Idea of the Day

Already this morning we’ve seen a move higher in the dollar as despite a day ahead that’s full of economic data releases, investors are concerned that a military strike by the US against Syria is imminent. Whilst it’s difficult to trade off geopolitical tensions traders ought to keep a close eye on proceedings. As things stand the UK will now wait until any findings from the UN inspectors before taking any action and the US remains undecided. The threat of an escalation is real as concerns that any strikes might trigger a reaction from Syria and even Iran leading to attacks on other countries in the region. But as mentioned whilst this situation should be monitored, so too should the economic data releases.

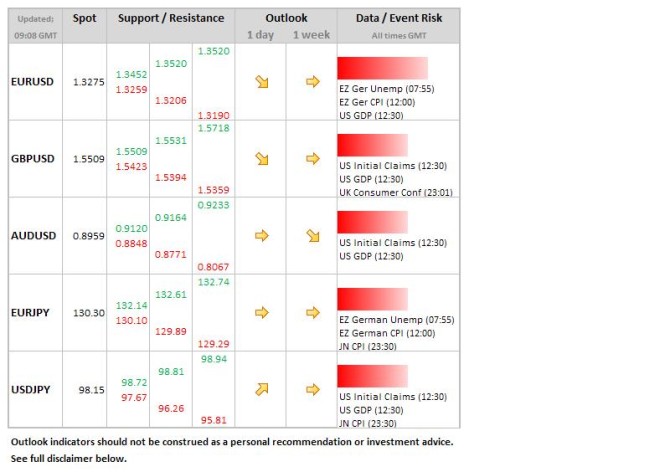

Data/Event Risks

EUR: German unemployment and inflation data is released this morning which could act as a market mover for the euro although it’s not expected to provide a dramatic change in sentiment or overall trend.

USD: Things could become quite volatile over lunchtime today as the weekly US initial jobless claims are released but at the same time Q2 GDP will also be divulged. Markets have largely dismissed economic data out this week due to the mounting tensions in Syria but today’s GDP has the potential to make traders sit up and take note. The past few months has seen headline GDP fall back from its recent highs and a bounce is expected to 2.2% which might support the dollar.

JPY: Later on overnight there are a number of Japan data releases which include the manufacturing PMI, inflation and industrial production. The industrial production figure has the potential to move affect the Yen the most as it is due to jump back with a positive reading following two months in negative territory.

Latest FX News

GBP: The new BOE Governor Mark Carney‘s speech yesterday allowed a volatile session to ensue for sterling. His comments were considered to be particularly dovish but once again we saw the market take sterling in the opposite direction to what might be expected as the pound rallied throughout and on the back of his speech. Nonetheless consensus remains that UK base rates are expected to remain very low for quite some time to come.

USD: The pending home sales release came in lower than expected which gave the dollar boost rather than unexpectedly. It looks like traders are largely ignoring the economic data for the time being as the focus is very much on what’s happening in Syria. If tensions mount then the dollar should benefit.

Further reading: