Idea of the Day

Today is likely to prove something of a disappointment compared to the price action seen after yesterday’s ECB decision. The US employment report for October is likely to have a very short half-life in the memory of markets, given the likely distortions from the government shut-down during the month. As such whilst markets expect a 120k gain in headline payrolls and a nudge higher to 7.0% in the unemployment rate, anything either side could fairly easily be dismissed given the fog of distortions, so the risk is that the initial reaction is eventually reversed.

Data/Event Risks

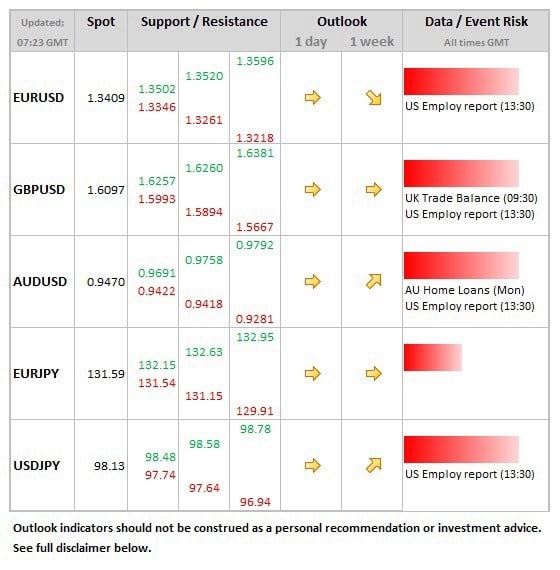

USD: The volatility risks in the employment report data are greater than normal, given that the numbers are for the month of October during which the government shut-down was taking place. Market expects 120k gain in payrolls, with 7.0% unemployment rate, the latter more impacted by the strike. Dollar could well shake off and reverse any initial reaction given the likely distortions in the data.

Latest FX News

EUR: The ECB delivered yesterday and initially took more than 1 big figure from EURUSD. The push below 1.35 proved to be fairly brief, as buyers emerged, but the key question is the impact on market and lending rates in the wider economy. Yields moved lower in Portugal, Italy and Spain, but the last rate cut saw less than half passed on to rates charged to households and businesses (on ECB aggregate data). France was downgraded this morning, from AA+ to AA by S&P. The last downgrade was January 2012. Euro was briefly below 1.34 as a result in late Asia trade.

GBP: Sterling was initially softer to 1.6055 in the wake of the BoE decision, but was soon pushed lower by the stronger USD. Once again, cable is left struggling above the 1.60 area on a sustained basis.

AUD: The RBA still being vocal about the level of the currency, both in its quarterly monetary policy statement and in comments from one of the assistant governors (Debelle) who said the recent exchange rate appreciation was not in line with fundamentals.

Further reading: