EUR/USD certainly bounced from the lows, mostly due to the Donald. However, the team at Deutsche Bank still lays out a path for EUR/USD way below parity:

Here is their view, courtesy of eFXnews:

We expect the dollar to continue to strengthen over 2017 – corporate tax reform; potential hawkish Fed appointments; fiscal stimulus; the dollar’s status as a high-yielder all favour continued gains throughout the year.

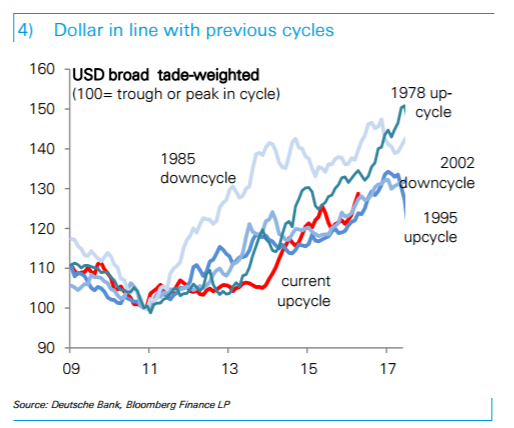

Dollar cycle still has juice. The USD is hardly stretched. Compared to a more than 10%y/y appreciation last January the broad-trade weighted dollar is only 2% higher. More generally, looking at previous cycles the dollar is perfectly tracking moves in terms of pace and duration. All previous dollar cycles have lasted at least six years with 30% moves. Given that the broad dollar troughed in 2011 there is at least one more year to go (chart 4).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

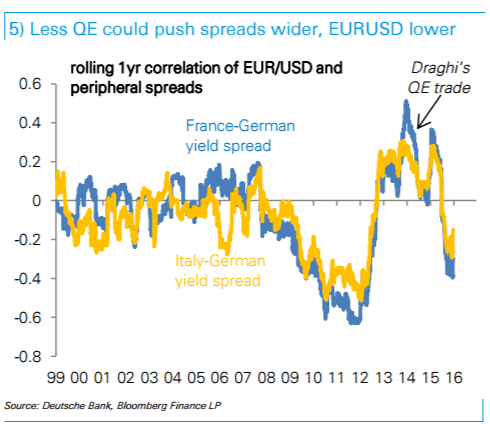

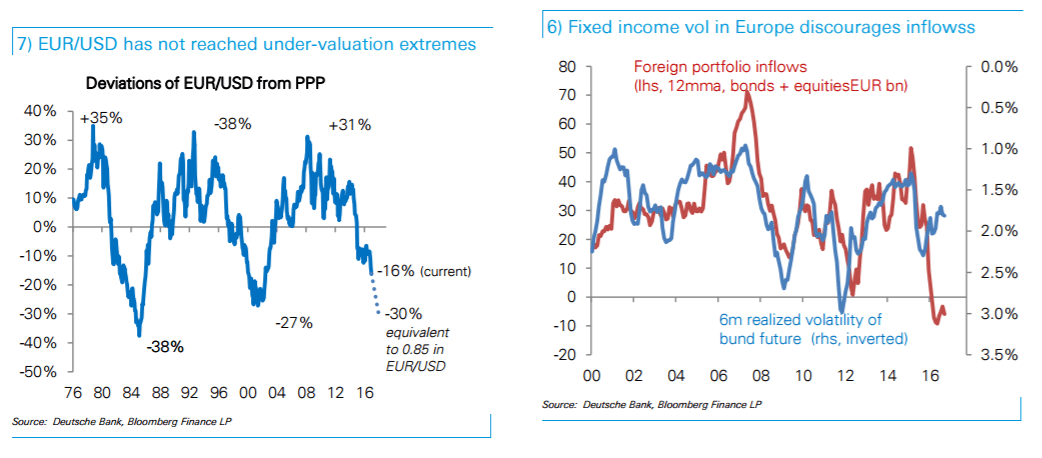

The Draghi trade is over. The ECB surprised in December by tapering but it is not clear this is bullish for the euro. First, the prospect of a sell-off in European fixed income hardly makes European bonds an attractive investment. Second, the correlation between peripheral spreads and EUR/USD has flipped back to negative. During “whatever it takes” more QE and narrowing yields were associated with a weaker euro. The relationship has now flipped because less QE may be associated with higher redenomination risk and a lower euro.More generally, there is an inverse relationship between higher volatility in the German bund and foreign portfolio inflows: when markets become volatile foreigners shy away from Europeans assets. With French, German, Dutch and likely Italian elections all due this year, the market reaction to a negative political surprise will be very asymmetric for EUR/USD.

Valuations and European basic balance Our model of the European basic balance suggests EUR/USD “fair value” is already below 1.00 given record portfolio outflows that are far larger than the current account surplus. EUR/USD valuations are not yet extreme, with typical over/under-shoots being around 30% or 85cents for EUR/USD.

Sell EUR/USD targeting at least 95cents. We are bearish for the year and we see risks to our 95cent forecast as skewed to the downside.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.