This is another case of the headline figure beating expectations with the core data coming short of expectations. Durable goods orders are up 1.7% against 1.2% forecast. In addition, the previous figure was revised to the upside: 2.3% against 2% originally reported for January.

Core orders are up 0.4%, below 0.5% predicted. At least there is a positive revision also here: 0.2% instead of 0% that was published a month ago.

The non-defense non-air are down 0.1% instead of rising 0.6%. Also here the revision is positive, from -0.1% to 0.1%. However, this is the core of the core and the miss here is more significant than elsewhere. This is where the bigger pain comes from.

The US dollar seems to be focused on the Trump-care vote. Nevertheless, the data feeds into the GDP calculations for Q1 2017. In addition, the Fed is looking at this quite closely, as core orders are a significant part of investment measures.

The US dollar initially advanced on Trump ´s ultimatum. It seemed like a “win-win” situation for the Administration on the path to tax cuts and infrastructure spending. However, it could be a lose-lose situation in the longer run.

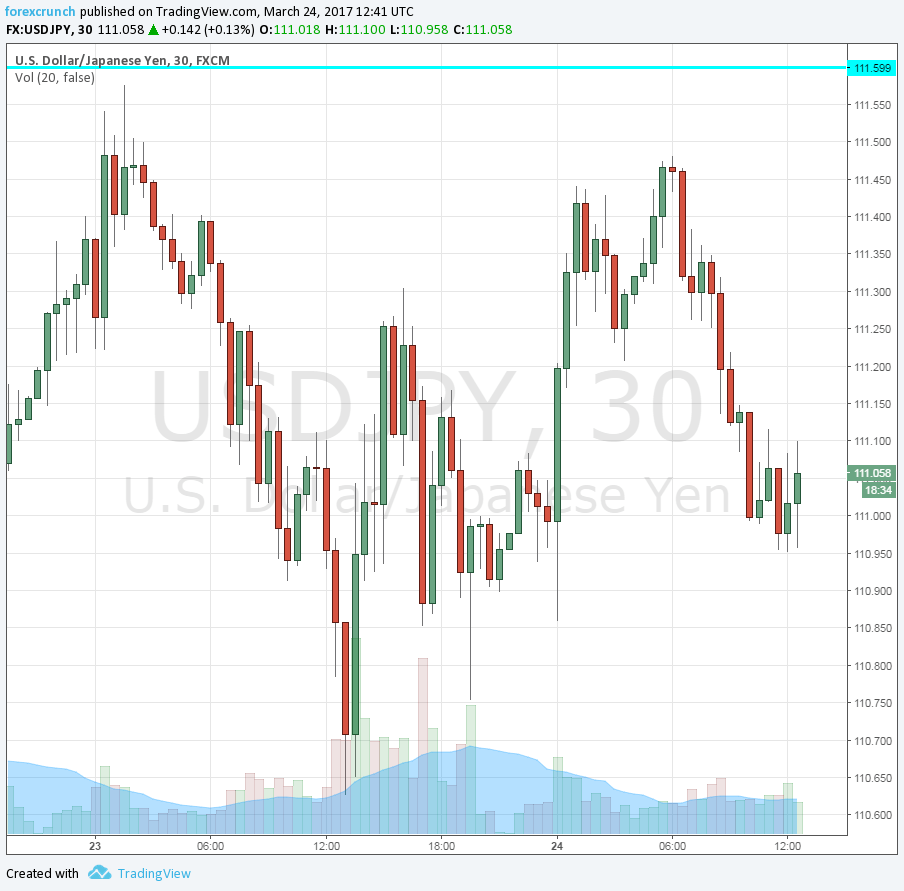

Here is how the situation looks on the USD/JPY chart. A “wait and see” mode best describes it.