- Bitcoin needs to close the day above the $48,000 mark to restart the bullish leg.

- Solana continues to discover new highs around $94.

- Cardano is currently consolidating between $2.69and $2.84. A break out above $2.84 will validate the bullish bias.

- If Terra breaks above the ATH at $37.61 it will discover new highs above the $40 psychological level.

- Ripple remains bullish amidst strong bearish price actions.

Bitcoin price slipped further away from the $50,000 psychological level. Data from Coinbase shows that BTC is currently having its third straight bearish session as bears push the price below the $48,000 psychological level. It forms the basis of our discussion on the top 5 cryptocurrencies to buy this week.

The short-term Bitcoin price prediction is bearish after the flagship cryptocurrency declined 6% from the recent three-month August 23 high around $50,588 to the current price around $48,140.

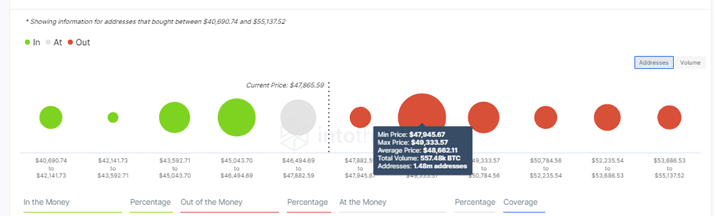

To accentuate this bearish outlook for the bellwether cryptocurrency are on-chain metrics from IntoTheBlock which illustrate that Bitcoin faces immense resistance upwards. The major resistance at the $48,600 mark lies within the $47,945and $49,333 where a lot of investors (1.48 million addresses) previously bought approximately 557,480 BTC. These traders might want to break even curtailing any efforts to take Bitcoin beyond the $50,000 mark.

Bitcoin IOMAP Chart

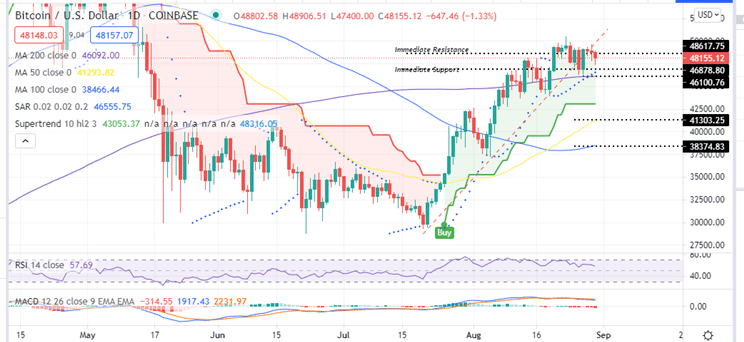

The downward movement of the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicator show that bears are currently in control of the BTC/USD price as shown on the daily chart.

BTC/USD Daily Chart

Note that Bitcoin’s bearish outlook could be reflected in the entire cryptocurrency market that may affect other cryptocurrencies.

The Crypto Market Snubs Powell’s Dovish Speech

As we seek details on the top 5 cryptocurrencies to buy, it had been expected that the cryptocurrency market would continue to soar thanks to the Federal Reserve Chair Jerome Powell’s dovish stance, which suggested that rates will rise at a lower pace than had been expected.

In a speech delivered on August 27, Powell said that the central bank will start tapering its $120 billion monthly bond purchases by the end of the year, but the interest rate hikes would have to wait until the job market and inflation pass a more stringent test.

In response to the speech, the US Dollar Index (DXY) fell to a two-week low with the S&P 500 index rising to a new all-time high. Bitcoin (BTC) surged 5% to close the day above $49,100 on Friday.

As a result, the traders shifted their focus to US jobs figures for clues on a tapering timeline on Friday. Thus, these dovish stances put bearish pressure on the US dollar.

Increased Institutional Adoption To Bolster The Cryptocurrency Market

A part from the weakened dollar following Powell’s dovish stance, it is expected increased institutional adoption and partnerships should increase the buying appetite of crypto investors.

From PayPal announcing that it was allowing its UK customers to buy, sell and store Bitcoin, Ethereum, Litecoin and Bitcoin Cash, to the Citi group seeking to trade Chicago Mercantile Exchange (CME) Bitcoin futures after receiving regulatory approval. From the Bill legalising Bitcoin as legal tender being passed in El Salvador to the latest news that Cuba recognizes and is regulating cryptocurrencies such as Bitcoin.

In a Resolution 215 published on August 26 by the state-run Official Gazette, Cuba’s central bank revealed its plans to roll out new rules regulating crypto assets. According to CNBC, the development implies that commercial providers of related services are now required to secure a license to operate from the central bank.

This is a show that countries are continuously embracing cryptocurrencies amid the rising popularity of this new class of assets.

Amidst these positive news, Bitcoin continues to consolidate below $50,000. The question remains, will this attract investors to buy altcoins over the coming week?

Next, I spell-out then top 5 cryptocurrencies to buy this week.

1. Bitcoin (BTC/USD)

Bitcoin is the first among the top 5 cryptocurrencies to buy this year. BTC remains bearish as it trades below the July rising trendline.. This suggests that the bears are in control and are aggressively focused on pushing BTC price below the immediate support embraced by the $48,000 psychological level.

If BTC closes the day below the $48,000 mark, the bears will be bolstered to resume the downtrend opening the door for a drop towards the $46,878 support wall.

BTC/USD Daily Chart

On the flipside, a breakout above the immediate resistance at the $48,617 mark will take the Bitcoin price up above the July rising trendline invalidating the bearish pattern. If this happens, Bitcoin could rally above the $50,000 psychological level. A further rise above this level, BTC may rally to re-test the all-time high (ATH) above $64,000.

Note that the upsloping 50- and 100-day SMAs and the positive parabolic SAR suggest that BTC remains bullish in the long-term. Moreover, the SuperTrend indicator flashed a buy crypto signal on July 25 and flipped below the price. Realise that as long as the SuperTrend indicator remains below the BTC price, Bitcoin will remain bullish. Also, the position of the MACD above the zero line in the positive region indicates that BTC’s market sentiment is positive and Bitcoin remains among the top 5 cryptocurrencies to buy in the near term.

Capital at risk

2. Solana (SOL/USD)

Solana continued with the roaring on Monday setting a new ATH at $110. Over the last two weeks, the competitive smart contract token show signalled another significant leg higher. Last week, the retracement towards the $65 level allowed more investors to get aboard the ship to the moon, bolstering the bullish momentum.

A confirmed break above $90 on Sunday set SOL on the trajectory to $110, but this target was overshot by increasing pressure as Solana closed the day in the red around $94. At the time of writing, Solana is dancing at $108 after bouncing off higher support at $94.

A technical outlook on the daily chart indicates that the uptrend is far from over and is set to continue over the week. A decisive break above $110 would see SOL trade another ATH as bulls eye $200.

SOL/USD Daily Chart

The position of the RSI in the overbought zone, the upsloping moving averages and the upward movement of the MACD above the signal line in the positive zone are all indications that bulls are in control of the Solana market.

Note that a daily closure below the immediate support at $94, the competitive smart contract token could consolidate for a few days. A break below the range support at $72 would validate the bullish momentum as bears take control of SOL.

Realise that the RSI indicates that Solana is heavily overbought, implying that the bullish momentum could be overheated and a correction could ensue sooner in the near term. Meanwhile, the $94 support wall is crucial to mitigating any pullbacks coming Solana’s way.

I hope this gives you enough reason to put SOL on your list of top 5 cryptocurrencies to buy this week?

Capital at risk

3. Cardano (ADA/USD)

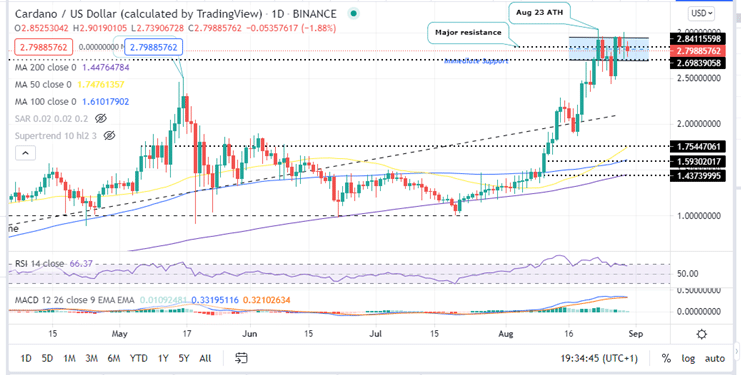

Cardano (ADA) is currently consolidating between $2.69and $2.84. ADA price action was marked by indecision on Sunday characterized by a doji stick. Cardano’s price had dropped to the breakout level at $2.52 on August 26 but the sharp rebound off this level on August 27 shows that bulls have flipped the level into support.

Consolidating near the ATH is a positive sign as it implies that investors are getting on board as they buy the dips. The upsloping SMAs and the position of the RSI at 66.32 near the overbought zone shows that the bulls are in control of Cardano. Moreover, the upward movement of the MACD, the movement of the MACD above the signal line and the position of the MACD above the zero line in the positive region are all positive signs that ADA faces least resistance upwards. This indicates that the bullish momentum may continue over the next week. At the time of writing, ADA is exchanging hands at $2.79 on most crypto exchanges.

If bulls firm their grip and move the price above the $3, psychological barrier, then the ADA/USD price could resume its uptrend. The next logical move would be rising above the ATH at $3.03 to discover new highs around the $3.50 mark.

ADA/USD Daily Chart

On the flipside , if the Cardano price slides below the immediate support at $2.69, the bullish bias will be invalidated at the asset may re-test the $2.52 support area. A break below this level could push the green token towards the $2.43 support wall or re-visit the SMAs below the $2.0 psychological level.

Capital at risk

4. Terra (LUNA/USD)

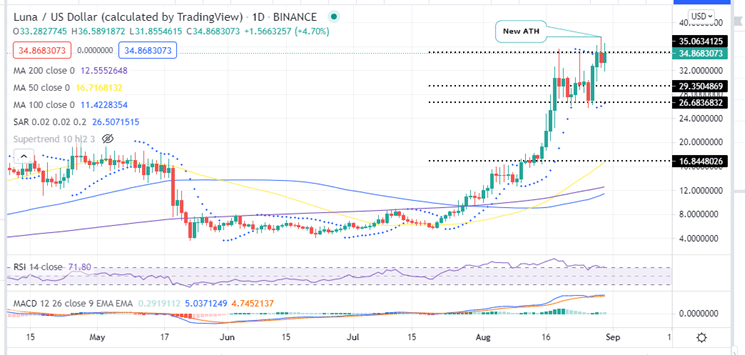

Terra went against the bearish sentiment over the weekend to set a new all-time high (ATH) around $37.61. Over the last two weeks, the LUNA price has rallied approximately 117% from $17.31 on August 16 to the Sunday August 29 ATH above $37. The retreat that started on August 20 pushed the Terra price to an intraweek low of $25.74 on Thursday August 26 allowed more investors to buy the dip, adding momentum to the bullish bias.

At the time of writing, LUNA is trading at $34.86 and appears to be battling immediate resistance at the $35 psychological level. A daily closure above this level could bolster the bulls to take Terra above the ATH at $37.61 to discover new highs above the $40 psychological level.

LUNA/USD Daily Chart

Technical outlook given by the position of the RSI in the overbought zone at 72.45 indicates that the bulls have the upper hand validating LUNA’s bullish bias. In addition, the upsloping averages and the upward movement of the MACD indicator add credence to this positive outlook. Note that the MACD retracted from sending a sell crypto signal on August 27 and remained above the signal line and way above the zero line in the positive region. Also the Parabolic SAR reversed from negative to positive on August 28 and remains so. All these indicate that the bulls are in control of the Tera price, a situation that is likely to continue in the near-term and Terra still remains among the top 5 cryptocurrency to buy this week.

On the downside, the long upper wick on yesterday’s candlestick is an indication that bears are getting more and more aggressive, perhaps due to profit taking at the current price.

Note that if LUNA closes the day below the immediate support at $33.33, the Terra price could drop to the $29.35 support wall with the next logical move being towards the 20-day SMA at $26.68

Capital at risk

5. Ripple (XRP/USD)

The Ripple price is trading with a solid bearish bias, falling to $1.14 and losing 1.45% on Monday. The XRP/USD price failed to stop its previous-session bearish rally and took some further offers around the $1.12 psychological level. The XRP price prediction remains bearish below the $1.16 level as it’s expected to push the pair lower towards the $1.06 level.

On the downside, the bulls must defend the immediate support prevails at the $1.07 level. A daily closure below this level could lead the XRP price towards the $0.96 support level. The 200-day SMA will likely support the selling trend below the $0.96 level. Whereas the RSI, is staying in the sell zone and the MACD is moving downwards and is positioned below the signal line. Therefore, the chances of a selling trend remain pretty strong.

XRP/USD Daily Chart

On the flip side, XRP is currently trading at $1.14 and seems to be battling immediate resistance at $1.18. A breakout of the $1.18 resistance level could trigger an additional buying trend until the $1.35 psychological level.

Note that the upsloping SMAs and the position of the MACD above the zero line indicate that a bullish momentum still remains and that Ripple is still among the top 5 cryptocurrencies to buy in the next few days.

Capital at risk

Where to Buy BTC, SOL, ADA, LUNA, and XRP

If you want to trade these cryptocurrencies, you can do so on the following crypto trading platforms:

- eToro

eToro is one an FCA regulated platform with over 20 million user globally. eToro charges low trading fees and commissions. - FTX

FTX is one of the largest exchange platforms that supports a wide range of cryptocurrencies and trading pairs. It also offers user-friendly features.