Huge disappointment in the US: the economy grew by only 1.2% annualized. This comes on top of a downwards revised Q1 with 0.8% instead of 1.1% reported beforehand. Core PCE prices came out at 1.7% as expected but PCE missed with 1.9%. The deflator beat with 2.2%.

Among the components, personal consumption came out at 4.2%, within expectations. The silver lining can be a drop in inventories, but the headline is still very bad. Exports are up 1.4% and imports are down 0.4%, both better than in previous months. Another silver lining can come from government spending: it dropped by 0.9% after rising last quarter. So, growth was weak but due to falls in “bad growth”, inventories and government spending, while “good growth”, consumer spending was solid.

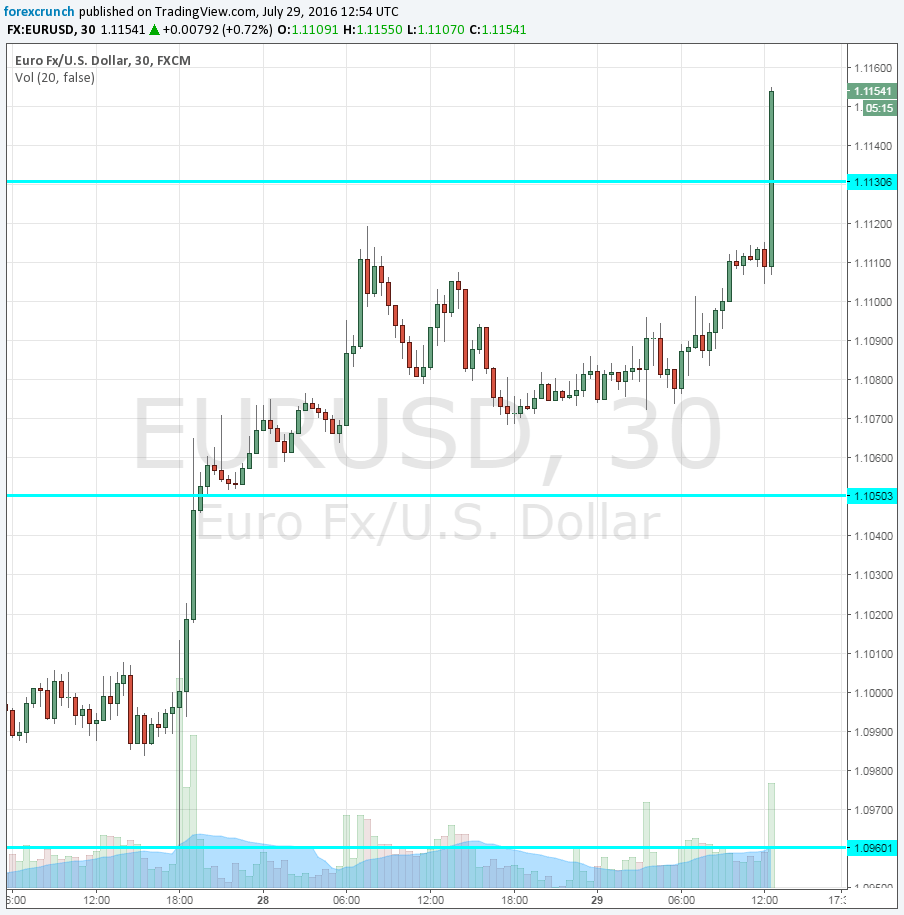

The US dollar is weakening

- EUR/USD is advancing towards 1.1160. Resistance awaits at 1.1190. Euro-zone inflation slightly beat expectations.

- GBP/USD is up to 1.3250

- USD/JPY is at 102.68, below the post-BOJ disappointment.

- USD/CAD is at 1.3095 despite weak Canadian GDP.

- AUD/USD is heading to 0.7580.

- NZD/USD shines with 0.7180, one of the biggest gainers of the day.

The US released its first GDP report for Q2 2016. Annualized growth was expected to rise by 2.6%, higher than 1.1% seen in Q1 and 1.4% in Q4 2015. Core PCE Prices were predicted 1.7% after 2% beforehand. Prices were expected to rise by 2% after 0.2% and the deflator carried expectations for a bump up of 1.8% after 0.4% beforehand.

See how to trade the US GDP with EUR/USD.

The Federal Reserve left its policy unchanged on Wednesday and there were no hints of a move in September. They probably had the GDP data in front of their eyes.

You can watch the live coverage with Valeria Bednarki and Mauricio Carrillo here: