US consumer confidence slides to 98.1 points, 0.4 below expectations and 0.1 under December’s number. One year inflation expectations are up from 2.2% to 2.6% and five-year expectations are up from 2.3% to 2.5%. The Conditions component is up from 11.9 to 112.5 points while Expectations are down to 88.9 points.Business inventories are up 0.7%, much better than expected, and with an upwards revision.

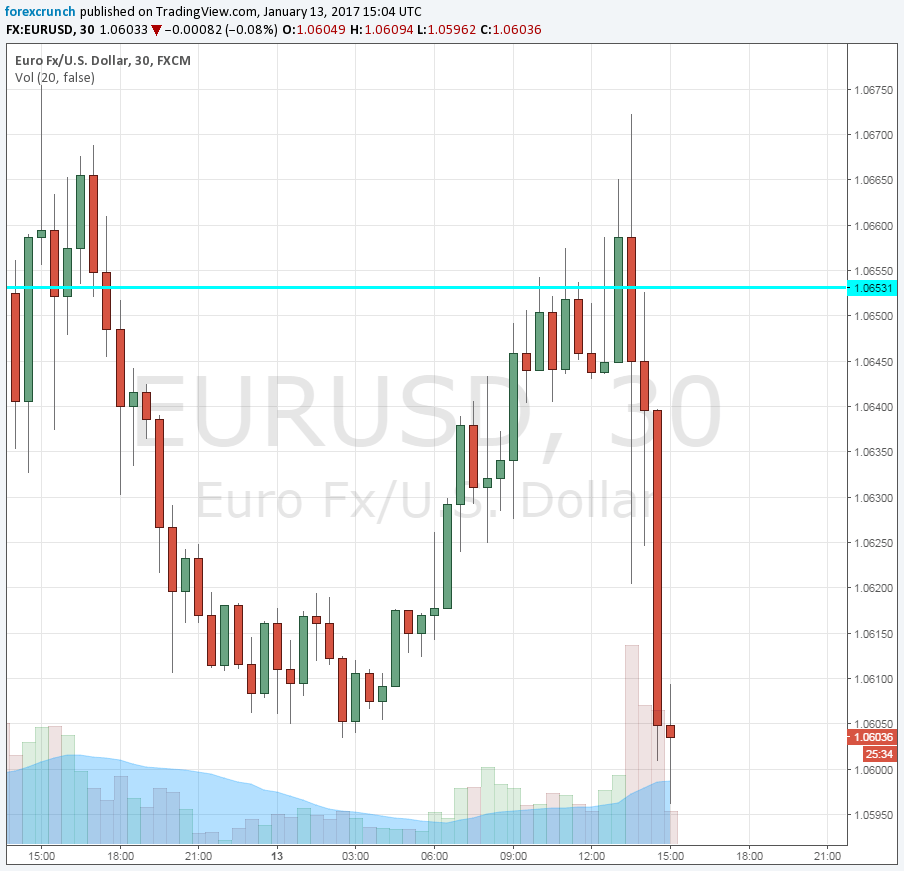

The US dollar looks strong.

The measure of consumer confidence by the University of Michigan and Reuters was expected to tick up to 98.5 points in January in the preliminary read. The final estimate for December stood at 98.2 points. In theory, consumer confidence translates to spending, but the correlation is not always clear to see. At the same time, the US releases business inventories, which were projected to rise by 0.3% after a slide of 0.2% beforehand.

The US dollar continued suffering from Trump’s press conference. Nevertheless, after another dip to new lows, the greenback managed to recover as a reaction to the retail sales report. The data was not that good: core figures missed expectations while the headline growth of 0.6% was balanced out by an upwards revision. Perhaps markets had expected worse figures in the last-minute run-up to the release?

The publication of consumer confidence concludes a week which saw few economic releases but the week was eventful nonetheless.

More: ‘Bad’ Versus ‘Good’ USD Rally; What Does It Mean For USD Trade? – Morgan Stanley