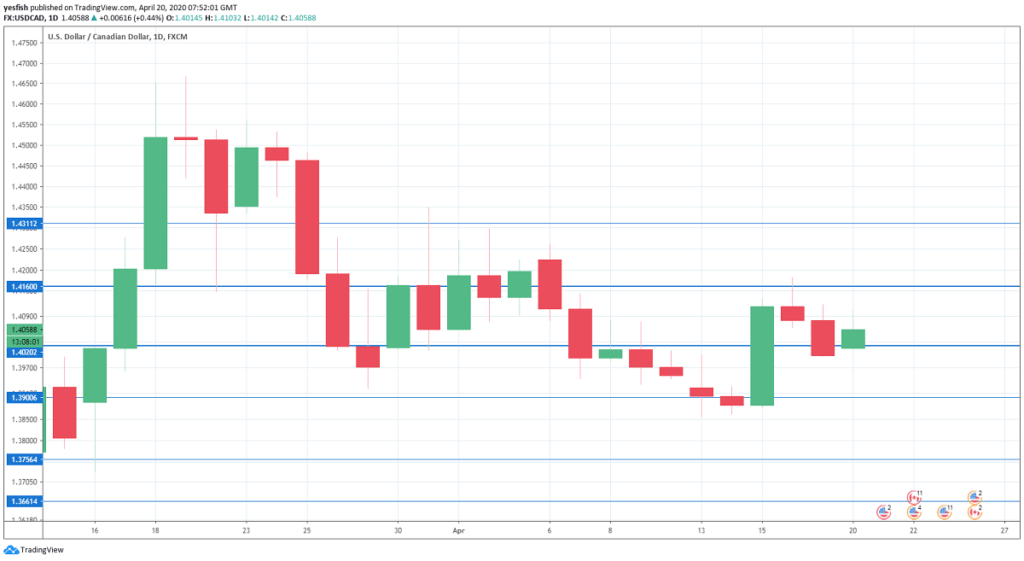

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Monday, 12:30. This indicator is a leading indicator of consumer spending. In January, the indicator gained 1.8%, up from 0.9% a month earlier. This was its highest level since January 2017. However, analysts are projecting a decline of 0.2% in February.

- Retail Sales: Tuesday, 12:30. The headline figure accelerated to 0.4% in January, up from zero in the previous reading. Core retail sales fell by 0.1% in January, down from 0.5% in December. We now await the February release.

- Inflation: Wednesday, 12:30. Consumer inflation rose 0.4% in February, up from 0.3%, This marked its highest level since July. The core figure improved to 0.7%, up from 0.4% a month earlier. Will the upswing continue in the upcoming release?

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.4310.

1.4159 (mentioned last week) has some breathing room in resistance.

1.4019 has switched to a resistance role after USD/CAD lost ground.

The round number of 1.39 is a weak support line. 1.3757 is next.

1.3660 is the final support level for now.

I remain bullish on USD/CAD

The outlook for the Canadian dollar is negative, as the economic fallout from COVID-19 has shut down much of the economic activity in Canada and the United States, its most important trading partner. Weak oil prices are also weighing on the Canadian dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!