- Uniswap price quick recovers quickly from $14 to areas above $20 could be reversed.

- A double-top technical pattern threatens to tank UNI towards $14.

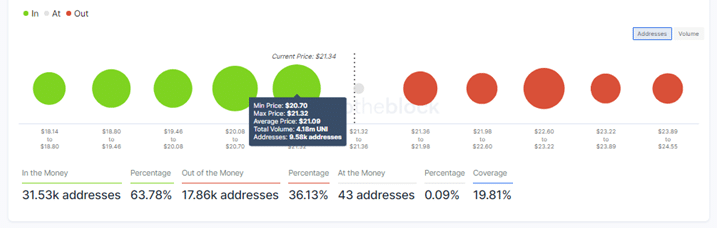

- The IOMAP Model indicates that Uniswap is sitting on robust support around $20.7

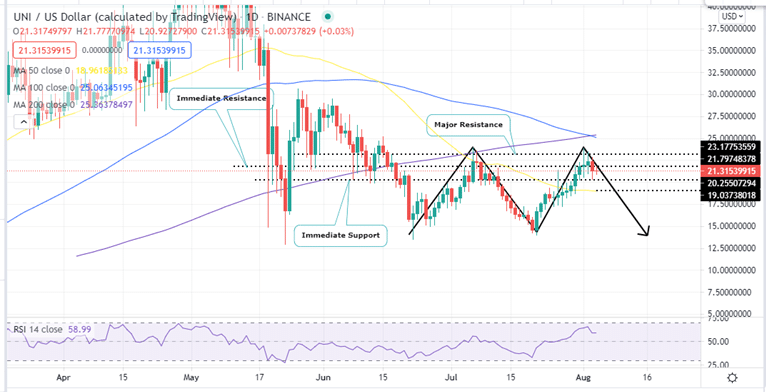

Uniswap price is currently exchanging hands 8% lower than the recently tested resistance at around $23.12. Retracement appears quick and sharp as seen on the daily chart probably due to seller congestion near this resistance zone. It could also be that investors took advantage of the recent upswing that the crypto market has experienced since July 21 to collect their profits.

At the time of writing, UNI was trading at $21.23 while sitting on immediate support around $20.25. Note that a daily closure above this level will see Uniswap price breakout downwards as sellers target $14.0.

Uniswap Price Could Tank To $14 If Key Technical Pattern Holds

UNI appears to be forming a double-top pattern on the daily chart after being rejected the $23.12 major resistance level. A double-top is an exceptionally bearish chart pattern that often results in a trend reversal.

Note that this pattern forms when an asset tests a resistance level twice without breaking above it. The two tops are usually separated by a moderate peak like the July 20 low around $14 as shown on the UNI daily chart.

The double-top pattern was confirmed when the Uniswap price slipped under the $22, a support level that is equal to the lows preceding the two highs. Note that a daily closure below the $20 psychological level will validate the UNI price correction that may trigger losses towards $14.

Uniswap Price (UNI/USD) Daily Chart

The bearish thesis is validated by a number of technical crypto signals. These include the appearance of a death cross that occurred when the 100-day SMA crossed below the 200-day SMA, the appearance of a bearish engulfing candlestick and the movement of the RSI away from the overbought zone in the exact daily time frame.

Can UNI’s Bearish Thesis Be Invalidated?

On-chain metrics from IntoTheBlock’s IOMAP model indicate that the Uniswap price is sitting on robust support around the $20.70 and $21.32 zone. At this range, 9,580 addresses previously bought roughly 4 million UNI. Such support is robust enough to absorb most of the selling pressure, allowing bulls to focus on pushing the price higher.

UNI IOMAP MODEL

Lack of robust resistance on the upside shows that the Uniswap price could have a smooth recovery. A daily close above the $22 psychological level and eventually a break above $23 will invalidate the bearish thesis fronted by the double-top pattern, propelling UNI significantly above $25.

- Are you new to crypto? This guide on how to buy cryptocurrency is good place to start.

Looking to buy or trade Uniswap now? Invest at eToro!

Capital at risk