Prices advanced by 0.2% y/y in the euro-zone in July. The preliminary release came out better than 0.1% expected. Core inflation did not provide surprises with 0.9%. GDP came out bang on expectations with +0.3%, despite the miss in France. The unemployment rate remained at 10.1%, exactly as expected.

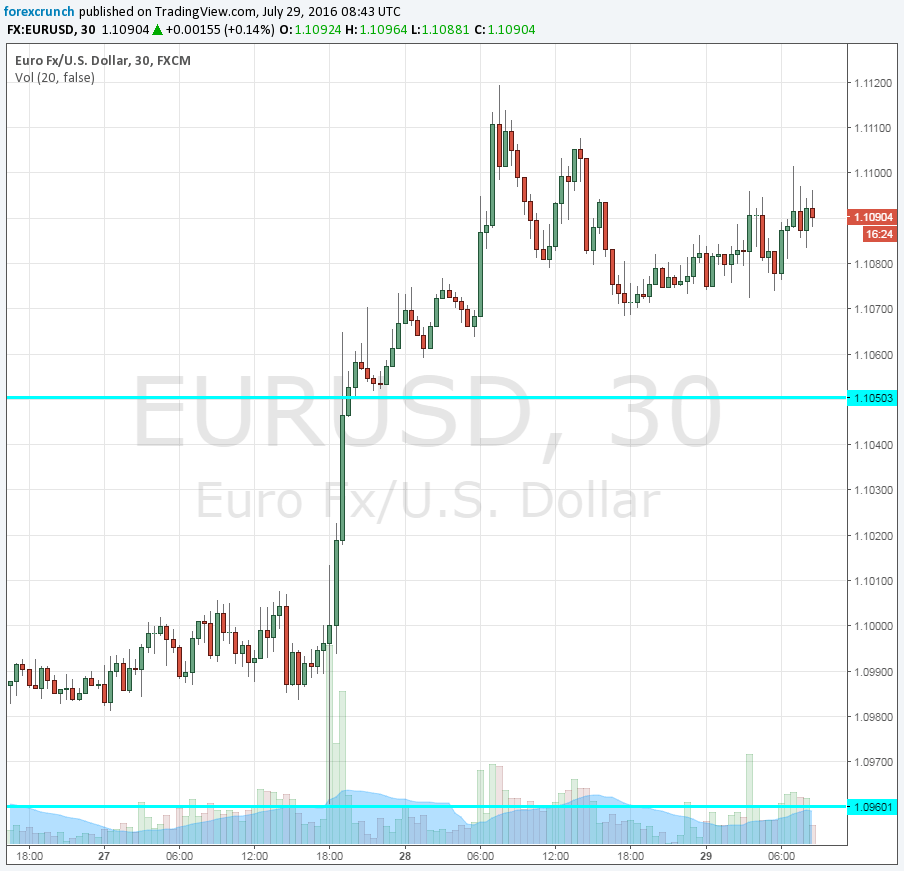

EUR/USD does not move too much. The surprises were quite limited, to say the least.

The euro-zone was expected to report a growth rate of 0.3% in Q2 2016, following +0.6% beforehand. This very early release is based on some big countries such as France and Spain, but not on Germany. Revisions are planned. Initial inflation data for July carried expectations for +0.1% in the headline figure and 0.9% in core CPI, a repeat of June. The unemployment rate was expected to remain unchanged at 10.1%.

EUR/USD traded a bit higher in range, around 1.1090 towards the multiple releases.

Earlier in the day, French GDP disappointed by remaining unchanged. This could have tilted real expectations down. Spain met expectations with a growth rate of 0.7%.

On inflation figures, both countries missed: Spain with -0.6% y/y and France with -0.4% m/m. Germany beat expectations with +0.3% m/m in the publication seen already yesterday.

The focus now shifts to the US with its own initial GDP measure for Q2. See how to trade the US GDP with EUR/USD.