- Retail Sales Report: Wednesday, 12:30. Consumer spending has been sputtering, with back-to-back declines. Analysts are braced for another decline in February, with a forecast of -3.0% for the headline read and -2.6% for Core Retail Sales.

- GDP: Friday, 12:30. Canada releases GDP on a monthly basis. The economy expanded by 0.7% in January and the estimate for February stands at 0.9%.

- Raw Materials Price Index: Friday, 12:30. This inflation index measures inflation in the manufacturing sector. The index jumped to 6.6% in February, up from 5.7%. Will the upturn continue in March?

.

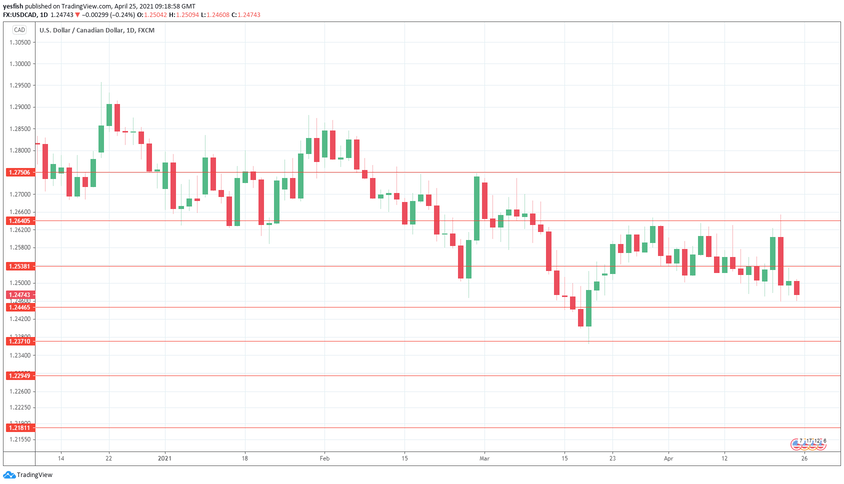

I am neutral on USD/CAD

The Canadian economy is recovering, and the slight taper by the Bank of Canada is a vote of confidence in the economy. However, the economy continues to grapple with Covid and ongoing lockdowns are weighing on the economy.

Follow us on Sticher or iTunes

Further reading:

-

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe Trading!