- BoC Rate Decision: Wednesday, 14:00. The BoC made another rate cut at an unscheduled emergency cut. The bank slashed rates from 0.75% to 0.25%, as policymakers try to stabilize the economy which has been hit hard by the Corvid-19 outbreak. The BoC is expected to maintain rates at the upcoming meeting.

- Manufacturing Sales: Thursday, 12:30. Manufacturing sales fell by 0.2% in January, marking a fifth straight decline. Will we see an improvement in the February data?

- ADP Non-Farm Employment Change: Thursday, 12:30. The economy created 7.2 thousand in February, down from 25.9 thousand a month earlier. We will now receive the March data.

- Foreign Securities Purchases: Friday, 12:30. Foreigners snapped up Canadian securities in January, which climbed to C$17.01 billion. This followed two successive declines. Will the upswing increase in February?

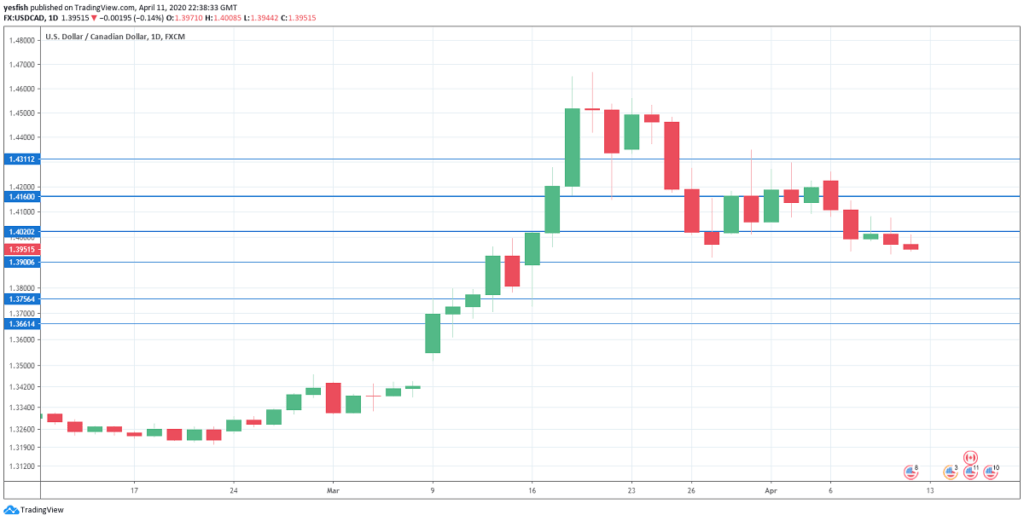

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.4310.

1.4159 (mentioned last week) has some breathing room in resistance.

1.4019 has switched to a resistance role after USD/CAD lost ground.

The round number of 1.39 is a weak support line. 1.3757 is next.

1.3660 is the final support level for now.

I remain bullish on USD/CAD

The outlook for the Canadian dollar is bearish, as oil prices remain low and the economic fallout from COVID-19 has paralyzed the Canadian economy, which is extremely dependent on the U.S. and global trade.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!