to overcome this hurdle, Bitcoin could rally to tag the $60,000 psychological level or the all-time high (ATH) above the $64,000.

On the flipside, if BTC favours the bears, it will mean that the sellers are aggressively ensuring that Bitcoin moves further below the 200-day SMA. Therefore, a daily closure below the immediate support provided by the $44,000 psychological level could see the bellwether cryptocurrency tag the $42,874 support zone. A break below this point could tilt the advantage in favour of the sellers which could see Bitcoin tank towards the $40,000 level embraced by the 100-day SMA.

Capital at risk

2. Algorand (ALGO)

Algorand (ALGO) has rallied approximately 64% over the last seven days to the current price around $2.17. ALGO price is one of the altcoins that continued to rally after the Tuesday 07 crypto market flash crash to record higher highs.

The long lower wick on the September 07 red candle shows that investors bought the dip around the $0.973 embraced by the 50-day SMA. This turned the ALGO market momentum bullish on Wednesday when the altcoin rallied almost 51% slicing through the stiff resistance around $1.91.

Things turned awry on September 10 when the Algorand price sank below the break out level at $1.91 but the buyers were not going to give up yet. The ALGO/USD price rebounded off this support on Sunday in a 19% rally that saw the asset record highs of above the $2.5 psychological level.

ALGO/USD Daily Chart

Note that daily closre above the immediate resistance at the $2.30 mark will mean that AGLO could resume the uptrend tagging the $3.0 and $3.32 levels. This Aglorand bullish market momentum is accentuated by the upward movement of the MACD in the positive region above the zero line.

Moreover, the moving averages formed a golden cross yesterday whe the 50-day SMA crossed above the 20-day SMA indicating that the bullish momentum is strong and that ALGO is set to record higher highs this week. Moreover, the position of the RSI in the overbought zone indicates that the bulls are in control of the Algorand price which makes one of the top-5 cryptocurrencies to buy this week.

On the flipside, if the price completely turns away from the $2.30 resistance level, ALGO/USD price could frop to the $1.91 and consolidate between these two levels in the near term. A break and close below the $1.91 will suggest that the current breakout was a bull trap and that ALGO could drop to tag the $1.62 support level or the $1.50 psychological level.

Note that the RSI shows that ALGO was massively overbought recently validtaing the resent price correction. Moreover, the negative parabolic SAR and the down ward pointing RSI shows that the bears are currently in control of the Algorand price.

Capital at risk

3. Tezos (XTZ)

The Tezos price has formed an ascending parallel channel chart pattern on the daily chart after successfully retesting the break-out level at $4.16 embraced by the 200-day SMA on September 07 and September 08. Even if the sellers tried to pull XTZ price below the 200- and 50-day SMAs during the Tuesday September 7 flash crash and Wednesday September 08’s consolidation but they could not hold the lower levels.

This drop allowed investors to board the ship in a ‘buy-the-dip’ scenario that has seen XTZ rally 106% from a low of $3.85 where the 50-day SMA coincide with the tip of the lower boundary of the ascending channel on September 08 to a high of $7.95 witnessed earlier today.

Note that as long as the Tezos price remains within the confines of the rising channel, it will continue to record higher highs. At the time of writing, XTZ/USD price is exchanging hands at $7.20 appears to be battling immediate resistance at the $7.0 psychological level. Note that a daily closure above this level will see Tezos rise higher to tag the $8.0 mark. A clear bullish breakout will be achieved once XTZ breaks above the upper boundary of the ascending parallel channel at $8.26. After which, a rise towards the May 07 range high at $8.78 would be the next logical move. XTZ/USD Daily Chart

Tezos’ bullish narrative is validated by the upward movement of the RSI into the overbought region indicating that bulls are in control of XTZ. Moreover, the positive Parabolic SAR also shows that the Tezos market momentum is bullish.

XTZ has also sent two bullish cypto signals on the daily chart. The first one is the call-to-buy signal sent by the MACD indicator on September 11. This happened when the MACD line (12-day Exponetial Moving Average – EMA) crossed above the signal line (26-day EMA) adding credence to Tezos bullish narrative. Second the moving averaged have formed a golden cross on the same time frame. This occurred yeterday when the 50-day SMA crossed above the 200-day SMA accentuating the bullish narrative.

These bullish technical indicators plus the fact that XTZ sits on a strong support provided by particlarly the 50-, 200-, and 10-day SMAs at $4.21, $4.16 and $3.54 place Tezos (XTZ) on our top-5 cryptocurrencies to buy this week list.

If things go awry for Tezos and the asset closes the day below the immediate resistance at $6.22, XTZ may drop towards the $5.6 support wall. A drop further could see XTZ tag the $5.0 psychological level or the SMA below it.

Capital at risk

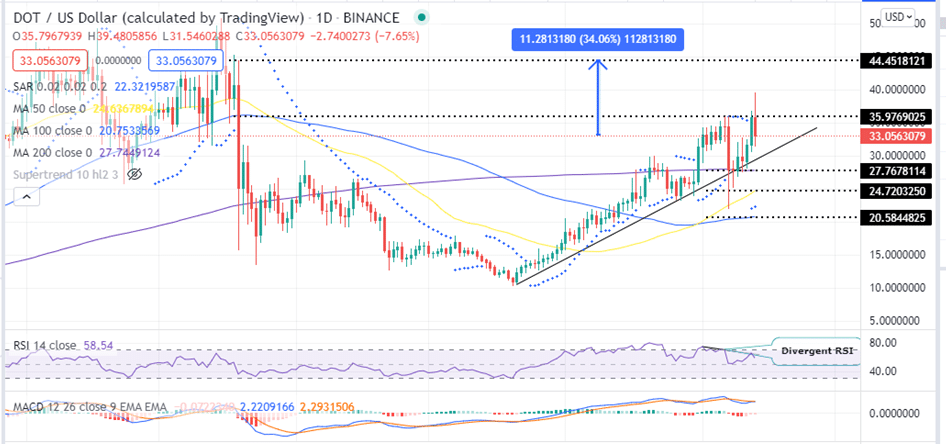

4. Polkadot (DOT)

Our fourth coin among the top-5 cryptocurrencies to buy over the next few days is Polkadot’s DOT. During Tuesdays cryptocurrency market flash crash, Polkadot’s price fell below the 200- and 50-day SMAs to lows of around $22.21. The long lower wick on Tuesdays candle stick suggests that investor’s bought the dip and were not ready to let go of the 200-day crucial support at the $27.76 level.

Polkadot bounced off from this crucial support on Thursday in a rally that saw the DOT/USD price gain as much as 78.25% from September 07 low at $22.10 below the 50-day SMA to a high of $39.53 recorded earlier today.

The DOT price also rose above the July rising trend line on Thursday September 09 adding fuel to the bullish momentum. Therefore, Polkadot price prediction for the week is bullish as the asset trades at $33.05 above the July rising trendline.

The upsloping moving averages and the position of the MACD above the zero line in the positive region adds credence to this bullish outlook.

DOT/USD Daily Chart

Therefore, a daily close above the current resistance at $35.97 could see DOT break out to tag the $40.0 psychological level. A rise above this level will confirm a clear bullish bfreakout with the May 19 range high at $44.45 being the next logical move. This would represent a 34% rise from the current price.

The divergent RSI indicates that the bears have not given up on pullisng the DOT price further down. If they manage to overpower the bulls and the current correction lingers, Polkadot may drop below the immediate support at $31.48. A drop further could see the Polkadot price tank below the July rising trendline at $30 to tag the 200-day SMA at $27.76, the 50-day SMA at $24.72 and the 100-day SMA at $20.58 respectively.

Capital at risk

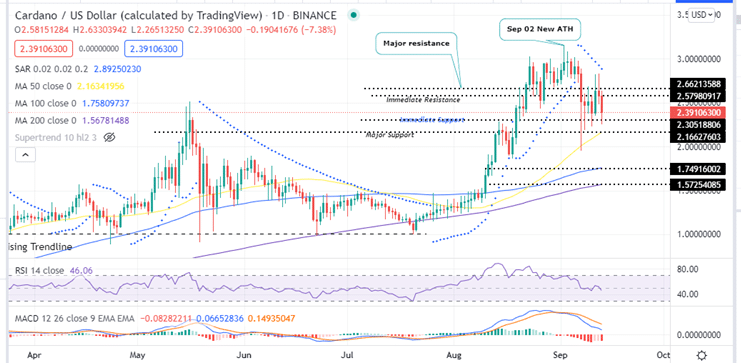

5. Cardano (ADA)

Marking the last of our top-5 cryptocurrencies to buy for the week ahead is Cardano’s ADA. Despite the current correction, Cardano price momentum remains bullish.This follows the fundamentals around the successful launch of the much-awaited and publicized Cardano Alonzo hard Fork on Sunday September 12. This introduces the smart contracts functionalities onto the Cardano blockchain.

The development team behind Cardano expects dozens of projects that deployed smart contracts on the testnet to increase on-chain activity on the mainnet in the following months. This should bolster the ADA price to jump as well.

At the time of writing, ADA/USD price teeters around $2.39 as the green token struggles below the $2.57 resistance. A break out above this level could see ADA rise to tag $2.66 major resistance level. A clear breakout above $2.66 could see Cardano re-test the September 02 ATH at $3.15 with the rise towards the $5.0 psychological level becoming a possibility.

ADA/USD Daily Chart

Cardano’s bullish outlook is accentuated by the the upsloping moving averages and the position of the MACD in the positive region above the zero line. Also note that the Cardano sits on strong support areas provided by the 50-,100- and 200-day SMAs downward.

However, if the bears tighten their grip on ADA and it slides below the immediate suport at $2.30, Cardano price could drop further to tag the 50-day SMA at $21.66, the 100-day SMA at $1.75 and the 200-day SMA around $1.57 respectively.

Capital at risk

Where to Buy BTC, ALGO, XTZ, DOT and ADA

If you want to trade the top-5 cryptocurrencies to buy this week, you can do so on the following crypto trading platforms:

- eToro

eTorois one of the trusted exchange platforms in the crypto space. eToro supports copy trading, which allows new traders to learn from market experts. eToro also charges low trading fees and commissions. - Binance

The other platform where you can buy COMP is Binance. Binance is one of the largest exchange platforms. It supports a wide range of cryptocurrencies and trading pairs. It also offers user-friendly features. - Kraken

Kraken charges transaction fees as low as 0.20% with free bank transfers. It offers a wide range of cryptocurrencies such as Aave, Algorand, Bitcoin, Ethereum, Dogecoin, Bitcoin Cash, Litecoin, Solana and others. You can transact on Kraken using such payment methods as Debit/Credit Cards, Cryptocurrencies and direct bank transfers